Vitality Referral Code

Click the Vitality Referral Offer button above or HERE to activate the referral and provide your email address. Then, once you have taken out a health or life plan directly from Vitality – provide your Vitality membership number to the same link, and you will receive a £100 Amazon or John Lewis voucher once you have made 3 monthly premium payments.

Introduction

If you are searching for a comprehensive approach to insurance where you can get your health and life insurance from one provider, chances are Vitality insurance has appeared on your radar.

Vitality’s unique approach to insurance, blending wellness incentives with traditional coverage, has attracted significant attention from customers looking to get the best benefits from their insurance payments. But is this UK insurance provider the best pick amongst the competition?

Vitality Life Insurance Review

Our Vitality insurance review dives into the details of Vitality’s life, car, and health insurance products. We will examine their features, benefits, and potential drawbacks. Whether you’re actively seeking to improve your health or simply comparing coverage options, you can scroll down to find the information you need.

Who are Vitality?

Formed in 1997, Vitality Insurance carved its path with a unique proposition: blending traditional coverage with a focus on health and wellness. This forward-thinking approach soon attracted attention, and in 2004, Vitality formed a strategic partnership with Discovery Limited, a global leader in incentive-based health insurance.

Vitality’s offerings go far beyond the typical life and health insurance policies. Their core philosophy revolves around empowering users to take charge of their well-being. The service offers dynamic products that not only provide financial security but also encourage healthy lifestyle choices through an innovative reward program.

This commitment to holistic well-being resonates with many users seeking a proactive approach to their health and finances.

Main Benefits of Vitality Health, Life and Car Insurance

Before we dive into Vitality Health, Life and Car insurance products in detail, here is a quick overview of the main benefits on offer from this UK insurance provider:

Innovative Rewards Program:

Vitality is known for its incentive-based rewards program. Policyholders are encouraged to adopt and maintain healthy lifestyle habits, including exercise, healthy eating, and mental well-being. By participating in the Vitality Program, individuals can earn points that lead to various rewards, including discounts on gym memberships, running shoes, health trackers, and more.

Comprehensive Health Coverage:

Vitality insurance provides comprehensive coverage for private medical treatment, offering quick access to high-quality healthcare services. This includes coverage for in-patient and day-patient treatments, advanced cancer cover, mental health support, and access to a wide network of private hospitals and healthcare providers.

Personalised Policy Options:

Vitality offers a range of policy options that can be tailored to individual needs. The Core Cover provides a solid foundation, and policyholders can add additional cover options based on their preferences. These options include out-patient cover, physiotherapy, mental health cover, therapies cover, dental cover, and worldwide travel cover.

Advanced Cancer Cover:

Vitality’s Advanced Cancer cover is notable for providing comprehensive treatment and support for policyholders diagnosed with cancer. It covers cancer screening, biological therapy, reconstructive and cancer surgery, wigs, mastectomy bras, follow-up consultations, and end-of-life care up to specified policy limits.

Primary Care Services:

The Primary Care coverage offers access to supplemental services, allowing policyholders to consult with GPs quickly. Services include virtual GP appointments, face-to-face GP consultations (available in Greater London), and additional services like physiotherapy through the Vitality GP app.

Financial Benefits:

Beyond health benefits, Vitality insurance provides financial rewards. Members can receive cash benefits if they choose NHS treatment over private, cash payments for childbirth, coverage for home nursing, parental accommodation, oral surgery, rehabilitation, and lifestyle surgery.

Global Presence:

As part of Discovery Limited, Vitality operates globally, protecting over 20 million lives in 30 countries. This global presence enhances accessibility and coverage if you live or travel internationally.

Vitality Referral:

Get £100 FREE Amazon or John Lewis voucher when signing up to a Vitality health or life insurance plan by clicking here to activate : CLICK HERE

Vitality Insurance Reviews of Options

Here is a breakdown of the three types of insurance Vitality offers and what is available with each option:

Vitality Health Insurance

Vitality Health Insurance offers users access to private healthcare and financial support for various medical needs. With plans starting from £1.25 per day and a 5-star Defaqto rating, it focuses on a unique blend of traditional coverage and health incentives.

Features of Vitality Health Insurance:

- Rewards for Healthy Living: Earn points for being active with a wearable device or app, and redeem them for exciting rewards like Apple Watches, Garmin devices, and gym memberships.

- Fast Access to Specialist Care: Users can bypass lengthy NHS waiting lists and get diagnosed and treated quickly by private GPs, specialists, and mental health professionals.

- Comprehensive Coverage: The insurance includes access to private hospital treatment, surgery, scans, tests, and physiotherapy. Coverages also include cancer care, menopause support, and video GP appointments.

- Optional Extras: You can customise your plan to include coverage for optical, hearing, dental care, worldwide travel insurance and additional mental health support.

- Easy Claim Process: Manage your health and submit claims conveniently online through their user-friendly platform.

Who is Vitality Health Insurance ideal for?

So, who would benefit from Vitality insurance for health? Here are some of the people who may find taking out a policy beneficial.

- If you are seeking faster access to private healthcare and specialist care.

- People who want to incentivise and reward healthy lifestyles.

- Those looking for additional support with specific health concerns like cancer or menopause.

- Individuals who want more choice and control over their healthcare treatment.

Remember, choosing the right health insurance depends on your individual needs and budget. Carefully compare different plans and options before deciding.

Life Insurance From Vitality

Vitality Life Insurance offers users financial protection for your loved ones while rewarding you for living a healthy lifestyle. This approach combines traditional life insurance coverage with incentives for staying active and making positive choices.

Features of Vitality Life Insurance:

- Affordable Options: With policies starting as low as £5 per month, Vitality makes life insurance accessible to a wider range of individuals.

- Healthy Living Rewards: By using a wearable device or app to track your activity, you can earn points for healthy habits. These reward points can then give you access to exciting rewards like Apple Watches, gym memberships, and spa breaks while also lowering your premiums!

- Flexible Coverage: You can choose from term life insurance, covering you for a specific period or life insurance offering lifelong protection.

- Peace of Mind: With a 99.7% claim approval rate, you can trust Vitality to be there when your family needs them most.

Who can benefit from Vitality Life Insurance?

Vitality Life Insurance can help a variety of different people in helping to protect their family and loved ones, including:

- Individuals with families or dependents who rely on their income.

- People who are looking for a life insurance solution that rewards healthy living and keeps premiums affordable.

- Those seeking peace of mind knowing their loved ones will be financially supported in their absence.

Vitality Car Insurance

Although Vitality car insurance still operates for those already covered, the provider no longer offers new car insurance policies due to unprecedented claims inflation and significant price increases in the car insurance market.

What is the Vitality Insurance Rewards Scheme?

If you’re looking for ways to stay healthy while enjoying exclusive rewards and discounts, the Vitality Insurance Rewards Scheme might be exactly what you need. Here’s a breakdown of how it works and the benefits it offers:

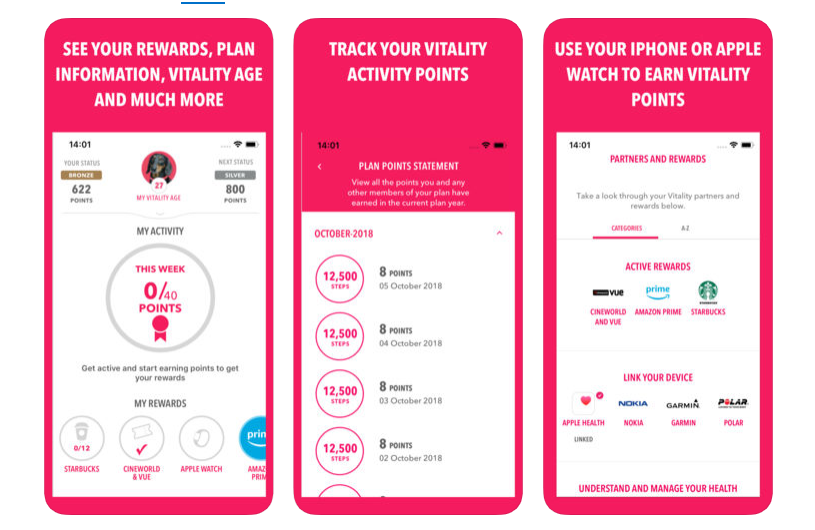

Joining Vitality Rewards

When opting for a qualifying insurance plan with Vitality, customers gain access to a range of discounts aimed at promoting a healthier lifestyle.

Earning Points

Active engagement is pivotal to the scheme’s functionality. Points are earned through physical activity monitored with a linked fitness tracker. To initiate the reward-earning process, members need to register on the Member Zone and Member app.

Redeeming Rewards

The more points you earn, the more substantial the reward options become. This systematic approach gives you incentives to commit to a healthier way of life.

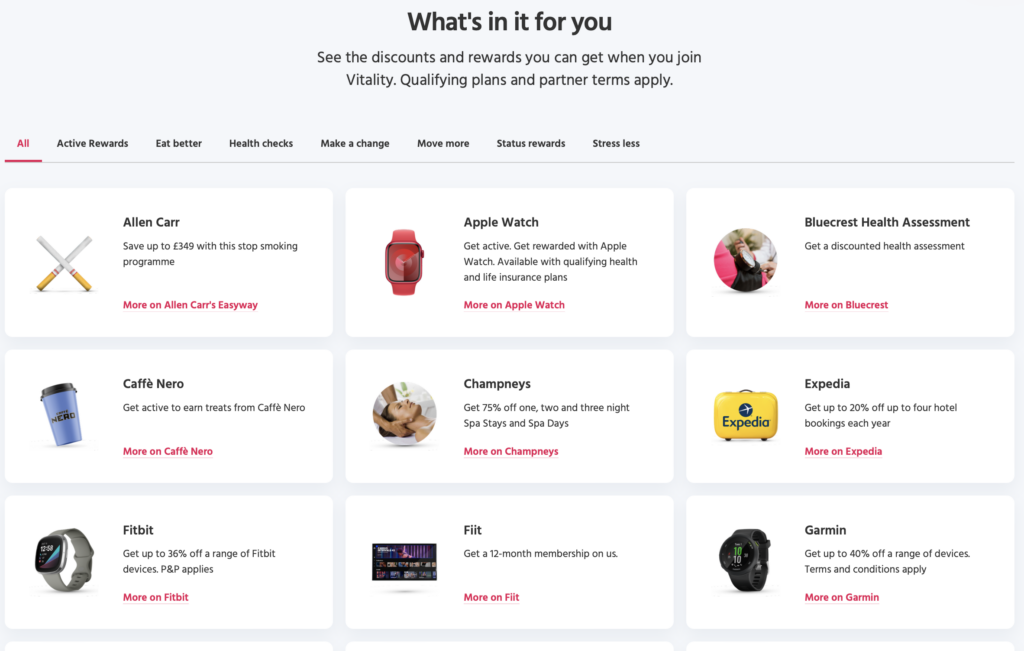

What Rewards Can You Earn with Vitality Insurance?

There are a wide variety of different rewards on offer, depending on how many rewards you earn and which insurance policy you have signed up for. These include:

- Allen Carr: Save up to £349 with the stop smoking programme.

- Apple Watch: You can also earn rewards points towards an Apple Watch, available with qualifying health and life insurance plans.

- Champneys: Enjoy 75% off from one, two, and three-night Spa Stays and Spa Days.

- Expedia: Receive up to 20% off up to four hotel bookings annually.

- Fitbit: Enjoy up to 36% off a range of Fitbit devices.

- Nike: Benefit from reduced prices on the exclusive Vitality collection by Nike.

- Peloton: Get cashback on Peloton hardware.

- Virgin Active: Save up to 50% on a monthly membership.

- Vitality Referral: Get £100 using our Vitality referral link here

Vitality Insurance Review of Pros and Cons

As you can see, there are lots of beneficial features available with Vitality insurance, but the policies on offer may suit some people more than others. Here are some of the pros and cons of Vitality to consider:

Pros of Vitality Health Insurance:

- Wellness Incentives: Vitality offers a unique approach by incentivising policyholders to adopt a healthier lifestyle. You can earn rewards, discounts, and benefits by engaging in activities that promote well-being.

- Comprehensive Coverage: Vitality Health Insurance provides extensive coverage for medical treatments, consultations, and hospital stays. You can tailor your plan with optional add-ons for dental, optical, and mental health coverage.

- International Coverage: Vitality insurance coverage extends internationally, offering peace of mind for policyholders who travel frequently.

- Digital Health Tools: Access to digital health tools and apps for tracking and improving your health.

- Flexible Options: You can choose from a range of available plans and coverage options, allowing customisation based on individual needs.

- Network of Providers: Vitality insurance gives you access to a network of healthcare providers, allowing flexibility in choosing doctors and hospitals.

Cons of Vitality Health Insurance:

- Cost Consideration: The premiums for Vitality Health Insurance can be relatively higher when they are compared to traditional health insurance plans.

- Complexity of Rewards System: Some individuals may find the rewards system complex or may not fully benefit from it if they are unable to engage in the specified activities.

- Initial Waiting Periods: Like many health insurance plans, Vitality may have waiting periods for specific coverages and pre-existing conditions.

- Rewards Scheme Not Suitable for Everyone: The focus on wellness incentives may not appeal to everyone, especially those who prefer a straightforward health insurance plan without additional lifestyle-related requirements.

- Limited Geographic Presence: While international coverage is offered, the geographic presence might not be as extensive as some global health insurance providers.

- Over-Reliance on Digital Tools: Reliance on digital health tools may not suit individuals who are uncomfortable with or have limited access to technology.

Vitality Health Insurance presents a unique blend of wellness incentives and comprehensive coverage. However, you should make sure to carefully weigh up the benefits and drawbacks to decide if the plan aligns with their health needs and preferences.

How Much is Vitality Insurance?

The cost of Vitality insurance can vary based on several factors, including the type of insurance coverage, the level of coverage, your age, health condition, and other individual factors. However, Vitality health insurance begins at a cost of £1.25 per day and £5 per month for life insurance.

To get an accurate and personalised quote for Vitality insurance, you should contact Vitality directly.

Conclusion – Vitality Insurance Review: A Comprehensive Overview for UK

Vitality Insurance doesn’t just fall into the category of ordinary insurance providers; it has carved a distinctive and unique proposition in the realm of financial protection. Going above and beyond the conventional boundaries of insurance, Vitality seamlessly integrates protection, a myriad of benefits, and an authentic commitment to encouraging the health and well-being of users.

The standout hallmark of Vitality Insurance lies in its unique ability to cater to the needs of individuals who seek more than mere coverage. This isn’t your typical insurance – it’s a comprehensive approach to improving and safeguarding your health. It features tech and policies that align seamlessly for those prioritising a proactive and motivational stance towards their well-being.

Whether your primary focus is on securing comprehensive health protection or finding an insurance plan that perfectly syncs with an active lifestyle, Vitality Insurance is an excellent option to consider. It goes beyond the confines of traditional insurance offerings, presenting itself as an option that extends into the realms of encouragement and motivation.

Don’t forget that if you decide to sign up for Vitality, you can get a £100 voucher through our Vitality referral link here. All you need to do is activate the offer and then take out a policy – You will need to click the link after signup and enter your policy number to receive your voucher after your 3rd-month premium payment.

Recent Comments