ClearPay Referral Code: FAISA-EBCRQ

Sign up for a Clear Pay account and enter Clearpay referral code: FAISA-EBCRQ and get £10 free credit on your first purchase (minimum £50)

Introduction to ‘BNPL’ services in the UK (Buy Now Pay Later)

BNPL stands for “Buy Now, Pay Later.” BNPL apps are financial technology applications that allow users to make purchases and pay for them over time, typically in installments without interest or with low-interest rates. These apps enable consumers to spread out the cost of their purchases over several payments, making expensive items more affordable and providing flexibility in managing finances.

Popular BNPL apps include Afterpay, Klarna, and Zilch, amongst others (check out our referral codes by clicking the links). These platforms often partner with retailers to offer their services at the point of sale, both online and in physical stores. Users can select BNPL as a payment option during checkout, and if approved, they can receive their purchase immediately while agreeing to pay for it in installments over a set period.

These BNPL apps have gained significant popularity in recent years, particularly among younger consumers, due to their convenience, ease of use, and ability to provide an alternative to traditional credit cards. However, it’s important for users to be mindful of their spending and repayment capabilities to avoid accumulating debt or late fees.

Clear Pay App Review

Sometimes, when you need to buy essential items, you may not have the funds immediately available. But that doesn’t mean you have to give up on the idea of your purchase. In 2024, payment apps will allow you to make your purchase and then spread the cost into interest-free payments. But which option is the best for you and your finances? In our Clear Pay app review, we will look at all the features of this service to help you decide.

What is ClearPay?

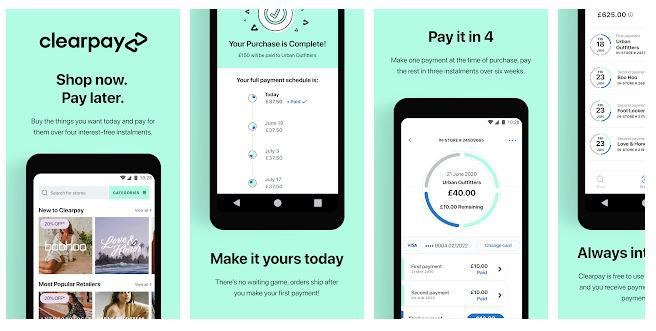

Clearpay is a popular Buy Now, Pay Later (BNPL) service that allows consumers to make purchases and pay for them over time in interest-free installments. It is particularly popular in the United Kingdom, Australia, and New Zealand. By using the Clear Pay App, you can make online and in-store purchases and then spread the cost of the payment over six weeks in four interest-free instalments. The ClearPay app will allow you to pay on thousands of partner products, retailers, and brands securely and even access exclusive discounts.

How Does ClearPay UK Work?

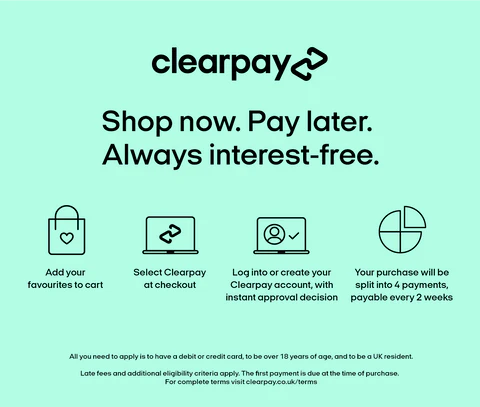

Getting set up with ClearPay is a simple and quick process. All you need to do is download the app and input your email, phone number and date of birth. You’ll also need to have your debit or credit card details at hand.

Once you use the Clear Pay App to make your first payment at checkout, your repayment will be split into four interest-free payments. The first payment will be due at the time of checkout; the next three will be payable every two weeks. Don’t forget to use our Clearpay referral: FAISA-EBCRQ to get £10 off your first purchase over £50.

(If you fail to make your repayment on time, then a late fee will be applied. ClearPay will send you reminders to help you keep on track and will cap late payments to help you remain on top of your debt. You can also reschedule your repayment dates to help you stay on top of your budget)

Does It Cost Anything to Use this Payment App?

You do not have to pay any interest or fees on your ClearPay credit as long as you make your payments in full and on time. If you do not have enough money in your linked account to cover the payment, then you will face a late payment fee and need to log into ClearPay to clear both the instalment and the extra late payment charges.

Which Online Retailers Can You Use ClearPay With?

Clearpay partners with a wide range of retailers across various industries, offering consumers the flexibility to use the service at many popular stores in the UK. While the specific list of retailers may vary over time as partnerships evolve, here are some categories of brands commonly associated with Clearpay:

- Fashion and Apparel: Many clothing, footwear, and accessory brands partner with Clearpay, allowing customers to split their payments on trendy outfits, shoes, and accessories. Examples include ASOS, Boohoo, Topshop, JD Sports, PrettyLittleThing, Missguided, and H&M.

- Beauty and Cosmetics: Clearpay is often available at beauty and cosmetics retailers, enabling customers to purchase makeup, skincare products, and fragrances. Brands such as Sephora, Cult Beauty, Lookfantastic, and Beauty Bay may offer Clearpay as a payment option.

- Electronics and Technology: Customers can use Clearpay to buy electronics, gadgets, and tech accessories from retailers like Currys PC World, Argos, Samsung, Apple, and Dell.

- Home and Lifestyle: Clearpay extends to home goods, furniture, decor, and lifestyle products. Retailers like IKEA, Wayfair, Anthropologie, Urban Outfitters, and The White Company may accept Clearpay.

- Sports and Outdoor Equipment: For sports enthusiasts, Clearpay is available at stores selling sports apparel, equipment, and gear. Examples include Nike, Adidas, Sports Direct, JD Sports, and Decathlon.

- Jewelry and Watches: Clearpay can be used to purchase jewelry, watches, and accessories from brands like Pandora, Swarovski, Michael Kors, WatchShop, and Goldsmiths.

- Health and Wellness: Some health and wellness brands may offer Clearpay, allowing customers to buy fitness equipment, supplements, and wellness products.

- Children’s Products: Parents can use Clearpay to shop for children’s clothing, toys, and accessories from brands like The Disney Store, Mothercare, JoJo Maman Bébé, and Mamas & Papas.

This list provides a general overview, and the availability of Clearpay may vary depending on the retailer and specific terms and conditions. Customers can typically find Clearpay as a payment option during the checkout process on the retailer’s website or app. It’s always a good idea to check with individual retailers to confirm Clearpay availability and any purchase eligibility criteria.

Can You Use ClearPay to Make In-store Payments?

You can also use ClearPay to make payments in-store. Before you go shopping, you need to set up a ClearPay digital card in your Google or Apple Wallet. To do this, you simply need to navigate to the “In Store” tab in your app and follow the prompts. Once this has been set up, you can then use the card to pay when you head to the checkout. UK partner retailers where you can use ClearPay include:

- Halfords

- The Perfume Shop

- BOSS

- Footasylum

- Shoe Zone

- Bobbi Brown

- Urban Outfitters

- Anthropologie

- M.A.C

- Swarovski

- Foot Locker

- The Fragrance Shop

- Calvin Klein

- Tommy Hilfiger

- Jo Malone London

- Pandora

- H Samuel

Using ClearPay to Access Retailer Discounts

Another significant benefit of using your Clear Pay App to make your payments is that you may also be able to unlock an exclusive discount with the retailer. Discounts of up to 90% are accessible. If you use the ClearPay app or website to search for a retailer and then click on the link to the retailer, you will be able to access the discount when you checkout using your app or card. Here are some of the popular retailers currently offering discounts to ClearPay customers.

- Temu – Up to 90% off.

- Wilko.com – Up to 30% off.

- Wowcher – Up to 71% off

- Boohoo – 30% off.

- Debenhams – Up to 70% off

- BoohooMan – 30% off

- Get The Label – Up to 90% off.

- Superdry – Up to 70% off

- Childsplay Clothing – 60% off

- BARGAINMAX – 20% off

- PatPat – Up to 80% off

- Footasylum – Up to 60% off

- Wilko.com – Up to 30% off

- The Range – Up to 50% off

- Mountain Warehouse – Up to 70% off

So, not only can ClearPay help you spread the cost of your purchase, but you may also be able to save money on your purchase by using the app or website to access exclusive partner deals.

What Are Clear Pay App Pulse Rewards?

As of January 2024, the ClearPay Pulse Rewards scheme has been closed. This is because the payment app is moving over to a new rewards scheme. Under the previous incarnation, users could build up rewards points and earn gift cards when making a repayment on time. Although there is not currently any information on the website about the new rewards scheme, ClearPay UK has stated that the new rewards programme will launch in 2024.

Essential Info for New Users

Before you rush to download the ClearPay app, it is essential that you have a clear idea of how the process works and whether it is the best fit for your financial circumstances. Here is some crucial info to keep in mind as you continue to read our ClearPay review.

- ClearPay will extend you a fixed credit amount for your purchase, which you will need to pay back in four separate instalments every two weeks.

- In order to use ClearPay, you must be 18 years of age and a permanent resident of the UK (not including the Channel Islands.)

- If you cannot make your repayments on time, you will be charged a late fee of £6 (for orders under £24) or 25% of your order (for payments over £24.). If this remains unpaid after a week, a further charge will be applied.

- If you miss your payments entirely, then you may not be able to use ClearPay in the future. The company may also pass your debt along to a debt collection agency.

How Does ClearPay Make Money?

One question which may have occurred to you while reading our Clear Pay App review is how the company manages to make money. You are not paying any interest on your credit, and there are no fees involved unless you are late on the repayments. So, exactly what is Clearpay, and how do they make a profit?

Well, the answer lies in the merchant fee that ClearPay charges its partner retailers. In exchange for advertising and recommending the retailers on the app and website, the payment app applies a merchant fee of 6% plus a fixed £0.30 fee on each purchase made through a ClearPay link.

This means that you don’t have to worry about any extra fees or costs added to your purchase and can even access exclusive discounts with selected stores.

Can I Make a Payment in Full to ClearPay?

If you have the funds available, you can use ClearPay to make a payment in full instead of instalments. Here is a breakdown of how the payment selection process works:

- Open the ClearPay App (this feature is not available on the website.

- Log in and select the My ClearPay tab.

- Select the Pay Button. This will take you to a screen with your upcoming payments.

- Then, you need to click on the “Make a Payment” button.

- On the next page, you will be able to choose whether you want to pay off the total amount you owe ClearPay, your payments, which are due within 15 days, or input your own customised repayment amount.

The ClearPay Referral Scheme – Use Our Code: FAISA-EBCRQ for £10 FREE

As well as enabling you to spread your payments and access exclusive discounts, ClearPay will also reward you for referring friends and family members to the app. The ClearPay UK refer-a-friend scheme offers a simple way to earn rewards by inviting friends to join ClearPay. Here’s how it works:

- Invite a Friend: Share your unique referral link or scan the provided QR code to invite friends to sign up for ClearPay. Remember our ClearPay referral code: FAISA-EBCRQ

- Get £10 Off: Once your friend signs up for ClearPay and makes their first purchase, you’ll receive £10 off your next purchase.

- Minimum Spend: Your friend’s first purchase must meet a minimum spend of £50 to qualify for the referral reward.

ClearPay’s refer-a-friend scheme is a fantastic way to earn discounts while introducing your friends to the benefits of using the Clear Pay App for their purchases. However, it’s essential to make sure you and your friends use ClearPay responsibly, as it is unregulated credit.

What If I Need a Refund for a Purchase made Using the Clear Pay App?

Sometimes, the products we have purchased are not satisfactory for our needs, and we need to send them back for a refund. But how do you go about this if you have made your payment using the Clear Pay App?

If you have returned an order, you should notify ClearPay so they can push your next scheduled repayment for a period of up to two weeks. During this time, it is expected that the retailer will be processing your return, and you won’t have to worry about late fees. Here is how the process works:

- Open up your ClearPay app and select the active order you will be returning to the retailer.

- On the order details screen, you will be able to select the “Returning an Order” button.

- You will then input whether you are returning the item in-store or by post.

- Then complete the remaining details to save your return and start the process.

- Your delayed repayment schedule will be emailed to you, and you can also view it in the app.

The payment will then be paused for two weeks or until the merchant has notified ClearPay of the processed return. If the return process has not been processed within the two-week period, then you may end up with two instalment payments due on the next payment day. If these payments are not made in time, then late fees will apply.

Pros and Cons of the Clear Pay App

So, now that we have looked at the answer to “What is ClearPay?” and the features of the service, let’s sum up with a breakdown of the pros and cons of the payment app. This should help you to decide if downloading the ClearPay app is the right fit for you and your purchasing behaviour.

Pros of ClearPay:

- Convenience: ClearPay UK offers you a convenient way to make purchases online and in-store, allowing you to spread the cost of payments over time.

- Interest-Free Instalments: You can split your payments into four interest-free instalments, making it easier to manage your budget.

- Wide Range of Retailers: ClearPay partners with a vast number of UK retailers across a wide variety of industries, offering you access to a diverse range of products and brands.

- Incentives for Timely Payments: Users can earn rewards for making payments on time, encouraging responsible financial behaviour.

- Exclusive Discounts: ClearPay users may unlock exclusive discounts with partner retailers, potentially saving money on purchases.

Cons of ClearPay:

- Late Fees: Failure to make repayments on time can result in late fees, which can add to the overall cost of your purchase.

- Limited to Permanent UK Residents: ClearPay is only available to permanent residents of the UK, excluding those in the Channel Islands.

- Potential Debt Collection: Missed payments could lead to debt collection actions and may impact your ability to use ClearPay in the future.

- Limited Online Payment Flexibility: While ClearPay offers the option to make full payments, this feature is only available through the Clear Pay App, not the website, which may be inconvenient for some users.

ClearPay UK vs Klarna – Which is Best for You?

One of ClearPay’s major competitors in the UK is Klarna. Both apps allow customers to make instalment payments on their purchases with no interest. When comparing ClearPay and Klarna, it’s essential to understand the differences in payment methods, affordability assessments, and handling of overdue payments. You can check out out Klarna review with £10 referral HERE. That said, here is a breakdown to help you decide which is the best pick for you:

Clear Pay App:

- Payment method: Split payments into four interest-free instalments over six weeks.

- Affordability assessment: No credit check or consideration of credit scores; may conduct a pre-authorisation on the selected payment method.

- Late payment policy: Charges a £6 capped late fee for missed payments under £24. The app prevents additional purchases until outstanding amounts are settled.

Klarna:

- Payment methods: Pay in 3: Cost divided into three equal payments with no interest.

- Affordability assessment: Typically, a soft credit check is conducted for Pay in 30 and Pay in 3 options.

- Late payment policy: No late fees for missed payments. Klarna attempts to collect payment multiple times before exploring alternative payment methods; unpaid debt may be passed to a debt collection agency for the Pay in 30 option.

Understanding these distinctions can help you make informed decisions based on your financial preferences and circumstances.

Is ClearPay UK the Best Payment App for You?

A Short Summary

How Does Clearpay Work? Clearpay operates on a straightforward principle: enabling consumers to buy now and pay later, without incurring interest charges. Here’s how it typically works:

- Select Clearpay at Checkout: When shopping online or in-store at participating retailers, customers can choose Clearpay as a payment option during checkout.

- Split Payments: Clearpay divides the total cost of the purchase into four equal installments, which are paid every two weeks. Customers pay the first installment at the time of purchase.

- No Interest or Fees: One of the key advantages of Clearpay is that it does not charge interest on purchases. As long as customers make all four payments on time, they won’t incur any additional fees.

- Instant Approval: Clearpay provides instant approval decisions, allowing customers to complete their purchase quickly and seamlessly.

- Repayment Schedule: Customers can manage their repayments through the Clearpay app or website, where they can view their payment schedule, track their spending, and receive payment reminders.

Benefits of Clearpay: Clearpay offers several benefits to both consumers and merchants, including:

- Convenience: Clearpay provides consumers with a convenient and flexible payment option, allowing them to spread out the cost of their purchases over time.

- Interest-Free: Unlike traditional credit cards, Clearpay does not charge interest on purchases, making it an attractive option for budget-conscious shoppers.

- Instant Approval: With instant approval decisions, Clearpay enables customers to complete their transactions quickly, reducing friction at the point of sale.

- Increased Sales for Merchants: For merchants, Clearpay can lead to increased sales and higher average order values, as it provides consumers with greater purchasing power.

- Risk Mitigation: Clearpay assumes the risk of non-payment, providing merchants with guaranteed payment for their goods and services.

Conclusion

In conclusion, Clearpay has emerged as a revolutionary BNPL service that is transforming the way consumers shop and pay for their purchases in the UK. With its convenient, interest-free installment plans and instant approval process, Clearpay offers a compelling alternative to traditional payment methods. As BNPL continues to gain popularity, its impact on the retail sector is likely to grow, shaping the future of consumer finance in the UK and beyond. Remember if you decide to sign up you should use ClearPay referral code: FAISA-EBCRQ to get £10 FREE

Recent Comments