Monzo Referral

Click the Monzo referral link and sign up for a Monzo account and you will receive a BONUS up to £50 credited to your account balance – The value will be a mystery. You need to open an account and complete one transaction within 30 days to receive your bonus.

Monzo Bank: Revolutionising Banking in the UK

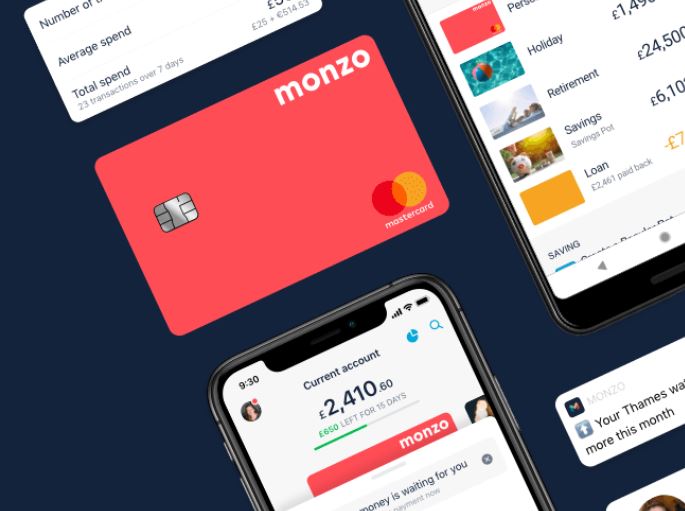

Monzo Bank is one of the UK’s most popular digital or “challenger” banks, designed to simplify personal finance management with its fully online and app-based approach. Founded in 2015, Monzo quickly gained a reputation for transparency, ease of use, and an engaging customer experience. As a bank built from the ground up on modern technology, it aims to meet the needs of people living in an increasingly cashless and mobile-centric world.

Who Are Monzo Bank?

Monzo Bank is a UK-based, fully licensed bank, offering a range of financial services via a mobile app, with no traditional brick-and-mortar branches. What sets Monzo apart is its commitment to making banking straightforward and accessible. Whether you need to set budgets, track your spending, or save automatically, Monzo offers these features directly from its intuitive app, available on both iOS and Android.

Initially starting as a prepaid card, Monzo later obtained a full banking license in 2017, allowing it to offer current accounts and other financial products. Today, millions of users trust Monzo for everyday banking, and it continues to grow in popularity as a leading choice in the UK’s digital banking space.

Key Features of Monzo Bank

- Instant Spending Notifications: Monzo provides real-time notifications whenever you make a transaction. This feature helps you stay on top of your finances by instantly tracking where your money goes.

- Savings Pots: Monzo allows you to create virtual “pots” to save for specific goals. You can automate transfers to these pots, making it easier to save without thinking about it.

- Budgeting Tools: Monzo’s budgeting tools give users insights into their spending habits by categorizing expenses and setting spending limits. You can easily track how much you spend on groceries, travel, and entertainment, helping you stay within your budget.

- Fee-Free Spending Abroad: When you travel outside the UK, Monzo doesn’t charge you extra for spending on your card. You can use your Monzo debit card abroad at the Mastercard exchange rate with no additional fees.

- Overdrafts and Loans: Monzo offers flexible overdrafts and personal loans to eligible customers. You can track how much of your overdraft you’ve used and get notified when you’re nearing your limit.

- Get Paid Early: One of Monzo’s standout features is the ability to get your salary paid into your account a day early. This feature is especially helpful for those who want quicker access to their wages.

- Bill Splitting: Monzo makes it easy to split bills with friends and family directly from the app. Whether it’s a restaurant meal or a utility bill, you can divide the costs and ensure everyone pays their share.

- Freeze and Unfreeze Your Card: Misplaced your Monzo card? No worries. You can freeze it directly from the app, and if you find it, unfreeze it instantly without needing a replacement.

- Joint Accounts: Monzo offers the option to open a joint account with a partner, allowing you to share finances and easily track spending as a couple.

- Monzo Premium and Monzo Plus: For a small monthly fee, Monzo offers premium features such as travel insurance, higher interest on savings, virtual cards, and other exclusive benefits.

How to Get Up to £50 Free with Monzo Referral Link

For a limited time, you can sign up to Monzo and receive Upto £50 free by using this Monzo referral link: https://join.monzo.com/c/c2x1h3l. Simply follow the link, download the app, complete the registration, and you’ll have Upto £50 credited to your account once you activate your Monzo card and make a transaction.

Pros of Monzo Bank

- User-Friendly Interface: Monzo’s app is extremely easy to navigate, even for those who are not tech-savvy. The clean design and simple features make banking on your phone hassle-free.

- Instant Notifications: Real-time alerts keep you updated on your spending, making it easier to manage money and prevent overspending.

- No Fees for Spending Abroad: Monzo’s fee-free foreign transactions make it an excellent option for frequent travelers.

- Innovative Features: From budgeting tools to early salary access, Monzo continuously adds new features that make managing finances simpler.

- Strong Customer Support: Monzo is known for its customer-centric approach, offering in-app chat and fast response times if you ever run into issues.

Cons of Monzo Bank

- No Physical Branches: Since Monzo is a digital-only bank, there are no physical locations to visit, which can be a drawback for those who prefer face-to-face service.

- Cash Deposits: Depositing cash into your Monzo account can be cumbersome as you need to visit a PayPoint location, and there’s a fee for each deposit.

- Limited Product Range: While Monzo excels in day-to-day banking, it doesn’t offer as wide a range of products as traditional banks, such as mortgages or investment accounts.

- Overdraft Fees: While Monzo offers overdrafts, the fees can accumulate if you regularly rely on them. It’s important to monitor your overdraft usage to avoid unnecessary costs.

How to Sign Up for Monzo Bank (and Get Upto £50 Free Using the Referral Link HERE)

Signing up for Monzo Bank is a quick and straightforward process that can be completed entirely from your mobile device. Here’s a step-by-step guide to help you get started, including how to take advantage of the free bonus by using the referral link provided:

Step 1: Use the Monzo Referral Link for £5 Free

To receive your free cash, begin by clicking on this special Monzo referral link: https://join.monzo.com/c/c2x1h3l. This will direct you to Monzo’s sign-up page, where you’ll be prompted to download the Monzo app on your smartphone.

Step 2: Download the Monzo App

The Monzo app is available for both iOS and Android. Simply follow the prompts to download and install the app on your mobile device from the App Store or Google Play.

Step 3: Create Your Monzo Account

Once the app is installed, open it and start the sign-up process. You’ll be asked to enter basic personal information such as:

- Your full name

- Date of birth

- Email address

- UK residential address

- Contact number

Step 4: Verify Your Identity

To comply with banking regulations, Monzo will ask you to verify your identity. You’ll need to provide a photo of your government-issued ID (passport or driver’s license), as well as a short video selfie to confirm it’s really you. This process is secure, and Monzo typically completes identity verification within a few minutes or hours.

Step 5: Wait for Approval

Once your identity is verified, Monzo will review your application. This is usually a fast process, and you’ll receive a notification in the app when your account is ready.

Step 6: Receive and Activate Your Monzo Card

After your account is approved, Monzo will send you a debit card in the mail. This should take around 2-5 working days to arrive. Once you receive your Monzo card, open the app and follow the instructions to activate it. You’ll be asked to enter a code from the card to link it to your account.

Step 7: Make Your First Transaction to Get Upto £50 Free

To receive your bonus, simply make your first transaction after activating your card. This could be anything from buying a coffee to paying for groceries, as long as it is a qualifying transaction.

Once you’ve made your first purchase, Monzo will automatically credit upto £50 to your account within a few days.

Additional Tips:

- Linking Other Accounts: Once you’ve activated your Monzo account, you can link it to other bank accounts or services like PayPal, allowing you to easily transfer money in and out.

- Set Up Direct Debits or Salary Payments: You can use Monzo as your main bank account by setting up direct debits or having your salary paid into your account. Monzo also offers the benefit of receiving your salary a day early if your employer supports BACS payments.

Conclusion

Monzo has revolutionised the UK banking sector with its innovative, customer-focused approach. Its suite of useful features makes it a perfect choice for those looking for a modern, mobile-first banking experience. While it may not be the best option for those who prefer traditional banking services like visiting a branch, Monzo continues to expand its features and refine its offerings.

Plus, with the opportunity to get a mystery payment up to £50 free by signing up via this Monzo link, there’s never been a better time to try Monzo! Whether you’re looking for fee-free spending abroad, better budgeting tools, or a straightforward way to manage your money, Monzo could be your perfect match.

Recent Comments