Cuvva Referral

Download the Cuvva app using our Cuvva referral HERE and get £10 off your first temporary insurance policy.

Today we live in a time of increasing flexibility and adaptability where traditional methods of doing things are evolving rapidly. This includes the way we approach insurance, particularly in regard to vehicle coverage. Amidst this changing landscape, Cuvva has emerged as a unique offering which provides temporary insurance solutions in the United Kingdom. Let’s delve into what Cuvva offers and how it’s reshaping the insurance market.

What is Cuvva?

Cuvva is a UK-based insurance technology company that specialises in offering temporary car insurance. Founded in 2014 by Freddy Macnamara, Cuvva was born out of the recognition that traditional insurance policies often fail to meet the needs of modern, flexible lifestyles. The company aims to provide an alternative solution for those who require short-term coverage, whether it’s for a few hours, days, or weeks or for specific needs such as learner drivers.

How Does Cuvva Work?

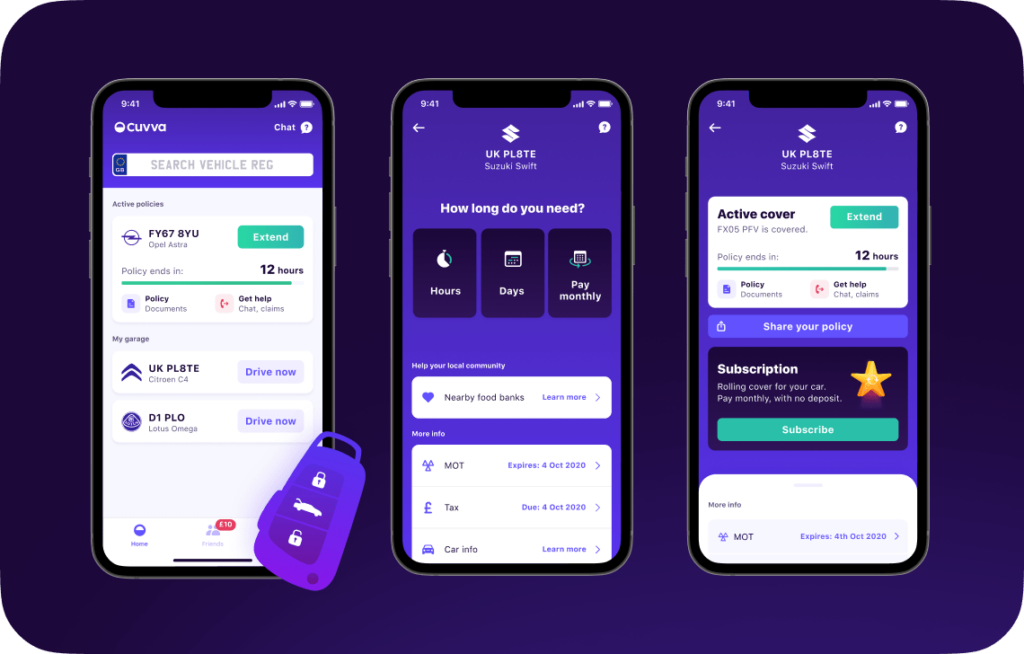

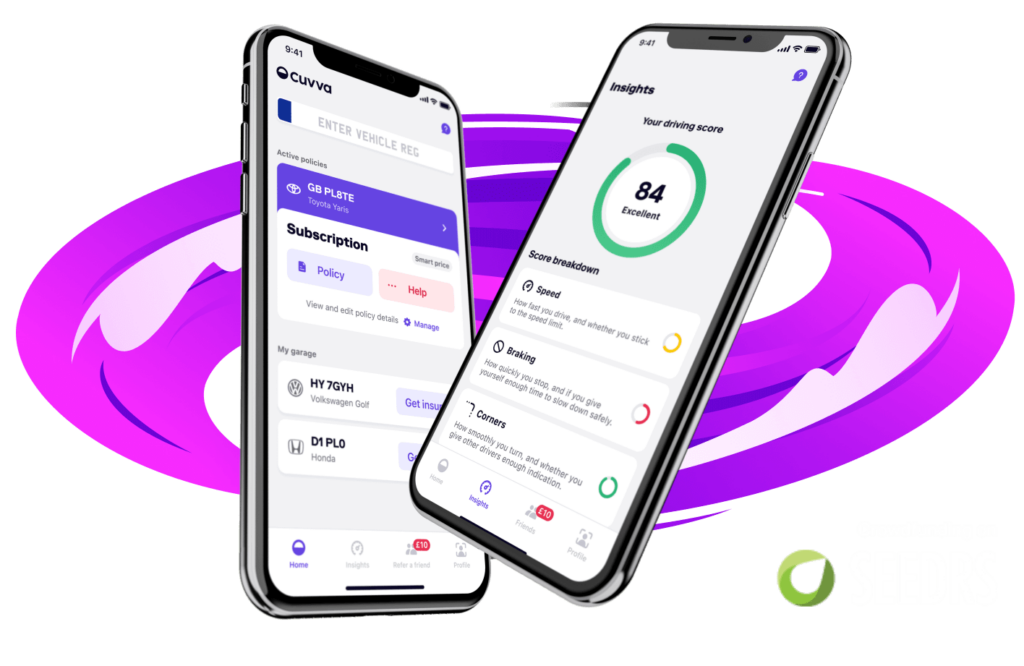

Cuvva operates through a user-friendly mobile app, making the process of obtaining temporary insurance quick and convenient. If you sign up with our Cuvva referral HERE you will get £10 off your first policy purchase. You simply download the app, enter some basic information, such as the vehicle registration number, and receive a quote in minutes. This streamlined approach eliminates the need for lengthy paperwork and enables users to get insured on the go.

The flexibility offered by Cuvva is one of its most appealing features. Whether you need insurance for a weekend getaway, borrowing a friend’s car, or test-driving a vehicle before purchase, Cuvva allows you to tailor your coverage to suit your specific requirements. This level of customisation is a game-changer for individuals who don’t want to commit to long-term insurance contracts or who find themselves in temporary driving situations.

Key Features and Benefits

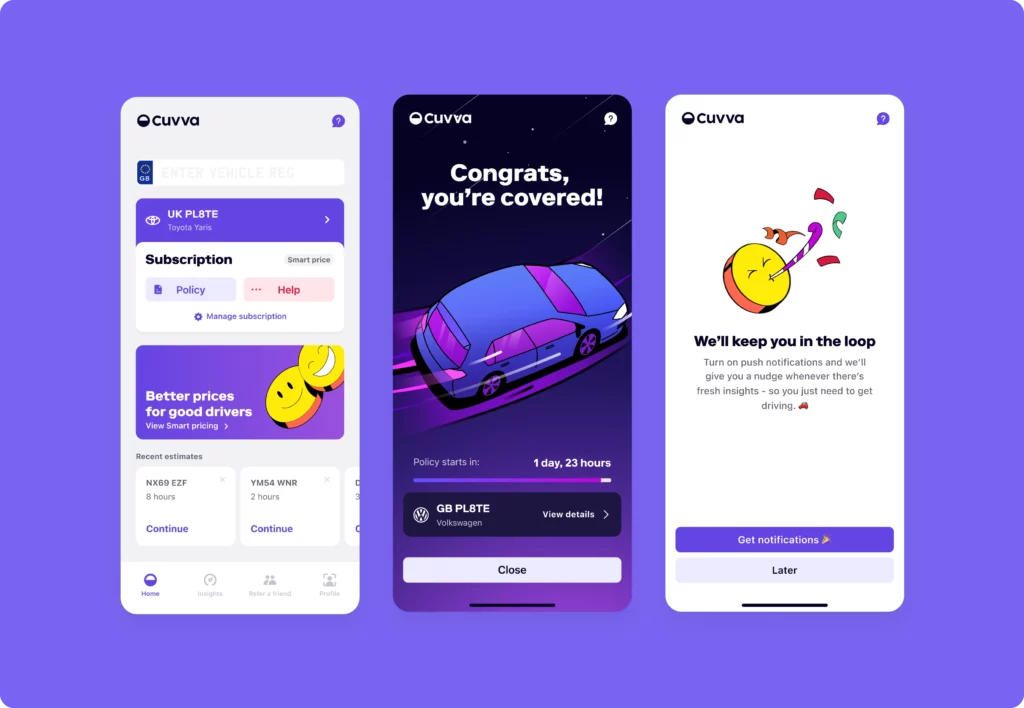

- Instant Coverage: With Cuvva, you can get insured within minutes, eliminating the need to wait for days or weeks for traditional policies to kick in.

- Flexible Duration: Whether you need insurance for a few hours or several weeks, Cuvva offers policies that can be customised to your desired duration.

- Affordability: Temporary insurance from Cuvva is often more cost-effective than traditional annual policies, particularly if you only need coverage for a short period.

- Comprehensive Coverage: Despite being temporary, Cuvva’s policies provide comprehensive coverage, including protection against theft, damage, and third-party liabilities.

- Ease of Use: The intuitive mobile app makes it easy to obtain insurance anytime, anywhere, with just a few taps on your smartphone.

What Types of Insurance Is Currently Available At Cuvva?

Currently there are a number of different types of temporary cover policies provided by Cuvva. These range from:

- Hourly cover: Perfect for short trips, errands, or test drives. Coverage starts from £10.39 per hour. This is Cuvva’s core offering which allows drivers to obtain coverage for a few hours and is perfect for individuals who need insurance for short-term driving needs, such as borrowing a friend’s car, test-driving a vehicle, or using a car for a brief trip.

- Daily cover: Ideal for day trips, borrowing a car for a day, or running errands over a longer period.

- Weekend or weekly cover: Great for getaways or periods when you’ll need the car for multiple days.

- Learner driver insurance: Hourly cover for learner drivers with a provisional license to practice with a supervisor.

- Van insurance: In addition to car insurance, Cuvva offers temporary van insurance for individuals who need to use a van for short-term purposes, such as moving house or transporting goods. This type of policy provides the necessary coverage for the duration of the van’s usage, offering peace of mind to drivers during temporary van rentals or borrowings.

It’s important to note that Cuvva provides fully comprehensive coverage for these temporary policies.

Conclusion

In conclusion, Cuvva insurance stands as a beacon of innovation and flexibility in the ever-evolving landscape of the insurance industry. With its range of temporary insurance policies tailored to the needs of modern drivers in the UK, Cuvva has revolutionised the way individuals approach vehicle coverage.

By offering short-term car insurance, pay-as-you-go options, temporary learner driver insurance, temporary van insurance, commercial hire insurance, and event-based insurance, Cuvva caters to a diverse array of driving scenarios, providing drivers with the flexibility, convenience, and affordability they need whilst also providing amazing prices for policies. Remember if you sign up for Cuvva with our Cuvva referral link HERE – you will save £10 on your first policy

With its user-friendly mobile app, instant coverage, and comprehensive policies, Cuvva has earned the trust and acclaim of customers and industry experts alike. As society continues to embrace flexibility and on-demand services, Cuvva is poised to lead the way in providing innovative insurance solutions that meet the evolving needs of drivers across the UK.

In a world where traditional insurance models often fall short, Cuvva is a new breed which delivers on adaptability, empowering individuals to navigate the roads safely and confidently, no matter how temporary their journey may be.

Recent Comments