How best to pay off your debts

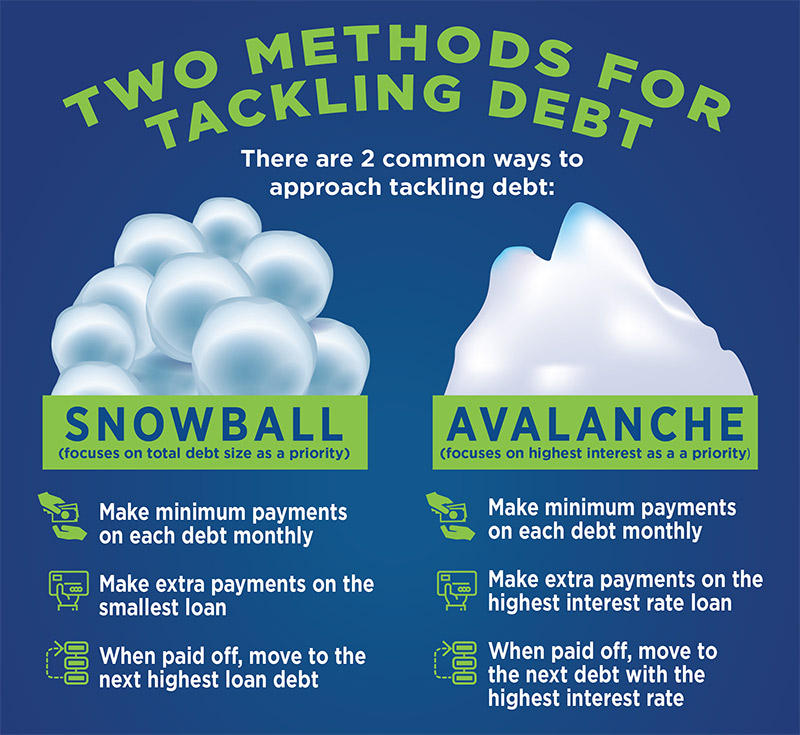

Debt snowball and debt avalanche are two popular methods for paying off debt. Both methods involve creating a plan to pay off debts in a specific order, but the methods differ in how they prioritize the debts.

The debt snowball method

The debt snowball method is a popular debt repayment strategy that involves paying off debts in order of smallest balance to largest balance, regardless of the interest rate. The idea behind this method is that by paying off small debts first, the person will see progress quickly and feel motivated to continue paying off their debts.

To use the debt snowball method, an individual first makes a list of all their debts, including the balance and interest rate for each debt. They then prioritize the debts by balance, with the smallest debt at the top of the list and the largest debt at the bottom.

The individual then focuses on paying off the smallest debt first, while making minimum payments on the other debts. Once the smallest debt is paid off, the individual moves on to the next smallest debt and so on, using the money that was previously being used to pay off the first debt to pay off the second debt.

The debt snowball method can be a great way to build momentum and motivation, as people can see progress quickly. By paying off small debts first, an individual can quickly cross debts off their list and feel a sense of accomplishment. This can help to build momentum, and make it more likely that they will stick to the plan.

It’s important to note that while this method can be effective in helping people stay motivated and on track with paying off their debts, it may not be the most cost-effective method in terms of paying off high-interest debt. The debt snowball method does not take into account the interest rate of the debt, so it may be more cost-effective to focus on paying off high-interest debt first.

However, for some people, the emotional and psychological benefits of the debt snowball method may outweigh the financial benefits of other methods. It’s important to weigh the pros and cons and consider your personal preferences and financial situation before deciding which method is best for you.

In conclusion, the debt snowball method is a popular and effective debt repayment strategy that can help people stay motivated and on track with paying off their debts. By focusing on paying off small debts first, the method can help to build momentum and make it more likely that an individual will stick to their plan. However, it’s important to consider the interest rate of the debt and weigh the pros and cons before deciding which method is best for you.

The debt avalanche method

The debt avalanche method is a debt repayment strategy that involves paying off debts in order of highest interest rate to lowest interest rate, regardless of the balance. The idea behind this method is that by paying off high-interest debt first, an individual will save the most money in interest charges in the long run.

To use the debt avalanche method, an individual first makes a list of all their debts, including the balance and interest rate for each debt. They then prioritize the debts by interest rate, with the debt with the highest interest rate at the top of the list and the debt with the lowest interest rate at the bottom.

The individual then focuses on paying off the debt with the highest interest rate first, while making minimum payments on the other debts. Once the highest interest rate debt is paid off, the individual moves on to the next highest interest rate debt and so on, using the money that was previously being used to pay off the first debt to pay off the second debt.

The debt avalanche method can be a cost-effective way to pay off debt as it saves the most money in interest charges in the long run. By focusing on paying off high-interest debt first, an individual can reduce the amount of interest they pay over time and be debt-free faster.

However, it’s important to note that the debt avalanche method may not be as emotionally or psychologically rewarding as the debt snowball method. This is because it may take longer to see progress and it might be harder to stay motivated if the individual has a large high-interest debt that takes a long time to pay off.

It’s important to weigh the pros and cons and consider your personal preferences and financial situation before deciding which method is best for you. It’s also a good idea to consult with a financial advisor who can help you to understand the benefits and drawbacks of each method and determine the best course of action for your particular situation.

Which is best?

In conclusion, the debt avalanche method is a cost-effective way to pay off debt by focusing on high-interest debt first, an individual can reduce the amount of interest they pay over time and be debt-free faster. However, it may not be as emotionally or psychologically rewarding as the debt snowball method, and it’s important to consider your personal preferences and financial situation before deciding which method is best for you.

Both methods have their own pros and cons. The debt snowball method can be a great way to build momentum and motivation, as people can see progress quickly. On the other hand, the debt avalanche method can save more money in interest charges in the long run, but it may take longer to see progress.

Ultimately, the best method for paying off debt will depend on an individual’s personal preferences and financial situation. It’s important to consider both methods and determine which one will work best for you, and if you are unsure, it is always a good idea to consult with a financial advisor.

In conclusion, both debt snowball and debt avalanche are two effective ways to pay off debt, and it’s important to weigh the pros and cons of each method to determine which one will work best for you. Both methods are effective and it’s up to the individual to decide which method will be most beneficial for them.

Recent Comments