Quickbooks Referral

Sign up to Quickbooks using our Quickbooks referral link above or here and you will save 90% off your monthly subscription for the first 7 months.

Introduction

Quickbooks, the popular UK online cloud accounting software service, is the go-to choice for millions of freelancers and business owners everywhere. The platform’s straightforward interface, intuitive database, and customisability have helped it carve a strong reputation in a crowded online accounting marketplace.

With helpful features such as online payroll, tax breakdowns, and various add-on accounting features – there is plenty to recommend. But is it the right fit for you and your business’s financial needs?

Review of Quickbooks UK 2024

Our review of Quickbooks will guide you through all of the features, plans, and costs of the service and help you decide whether this is the right UK accounting software that you need of your business. With our detailed breakdown of both the pros and cons of this cloud accounting software, we’ll give you all the information you need to make this critical business decision.

What is Quickbooks Online?

To begin our Quickbooks review, let’s take a quick look at exactly what Quickbooks is and how it can help you with your business and freelancer accounting.

Well, Quickbooks is a subscription service for cloud-based accounting software for various business types and industries. You can either upload your finances using the online database yourself or give your accountant and bookkeeper access so that they can do it for you.

Using the software, you can input your incomings and outgoings, upload invoices and receipts, and categorise your spending. You can also use the service to help you with your tax return, manage your payroll, and create invoices for clients.

Review of QuickBooks Standout Features:

Quickbooks (UK version) features a host of helpful and easy-to-use features which will save you both time and effort when it comes to managing your finances and ensuring you are HRMC compliant in your tax and VAT reporting. These include:

- Accounting for Self-Assessment tax submissions.

- Detailed analysis & reporting for annual accounts/corporation tax purposes

- Access to Income tax estimates for financial planning.

- Separation of personal and business transactions for accurate tax returns.

- Management and categorisation of income & expenses.

- Professional invoice creation and sending.

- Free onboarding session and customer support.

- Making Tax Digital readiness compatibility.

- Automated payroll services

Sign up with our EXCLUSIVE Quickbooks referral and get 7 months subscription with 90% discount. CLICK HERE

How Does QuickBooks Online Work?

When you sign up for QuickBooks Online, you gain access to a dynamic platform with various features to streamline your accounting processes. The user experience begins with logging in to your account, where you are greeted with your main dashboard view. If you’re transitioning from another accounting software, QuickBooks will guide you through the process of importing your existing data into your new account.

Dashboard Overview:

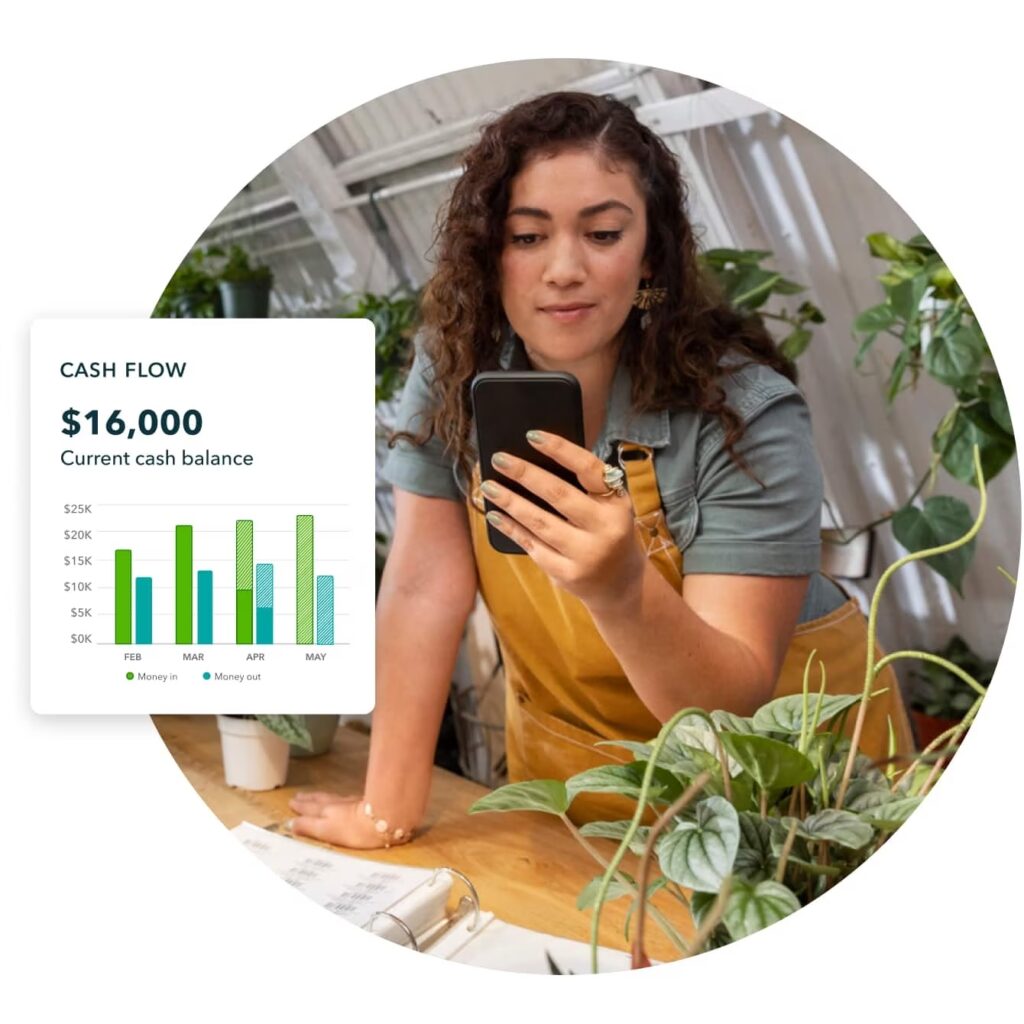

The main dashboard serves as the nerve centre of your QuickBooks account, offering you a comprehensive overview of critical financial aspects. This includes a snapshot of your profit and loss, details on invoices, a summary of expenses, and insights into sales performance.

Banking Integration:

To enhance the efficiency of reporting, QuickBooks Online allows you to integrate your bank and credit card accounts through the Banking tab on the left side of the dashboard. By connecting these accounts, the software will automatically import transactions and categorise them for you. Later, during the reconciliation process, you can conveniently view each of these transactions in the “For Review tab within the banking menu.

Account Customisation and Settings:

QuickBooks Online includes a host of customisation options to help you tailor the platform to your business needs. You can customise client invoices, set up automatic sales tracking if required, and also input mobile receipts and bills. The gear button in the top right corner serves as the gateway to editing all your business’s account settings, ensuring flexibility and alignment with your unique requirements.

Accountant Collaboration and User Management:

If you currently use an accounting service, QuickBooks Online allows you to invite your bookkeeper or accountant to your account. This can be done through the My Accountant section or the Manage Users page in Settings. They can then use the information contained online to complete your yearly accounts without requiring additional information from you.

Resource Guide:

QuickBooks Online also offers valuable guidance through resources such as videos and wiki guides ensuring that users can easily set up and navigate the platform. Whether you are new to the system or looking to maximise its potential, these resources provide step-by-step instructions and insights.

From a user-friendly dashboard and seamless banking integration to extensive customisation options and collaborative features, the platform ensures a comprehensive and efficient accounting experience. And if you have trouble navigating the database, there are a host of helpful resources to help you access the help you need.

Pros and Cons of Using QuickBooks Accounting Software:

As you can see from our review of Quickbooks features so far, there is plenty to recommend Quickbooks to limited company business owners, freelancers, and sole traders. However, as each business is unique, the service may be more suitable for certain types of companies over others. Here is a Quickbooks UK review of the pros and cons to help you decide if this software is the best fit for you.

Pros of Quickbooks UK

Quick and Easy Record-keeping and Reporting:

QuickBooks Online excels when it comes to detailed record-keeping features, offering options for attaching documents, adding memos, and including reference numbers. Custom tags and reports also enhance financial organisation and provide valuable insights.

Robust Feature Set of Accounting Features:

QuickBooks offers a robust feature set that includes finance reporting, invoicing, inventory management, and mobile app functionality. This comprehensive toolkit ensures that businesses have the necessary tools to manage various aspects of their financial operations.

In-depth Financial Management and Analysis:

Using QuickBooks allows you to access a detailed, robust system for managing your incomings and outgoings. The software allows for comprehensive financial tracking, ensuring accuracy and clarity in profitability and tax records. You can link your business account and categorise/reconcile transactions as you go to ensure accurate reporting on a day by day basis.

Excellent Inventory Management and Time Tracking:

As well as providing accounting software, QuickBooks can also improve your inventory management, delivering advanced tools to track your inventory levels as well as the cost of goods and set up reorder points. Additionally, certain plans allow you to enhance efficiency with employee time-tracking features.

Numerous Customisable Reports:

QuickBooks provides users with an extensive array of customisable reports, allowing you to tailor financial insights according to your specific business needs. This flexibility is invaluable for giving you in-depth insights into various aspects of your business’s economic performance. Need a profit and loss account or balance sheet overview from last year – or even this year so far…. You got it. Need to check your chart of accounts or your cash flow position – that’s simple too.

Supports Projects, Payroll, and Many Add-ons:

Quickbooks accounting software goes beyond basic accounting features by supporting various aspects of your business, including project management, payroll processing, and integration with a wide range of add-ons. You can integrate over 300 online services into Quickbooks, such as PayPal, Expensify, and even Soldo.

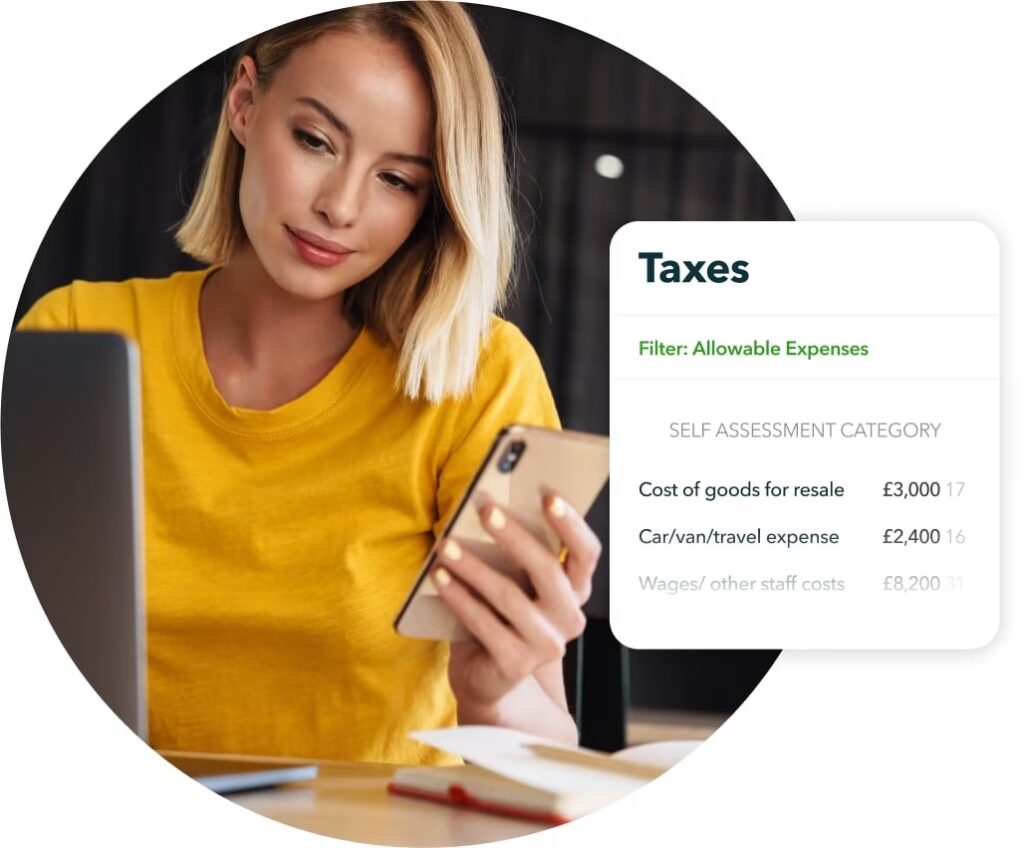

Easy to Use Mobile Apps:

QuickBooks also boasts user-friendly and feature-rich mobile applications, ensuring that users can access crucial financial information on the go. This mobility enhances flexibility and convenience in managing finances for your business, no matter where you are.

Already Widely Used with Bookkeepers and Accountants:

QuickBooks is a preferred choice amongst a large number of professional bookkeepers and accountants, which can help with company collaboration and compatibility. Most accountants in the UK will be well versed in using Quickbooks and will have no problem using this software to carry out all your account returns.

Integration with Over 300 Compatible Apps

The software provides access to a marketplace of over 300 apps, including options for live, in-house bookkeeping. This extensive integration enhances the functionality of QuickBooks by offering specialised solutions for finance tracking and making sure you have an up-to-date overview.

Extensive and Easy-to-Find QuickBooks Resources:

QuickBooks Online users benefit from a wide range of online resources to help them make the most of the software, including video tutorials, webinars, and a supportive community.

Review of Quickbooks Cons:

Higher Subscription when compared to some competitors:

One notable drawback of QuickBooks is its higher subscription cost compared to some competitors. The pricing structure may be an off-putting factor for smaller businesses with budget constraints. However, you should balance this cost against the level of features and software you will be using when deciding if this is the most cost-effective option for you. They regularly provide a steep discount in the first year – you can use our QuickBooks referral link here to make a substantial saving in the first year – but this is then reduced in future years once you have bought into the Quickbooks ecosystem. Some other providers are far cheaper and a few even come free bundled with bank account (Freeagent is free with a Natwest Business Account)

Limited Options for User Support:

Some users may find the phone and live chat support options to be limited, potentially leading to challenges in resolving issues or seeking assistance with specific functionalities.

The Learning Curve for Corrections Can Be Frustrating:

Due to the robust feature set available with the software, some users may have a steeper learning curve for corrections and adjustments when they first get started.

Is Quickbooks Safe and Secure to Use?

QuickBooks Online prioritises user data security through various measures. Notable aspects include:

- SSL Encryption: QuickBooks Online utilizes industry-standard 256-bit SSL encryption, ensuring secure data transmission between users’ browsers and the servers. This safeguards sensitive information during online interactions.

- Secure Data Centres: Hosted by Intuit, QuickBooks Online resides in secured data centres equipped with access controls, physical security measures, and redundancy systems, minimizing the risk of data loss.

- User Authentication: User access is authenticated through usernames and passwords, with an option for multi-factor authentication, adding an extra layer of security.

- Regular Data Backups: To prevent data loss, QuickBooks Online performs routine backups, ensuring the recoverability of financial data in unforeseen circumstances.

- You Can Access Controls: Users can establish different roles and permissions, controlling access to features and data within the platform, thereby limiting exposure to sensitive information.

- Automatic Security Updates: The platform undergoes regular updates to patch vulnerabilities and enhance security, ensuring users benefit from the latest security features without manual interventions.

- Monitoring and Auditing: Continuous monitoring as well as auditing of system activities are employed, enabling the identification, and addressing of unusual or suspicious activities that may indicate a security threat.

- Bank-Level Security: QuickBooks Online employs bank-level security standards, incorporating secure servers, firewalls, and encryption protocols commonly used in the banking industry to protect financial data.

- Secure File Transfer: During file uploads or downloads, QuickBooks Online ensures secure processes, preventing unauthorized access or interception of sensitive documents.

- Compliance: QuickBooks Online adheres to various industry standards and also regulations related to data security and privacy, underscoring its commitment to responsible handling of user data.

While QuickBooks Online implements robust security measures, you and your fellow users will play a vital role in maintaining your account security. This includes creating strong passwords, regularly updating them, and exercising caution when sharing login credentials with others.

QuickBooks Review of Different Price Plans – Remember To Use Our Quickbooks Referral Above Or CLICK HERE

Quickbooks has a variety of different plans available depending on on the type of user/business you are and what type of service you need. Quickbooks have split these services up depending on whether you are an accountant, a sole trader, or a limited company. Within these categories, there are several different price plans available with other services and features included. Note that Quickbooks regularly provide promotions for new users (which usually apply for the first year) after which the pricing below takes effect. Our Quickbooks referral here provides you with a massive saving in the first year.

Here is a breakdown of the different plans to choose from, including QuickBooks costs and the features you’ll access for your monthly payment.

Quick Books Self-Employed Plan (£10/mo):

This plan is best for sole traders and freelancers who are not registered for VAT and need software to help with their Self Assessment tax preparation.

Quickbooks Self-Employed Features:

- Accounting to help you prepare for Self-Assessment tax submissions.

- Access Income Tax estimates so you can make sure you are saving up enough for your annual tax payment.

- Separate your personal and business transactions to ensure your tax return is accurate.

- Manage and categorise your income & expenses for a detailed overview of your finances.

- Send professional-looking invoices directly to your clients.

- Free onboarding session to help you get to grips with the software.

- Free phone & customer service chat support from Quickbooks if you run into trouble.

- Software to ensure you are Making Tax Digital ready.

Quick Books Simple Start Plan (£14/mo):

This affordable accounting plan is suitable for director-only or small businesses that need software to help with managing VAT and Income Tax.

Review of QuickBooks Features:

- Software to ensure you are Making Tax Digital ready.

- Use the accounting service to submit VAT directly to HMRC.

- Check your calculations with the VAT error checker.

- Plan and prepare for your Self Assessment return and payment.

- Access Income Tax estimates to help with your financial planning.

- Manage, categorise, and analyse your business income & expenses.

- Send one-click payable invoices to your clients.

- Insights into your cash flow to enhance financial planning and management.

- Free onboarding session as well as free phone & chat support

- The payroll add-on feature is available for £0.40 per month.

Essentials Plan Quickbooks Review (£28/mo):

This price plan is a good fit for all types of businesses that work with suppliers and manage VAT and Income Tax (for up to 3 registered users).

Accounting Features:

- Software to make sure you are Making Tax Digital ready.

- Feature so you can submit VAT directly to HMRC.

- Use the VAT error checker to make sure you have the correct data.

- Software to help you prepare for Self Assessment.

- Access Income Tax estimates to assist you with your tax payment planning.

- Manage and categorise your cash flow, income & expenses.

- Create and send one-click payable invoices to clients.

- Insights into your cash flow to help analyse your finances.

- Free onboarding session, chat support and phone customer service to assist you in getting started with the platform.

- Manage your outstanding payments and business bills.

- Accept client payments in different currencies.

- Track your employee time to gain an overview of cost-effectiveness and operations.

- Add the optional Payroll feature from £0.40 each month.

QuickBooks Plus Plan (£38/mo):

This accounting software plan is best for those who have businesses that need help managing projects, stock levels, VAT data, and income tax (up to 5 users can use the software).

Software Features:

- Ensure your company is Making Tax Digital ready.

- Use the software to submit your VAT directly to HMRC.

- The VAT error checker will help you make sure your data is correct.

- Prepare for your HRMC Self Assessment return.

- Use Income Tax estimates to manage your tax payment planning.

- Manage and categorise your company income & expenses.

- Send your clients a professional standard one-click payable invoice.

- Insights into your cash flow with categorisation and reports.

- Free onboarding session and phone & chat support from the Quickbooks expert team.

- Manage your client bills and track your outstanding payments.

- Accept payments from customers in different currencies.

- Track your employee time to assess productivity and cost-effectiveness.

- Use the software to manage your stock.

- Project profitability insights to enhance your financial planning.

- Set smart budgets for your business to increase profitability and manageable expenses.

- Optional add-on feature – Payroll from £0.40 per month.

Quickbooks Advanced Plan (£90 each month.)

This Quickbooks plan is suitable for businesses needing advanced features, data backup, custom permissions, and insights (up to 25 users can use the platform).

Review of Quickbooks Features:

- Software to ensure you are Making Tax Digital ready.

- Submit your VAT data directly to the HMRC.

- Use the VAT error checker to make sure you have the correct figures.

- Prepare your financial date for your Self Assessment return.

- Create Income Tax estimates to help you manage your finances.

- Manage business income & expenses clearly using the software.

- Send your clients one-click payable invoices online.

- Use cash flow insights to access profitability and manage finances.

- Free onboarding session as well as free phone & chat support

- Manage your supplier and customer bills and outstanding payments.

- Accept customer payments in different currencies.

- Track employee time and manage your stock.

- Access project profitability insights, advanced reports, and set smart budgets.

- Improve your business analytics with Excel spreadsheet compatibility.

- Use batch invoicing to save time and increase efficiency.

- Automate workflows & reminders.

- Employee expense management feature to increase understanding of outgoings.

- Optional add-on payroll feature from £0.40 each month.

Is Quickbooks the Right Accounting Software for Me?

Choosing the right accounting software for your business is a crucial decision that depends on various financial and operational factors. One key consideration is the size and type of your business. Here are some things to consider when assessing whether this is the right accounting option for your business.

- QuickBooks is well-suited for small to medium-sized businesses across various industries, offering scalable plans that make it adaptable as your business grows. Additionally, QuickBooks Self-Employed is specifically designed for sole traders and freelancers who require simplified accounting tools.

- Another critical factor to consider is your accounting needs. QuickBooks provides essential accounting features, such as invoicing, expense tracking, and financial reporting. For businesses with more advanced requirements, higher-tier plans offer features like inventory management, payroll processing, and project tracking.

- Efficient invoicing and payment processing are significant strengths of QuickBooks. The platform excels in creating professional invoices, managing sales, and offering flexible payment options to streamline the invoicing process.

- QuickBooks allows seamless integration with bank and credit card accounts, providing banking features that automate transaction imports and categorization for efficient reconciliation.

- The user-friendliness of QuickBooks is also noteworthy. The software is known for its intuitive interface, which is accessible and easy to use for users with varying levels of accounting knowledge.

- Collaboration and user access are facilitated through collaborative features, enabling you to invite accountants or bookkeepers to your account. QuickBooks also offers user management options.

- Regarding industry-specific needs, QuickBooks is versatile and caters to various industries. However, businesses with highly specialized industry requirements may need to assess whether QuickBooks meets those specific needs.

- Cost considerations play a crucial role, and QuickBooks offers different plans with varying features and price points. It’s essential to also consider your budget and choose a plan that aligns with your business requirements. Remember to sign up with our Quickbooks referral to save in your first year here

- Scalability is a crucial feature of QuickBooks, allowing your business to start with a basic plan and upgrade as needed to accommodate growth and additional features.

- In terms of compliance and regulations, QuickBooks helps businesses stay compliant with tax regulations and provides tools for tax preparation.

- Lastly, QuickBooks supports integration with various third-party apps and services, enhancing its functionality and adaptability to your business ecosystem.

QuickBooks online is a very popular and widely used accounting solution suitable for many businesses. However, the right choice depends on your specific business needs, size, industry, and future growth plans. You should explore the features of different QuickBooks plans and assess how well the software aligns with your business requirements before deciding.

Quickbooks UK Review of Alternatives

When considering whether Quickbooks UK is the right fit for you, you should also consider some online accounting alternatives. Several online platforms also offer diverse features catering to various business needs. Here are some noteworthy alternatives for you to compare and contrast with Quickbooks:

FreshBooks

- Pricing: Prices from £7.50 per month (after promotional pricing has ended)

- Pros: FreshBooks stands out with a robust mobile app, making it an excellent choice for freelancers, independent contractors, and professionals on the go. All plans include a client self-service portal, estimates, invoices, time tracking, and expense tracking. The software also features mobile mileage tracking, basic inventory tracking, and live phone support.

- Cons: Limitations exist in the number of billable clients for Lite and Plus versions (five and 50, respectively). Some features, such as double-entry reports and accountant access, are only available in some plans. Additional charges apply for adding team members to your account at £8 per person per month.

Xero Accounting (Check our detailed review and Quickbooks referral offer here)

- Pricing: Plans start at £15 per month (after promotional period has ended)

- Pros: Xero, a robust accounting software similar to QuickBooks Online, offers lower-priced plans with unlimited users and inclusive inventory management. It is known for its user-friendly and intuitive setup and design.

- Cons: The Early plan has limitations, allowing only 20 quotes and invoices and the entry of five bills. Time tracking is exclusive to the highest-level plan, the Ultimate plan (£55 per month). Xero’s customer service is considered lacking, lacking live chat support, and providing a phone number only for necessary calls.

Whether these accounting software options are a good fit for you will depend on your business type, operational needs, budget, and exactly what type of accounting requirements you have. The robust features available with Quickbooks may mean it is a better fit if you require more detailed analysis and robust accounting features to support your business growth.

Conclusion: Review of Quickbooks UK – Costs, Features & Pros and Cons

As you can see from our QuickBooks UK review above, this service stands as a top choice for cloud accounting software for freelancers and businesses, renowned for its user-friendly interface, intuitive database, and robust customization options.

The platform’s seamless accounting processes cover everything from Self-Assessment tax submissions to income and expense management. Boasting a dynamic dashboard, efficient banking integration, and robust user support, QuickBooks ensures a tailored accounting experience.

Exploring plans like Self-Employed, Simple Start, Essentials, Plus, and Advanced unveils a range of features and benefits to which can suit various business needs. Regarding security, QuickBooks Online prioritises user data protection through SSL encryption, secure data centres, user authentication, and regular backups. Compliance with industry standards also solidifies its commitment to a secure financial management environment.

Ultimately, the suitability of QuickBooks for your business depends on factors like business size, industry, accounting needs, budget, and growth plans. Before deciding if this is the right software for you – read through our Quickbooks UK review again and decide which features and plans best align with your business requirements.

Remember if you sign up with our Quickbooks referral here you will get a 90% discount for 7 months.

Recent Comments