Zilch Referral Code

Click the Zilch referral above or here and download the Zilch app and sign up to get £5 free cash added to your balance when you use tap & pay for the first time.

Zilch Review – Easy Cashback and Pay Later Options

Check out our Zilch review below, which will give you all the information you need about one of the most popular Buy Now Pay Later (BNPL) and cashback virtual cards in the UK. We’ll discuss the benefits available when you pay in full and the added costs if you decide to buy on credit and use the Zilch BNPL services.

Zilch Card Introduction

In recent years, the landscape of consumer finance has witnessed a significant transformation, with Buy Now Pay Later (BNPL) services gaining immense popularity. Among the various players in the market, Zilch has emerged as a notable name, offering a unique and customer-friendly approach to the traditional credit system. In this article, we will explore the Zilch Buy Now Pay Later service and its impact on the UK market.

Zilch is a fintech company that has carved a niche for itself in the BNPL sector. The company’s mission is to provide consumers with a flexible and transparent alternative to traditional credit, enabling them to make purchases without the immediate burden of payment. Zilch allows users to spread the cost of their purchases over several weeks, making it an attractive option for those seeking financial flexibility.

You can also check out Klarna, which is another well-known BNPL service available in the UK. They are currently offering £10 FREE when you sign-up – Full details here

How Zilch Works:

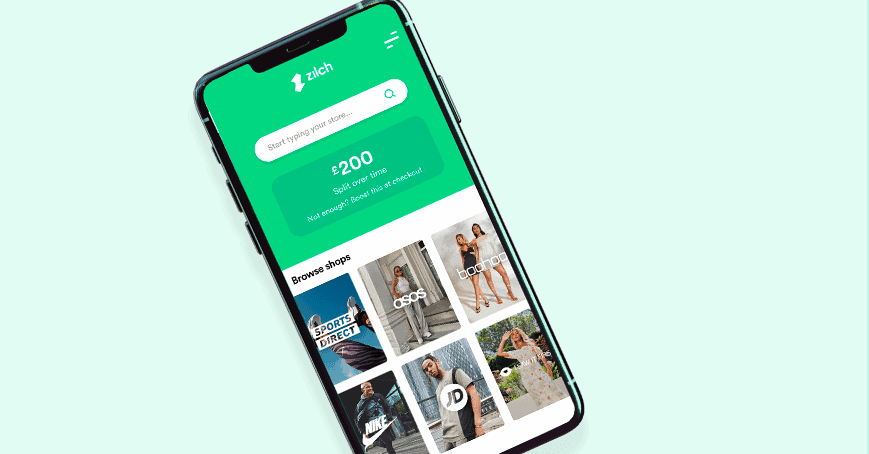

Zilch operates on a simple yet effective premise. Users can sign up for the Zilch app and link it to their debit card. Upon approval, users can shop at Zilch’s partner merchants (or any other merchant with a small fee) and choose the option to pay with Zilch at the checkout. The purchase amount is divided into four equal installments, with the first installment paid at the time of the transaction and subsequent instalments automatically deducted from the linked debit card over the next six weeks. Today Zilch also offers a linked card which can be used to make payment online or instore at any merchant using Zilch anywhere.

Key Features and Benefits of Zilch BNPL:

- No Interest Charges: One of the primary attractions of Zilch is its commitment to transparency. The service does not charge interest on purchases, making it a cost-effective alternative to traditional credit cards.

- Budget-Friendly Instalments: Zilch’s instalment model is designed to align with users’ pay cycles, making it easier for them to manage their budgets. The fixed instalments over six weeks provide a clear repayment schedule.

- Quick and Easy Approval: The application process for Zilch is streamlined and user-friendly. Users can receive approval within minutes, enhancing the accessibility of the service.

- Wide Network of Merchants: Zilch has partnered with a diverse range of merchants, spanning fashion, technology, and lifestyle, providing users with a broad array of options for their purchases.

What about the Zilch virtual Mastercard?

Unlike the Zilch app which allows you to make payment at partner sites the Zilch virtual Mastercard allows you to make payments both instore and online anywhere that accepts Mastercard.

But there isn’t actually a physical Zilch card -Instead, Zilch operates using a virtual Mastercard directly linked to your bank account through their app. This means you can:

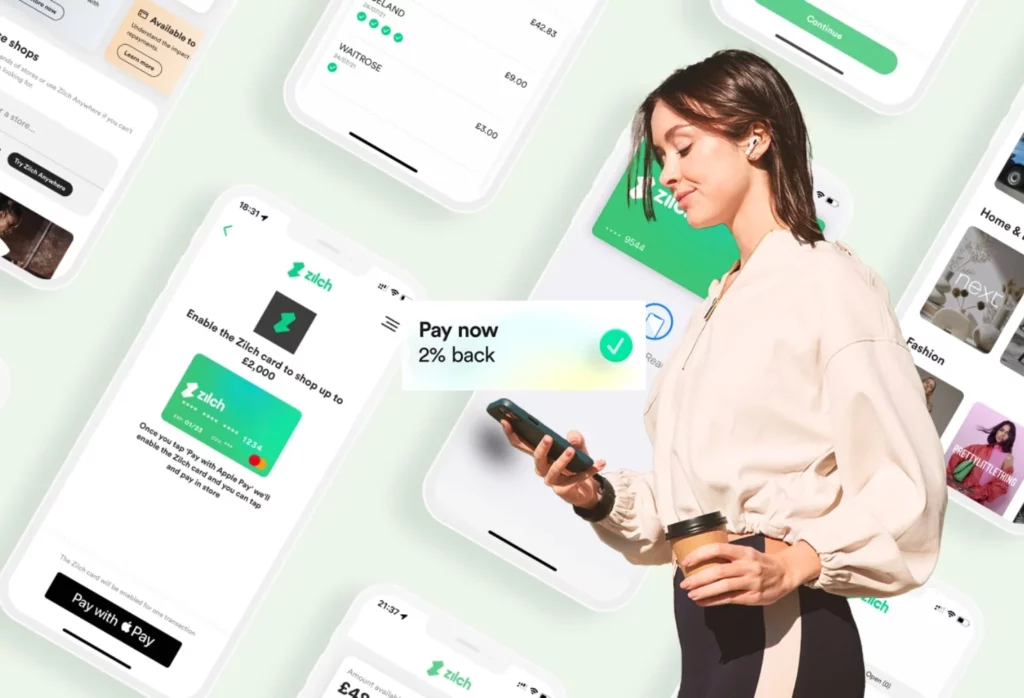

- Shop online and in-store: Pay with Zilch anywhere Mastercard is accepted, either by choosing “Zilch” at checkout or using your virtual card details within the app.

- Choose payment options: Decide whether to split your purchase into four equal installments (at no interest or fees) or pay in full for 2%-5% back in Zilch Rewards.

- Manage your account: Track your spending, set spending limits, and make payments easily through the Zilch app.

So, although Zilch doesn’t offer a physical card, it provides the same flexibility and convenience of a credit card without the fees or interest, making it a unique and appealing option in the BNPL market.

Standout Benefits of Using the Zilch Mastercard

- Access zero-interest repayments for purchases. (To be repaid in full within six weeks!)

- Spread repayments into four instalments of 25%.

- Earn up to 5% cashback when you make payments in full at the time of purchase.

- Use with a wide range of UK retailers, including clothing stores, tech giants, and travel providers.

- Zilch can help improve your credit score by extending credit limits of up to £1,000 (with a fixed APR of 22.6%.)

- Flexible repayment schedule. You can choose to pay your next instalments before the two-week deadline with no added fees.

- No late fees if you fail to make your scheduled repayment on time.

How do I sign up for Zilch?

To sign up for Zilch and use their Buy Now Pay Later (BNPL) service, you typically need to follow these general steps:

- Download the Zilch App using our Zilch referral here (to get £5 FREE)

- Start by downloading the Zilch app from the official app store on your mobile device. The app is available on both iOS and Android platforms. Remember to click our link before signing up to get your free referral bonus.

- Create an Account:

- Follow the on-screen instructions to create a Zilch account. You will need to provide some personal information, such as your name, email address, and phone number.

- Link Your Debit Card:

- Zilch typically requires users to link their debit card to the app. This is the card that will be used for payments and instalment deductions.

- Identity Verification:

- Zilch may require identity verification, which could involve submitting a photo of your ID or other relevant documents. This step is often part of the Know Your Customer (KYC) process.

- Credit Check and Approval:

- Zilch may perform a soft credit check to assess your creditworthiness. Once the check is completed, and if you meet their criteria, you will receive approval to use the service.

- Start Shopping:

- Once your account is set up and approved, you can start using Zilch to make purchases at partner merchants. During the checkout process, you should have the option to pay with Zilch.

- Once your account is set up and approved, you can start using Zilch to make purchases at partner merchants. During the checkout process, you should have the option to pay with Zilch.

How Do Zilch Repayments Work?

So, exactly what happens when you choose to pay only 25% of the payment price with your Zilch card and repay the remaining amount over six weeks? Here’s a quick breakdown of an example purchase:

- You purchase a new winter coat for the price of £100.

- At the time of purchase, the first 25% of £25 will be taken from your account when you make your payment at the till.

- Two weeks after your initial payment, the following payment of £25 will be due.

- Four weeks after your purchase, your next payment of £25 will be taken.

- Six weeks following your purchase, the final £25 will be taken from your account.

This can be a handy way for you to split up payments for essential items if you don’t have the total amount available when you want to make the purchase.

But you should remember that you will need to have covered the full amount within the six-week period, so you shouldn’t use it to make bigger purchases your budget won’t actually cover.

How Does Zilch Cashback Work?

As with the spread payments option, you first of all need to head to the Zilch app or website in order to enable a transaction with the retailer. Once this has been done, you can choose to make the purchase payment in full.

Earning cashback is simple – If you decide to make payment in full rather that using the BNPL option you will receive cashback! Once you have made your payment, you will earn a 2%-5% cashback reward for your purchase. The cashback will then be credited to your Zilch account, and you can use it for future purchases.

This means that you can add to the value of your payment with a few quick and simple steps using the card, helping you to reap rewards with major UK retailers who accept Zilch.

Do I Need to Pay a Fee to Use Zilch?

Using Zilch comes with no upfront costs or hidden fees as long as you stick to their terms and conditions. Here’s a breakdown of what you can expect:

No fees for standard use:

- Pay in four: Splitting your purchase into four equal installments is completely free, as long as you make your payments on time. No interest or late fees apply.

- Pay in full: Paying the full amount upfront earns you 2% back in Zilch Rewards, which you can use towards future purchases.

Potential fees to be aware of:

- Late payment fees: Missing a payment can incur a late fee, usually around £2.50 in the UK.

- Transaction fees: In the UK, using “pay in four” for online purchases at non-partner stores might incur a small upfront fee, clearly displayed before confirming the transaction.

- Snooze charges: If you choose to “snooze” a payment (delay it by a few days) in the UK, the second and third uses carry a £1.50 charge.

Overall, Zilch aims for transparency and avoids hidden fees. They make it clear if any charges apply to your specific transaction before you finalize it. However, remember that responsible spending is crucial, and missing payments can come with fees and impact your financial health.

Here are some additional points to consider:

- Zilch doesn’t affect your credit score (unless you miss payments).

- There are minimum purchase amounts for both “pay in four” and “pay in three months” options.

- Zilch doesn’t offer credit checks, but they may look at your bank account information to assess your spending habits and determine your spending limit.

Which Brands Accept Zilch Card Payments?

Zilch’s reach is extensive, but not limitless. You can use it at a large number of retailers, but not absolutely every single one. Here’s a breakdown:

Where you can use Zilch:

- Thousands of partner retailers: Both online and in-store, these are listed within the Zilch app and often come with special offers or deals. Look for the “Zilch” option at checkout.

- Anywhere Mastercard is accepted: If you choose the “pay in full” option with your virtual Zilch card, you can use it anywhere Mastercard is accepted, similar to a debit card. However, keep in mind that non-partner online purchases in the UK might incur a small transaction fee (£3 fee)

Where you can’t use Zilch:

- Specific retailers: Some retailers have opted out of partnering with Zilch or may not support BNPL services in general.

- Recurring payments: Subscriptions, utilities, and certain types of bills may not be eligible for Zilch payments.

- International transactions: You currently cannot use Zilch for international purchases outside your region.

Partners sites which all accept Zilch online and instore:

- Airbnb

- Amazon

- Argos

- ASOS

- Beauty Expert

- boohoo

- boohooMAN

- Coast

- Coggles

- Cult Beauty

- Dunelm

- easyJet

- eBay

- ESPA

- Expedia

- Eyeko

- Footpatrol

- Fragrance Direct

- Free People

- Glossybox

- Grow Gorgeous

- House of Fraser

- HQHair

- Iceland

- I Saw It First

- Illamasqua

- IWOOT

- JD Sports

- Karen Millen

- LOOKFANTASTIC

- Mankind

- Matalan

- Mio Skincare

- Missguided

- Missy Empire

- MyProtein

- MyVitamins

- Nasty Gal

- New Look

- Nike

- Pop in a Box

- PrettyLittleThing

- Probikekit

- River Island

- Secret Sales

- Sports Direct

- Tesco Groceries

- Tessuti

- The Hut

- Uber Eats

- Urban Outfitters

- Wickes

- Zavvi

You can also use your Zilch card to make payments at UK retailers where Mastercard is accepted in order to earn 0.5% on your purchase.

What Happens if You Don’t Make a Zilch Repayment?

Zilch will send you emails to remind you if you have overdue payments. If you fail to make a repayment on time, then you will not initially have to pay any fees. However, you should be aware that your credit score may be affected. Zilch will report your failed payments to the main credit agencies, such as Equifax, and this could then see your score go down. This could then result in you having trouble securing credit from other lenders in the future

If you fail to make your repayments on time, you should get in touch with the Zilch customer support team to discuss your difficulties. If you continue to fail to clear the amount you owe, then you may be blocked from using Zilch in the future.

Will Using Zilch Affect My Credit Score?

As we have seen above, if you fail to make a repayment, then this will be reported to the credit reference agencies. Meaning that if you miss your repayments, you could see your credit score lower. So, it’s essential to make sure you can realistically afford to repay what you have borrowed.

But it’s not all negative! If you keep on track with your Zilch repayments, then this will also be reported to the credit agencies – meaning you could see your credit score start to rise in the long term.

What Happens When I Get a Refund on a Zilch Purchase?

If you decide you don’t want to keep an item you have purchased through the Zilch repayment option, then you will need to continue to make repayments until your refund has been completed. Here is how the process works:

- Apply for a refund for the item, either online or in-store, as you would for any other purchase.

- Once the item has been refunded, then Zilch will check your current balance on the repayment plan.

- If the entire amount has been refunded, then the payments you have made will be reimbursed, and your future repayment schedule will be cancelled.

- If you have received a partial refund, then this will be applied to your balance to reduce your future payments due. If the payments due are less than the refund received, then the difference will be refunded back to your account.

This may be a more complicated process than you are used to when it comes to refunds. So, you should consider this factor when deciding whether you want to use the Zilch repayment option on your purchases.

Applying For a Zilch Virtual Credit Card

Signing up for Zilch is a quick and straightforward process. You simply need to download the app and create an account using your email and a password. Once you have done this, you will receive an email that will instruct you on how to link your debit card account with your new Zilch account.

Payments and repayments will then be made from this linked account when you start to make purchases using your virtual Zilch credit card.

Zilch Review – Will Zilch Do a Credit Check When I Apply?

After you set up your Zilch account, the service will run a check to see if they can preapprove you. If they fail to preapprove you based on this affordability check, then they will run a soft credit search. This process will have no effect on your current credit score.

When you join Zilch and accept the terms and conditions of the service, then Zilch will run a hard credit search with the credit reference agencies. This will show up on your credit history report. But as long as you make sure to make your repayments on time, then this should have no long-term negative effect on your credit level.

Is It Safe to Use Zilch?

When it comes to your financial and personal information – you can never be too safe. And before you share any financial information with a company, you need to make sure that your details are safe and secure. Well, the good news is that Zilch is a safe and secure service for you to share your info with.

Zilch is PCI DSS Level 2 compliant and, as such, meets security standards with regard to payment card fraud and protection against data breaches. The card also satisfies the requirements to be authorised by the Financial Conduct Authority.

What do Zilch Customers Have to Say?

Zilch’s cashback and pay later features have made the company a popular choice with UK customers. And they currently have a solid Trustpilot score of 4.6 out of 5 from more than 50,000 reviews. This means it has been awarded an Excellent rating on the site.

Strengths of the service highlighted in the positive Zilch reviews include:

- Quick and easy account set-up.

- No fee repayment option.

- Can be used with a wide range of UK retailers.

- Easy functionality of the app.

However, the virtual card app does also have a small number of retractors. Negative reviews describe issues with contacting customer service when needing to discuss repayments or problems with the app.

Zilch Review of Pros and Cons (including £5 free using our Zilch referral)

Now that we have taken a look in our Zilch review at how the Zilch card works, the fees, and how to get started – let’s look at a breakdown of the pros and cons of this virtual credit card to help you decide if it is the right fit for you.

Review of Zilch Pros

- No interest Buy Now Pay Later option. To help you space out larger payments over a manageable six-week period. A good option if you want to make a larger purchase now, which you will be able to cover with your next payday.

- Early payment flexibility. If you find you have the funds to make repayments earlier, then you can do so without facing any extra fees. This contrasts with other services, which may impose an advance payment fee.

- Use with a vast number of UK retailers. You can use your Zilch virtual card anywhere a Mastercard is accepted. Spending with partner retailers will net you 2-5% cashback when you pay in full, and you can also earn 0.5% on your spending with other UK stores.

- No late fees on your repayments. Even if you are late on your repayments, you will not have to pay any extra fees.

Cons of Using Your Zilch Card

- Added fees for spending with non-partner retailers. You may face an extra fee on top of the purchase price when you shop from a UK retailer which is not a Zilch partner.

- Missed payments could affect your credit score. If you miss your Zilch payments, then this will be reported to the credit agencies. This is why it is essential to only use the repayment option if you are confident that you will be able to pay the amount back within the six-week time limit.

- Inflexible repayment structure. No matter where you shop or the amount you spend, the repayment timeline of four payments over six weeks remains the same. You may find more flexible repayment options available from other buy now, pay later services.

- Some negative customer service feedback. As we have looked at, some Trustpilot reviews do mention some difficulty with getting in touch with Zilch customer service agents when they run into problems.

- No suspension of repayments during refunds. Zilch will not allow you to suspend your repayments if you decide to return your item. This means you will still need to make your planned repayments until your refund has been completely processed.

Zilch Review – Is Zilch right for me?

As you can see from our Zilch review above, there is plenty to recommend for both the cashback card and a Buy Now Pay Later option. The wide range of UK retailers who partner with Zilch makes it a no-brainer to use when you are paying upfront. Based upon deals and offers, you can easily earn between 2 and 5% cashback on your spending on tech, clothing, food, and a wide variety of other products.

Whether you should use the credit option will depend on whether you can realistically pay the amount back within the six-week time limit. If you fail to make your repayments, you could see your long-term financial health affected as your failed payments are reported to the credit agencies.

Zilch’s Buy Now Pay Later service has undoubtedly made waves in the UK’s consumer finance sector. Its commitment to transparency, flexibility, and accessibility has resonated with a wide audience. As the industry continues to evolve, it remains to be seen how Zilch and other BNPL providers will navigate regulatory scrutiny and address concerns to ensure a sustainable and responsible financial ecosystem.

As long as you use the Zilch card responsibly and stay within your spending means, then this service can be a very useful financial tool to help you get the most from your everyday purchases. When deciding if this is the right option for you, look back through our Zilch review above and assess how the features and the pros and cons of this service can work for you.

Remember if you sign up to Zilch using our Zilch referral code: HERE you will get £5 free cash added to your balance to spend as you wish!

Recent Comments