InvestEngine Referral

Use our InvestEngine referral link above or here to receive up to £50 bonus cash to fund your investments. You must fund your account with at least £100 within 7 days to receive your bonus. Note the bonus rate will be based on the following probabilities. £35-£50 (5%), £13-£34 (20%), £10-£12 (75%)

Introduction

As we head into a new year, finding an affordable and easy-to-use investment platform is a priority for many of us. Investing apps such as InvestEngine have become popular choices for online investors looking for a way to make their money work for them without incurring the usual fees that come along with buying stocks and shares. Our Invest Engine review will tell you everything you need to know about this trading option.

InvestEngine UK provides users with a no-fee platform for DIY investing and a very affordable 0.25% charge for managed investing services. However, these low costs do come with a restriction – you will only be able to invest in ETFs. But unless you are a day trader looking for quick buys and sales in specific stocks – a medium or long-term and measured investment may be preferable anyway.

Invest Engine Review

Our Invest Engine review will tell you everything you need to know about this affordable trading platform and help you decide if this is the right investment option for you in 2024. Here is a breakdown of the key points you need to know about:

- Low-Fee Investing: InvestEngine is a very affordable option for beginner and experienced investors.

- Easy to use Investment Platform: The platform boasts a user-friendly interface and efficient investing experience, making it accessible even if you are new to online investing.

- Digital tools and resources: Despite its minimalist approach, InvestEngine provides essential info and resources to support informed decision-making.

- Secure and safe online investing: The InvestEngine platform offers a reliable and protected environment for your investments.

- Multiple account options: You can choose from different account types, such as General Investment Accounts, Stocks and Shares ISAs, and Business Accounts, to best suit your needs.

- Limited investment choice: While InvestEngine offers a good range of ETFs, it lacks other investment options like individual stocks or investment trusts.

What is an EFT Investment?

ETFs (Exchange Traded Funds) are like owning a tiny slice of the entire stock market, a diverse basket of companies reflecting an entire sector, or even access to the price of gold – all wrapped up in one single investment.

The beauty of ETFs lies in their versatility. They can track anything from broad market indexes like the S&P 500 to specific industry sectors like technology or healthcare. You can even find ETFs focused on commodities like oil or gold or those following unique investment strategies like dividend growth or socially responsible investing.

In essence, purchasing EFTs through a platform like InvestEngine is a simple and efficient way to diversify your portfolio, gain exposure to different asset classes, and potentially manage risk. They combine the benefits of broad diversification with the ease and flexibility of stock trading.

Invest Engine Review of Pros and Cons

Before we delve into our InvestEngine in detail, let’s have a brief look at the most important pros and cons of using the service.

Pros of Using InvestEngine UK

Cost-Effective Investing:

- Fee-free DIY ETF Investing: You can build your own ETF portfolio without paying the platform any add-on fees. This makes InvestEngine an ideal choice for cost-conscious investors who want to maximise their returns.

- 0.25% fee for managed investment portfolios: If you choose the option for a professionally managed portfolio, you will be charged a very competitive annual fee of 0.25%. This fee is transparent and affordable when compared to other investment platforms offering the same service.

Variety and Flexibility:

- Over 590 ETF options to choose from: You can use the platform to access a diverse range of ETFs covering various asset classes, regions, and investment strategies. Whether you’re looking for broad market exposure, sector-specific investments, or thematic options, you can use this ETF platform to access what you need.

- Fractional investing option: You can invest in any of the available ETFs with as little as £1, allowing you to build a diversified portfolio even with lesser amounts of money. This feature is perfect for beginner investors or those looking to test different investment ideas.

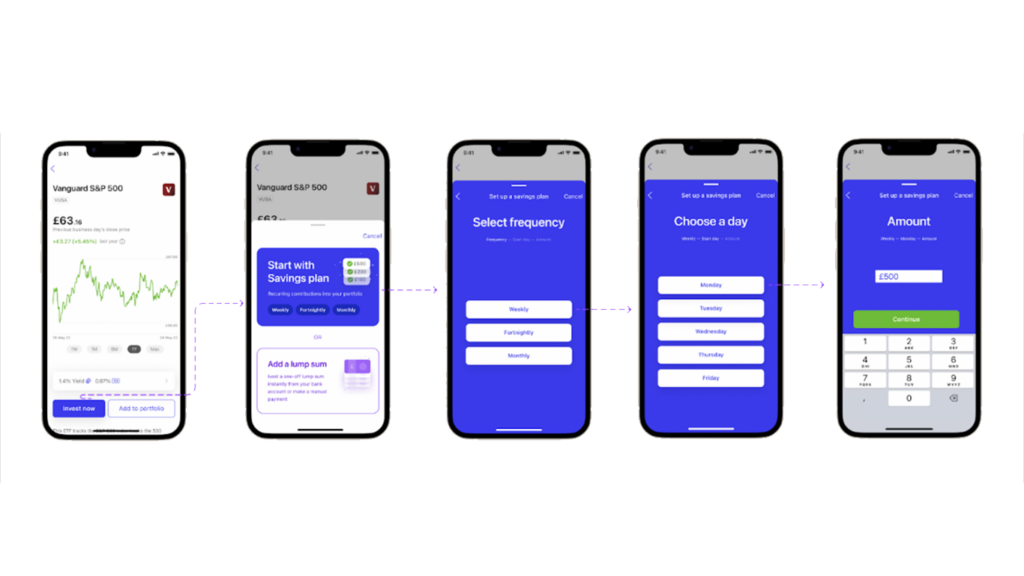

- Auto-invest feature: You also have the option to set up recurring investments to add funds to your chosen ETFs automatically at regular intervals. This helps you stay disciplined and build your wealth over time without manually placing orders.

Convenience and Control:

- One-click account rebalance feature: The platform allows you to maintain your desired portfolio asset allocation with a single-click rebalance. This feature simplifies portfolio management and helps ensure your investments are still aligned with your goals.

- Quick and easy access to major ETF providers: You can use the platform to find and invest in ETFs from popular providers like Vanguard, iShares, and BlackRock.

- User-friendly platform with detailed information on ETF options: You can use the investment app to access comprehensive information about each ETF, including performance data, holdings, and risk profile. This helps you make informed investment decisions.

Additional Benefits:

- InvestEngine is fully authorised and regulated by the Financial Conduct Authority (FCA), ensuring your investments are protected.

- The platform offers online educational resources to help you learn about investing.

Cons of Using InvestEngine UK:

Limited Investment Options:

- Investing is restricted to ETF options; you cannot buy individual stocks. This might be a drawback for investors who prefer the flexibility of investing in individual companies.

- Does not include personal pension options yet. If you’re looking for a platform that also offers pension solutions, InvestEngine won’t be a complete fit for you at this time.

Other Considerations:

- Minimum deposit limit of £100. This might be a barrier for some investors who want to start with smaller amounts.

- Orders may not be executed as speedily as on other platforms. This is not a major concern for most investors, but for those who prioritise fast trade execution, it might be a factor to consider.

- Limited choice when it comes to managed portfolios. InvestEngine currently offers a smaller selection of managed portfolios compared to some competitors.

Overall, as you can see from our Invest Engine review of the pros and cons, this app offers a compelling package for cost-conscious investors seeking an easy-to-use platform with a wide range of ETFs and convenient features. However, the limitations in individual stock investing, pension options, and execution speed might deter certain users.

How Does InvestEngine Work?

Remember to use our InvestEngine referral to get your BONUS of up to £50 by clicking here and signing up.

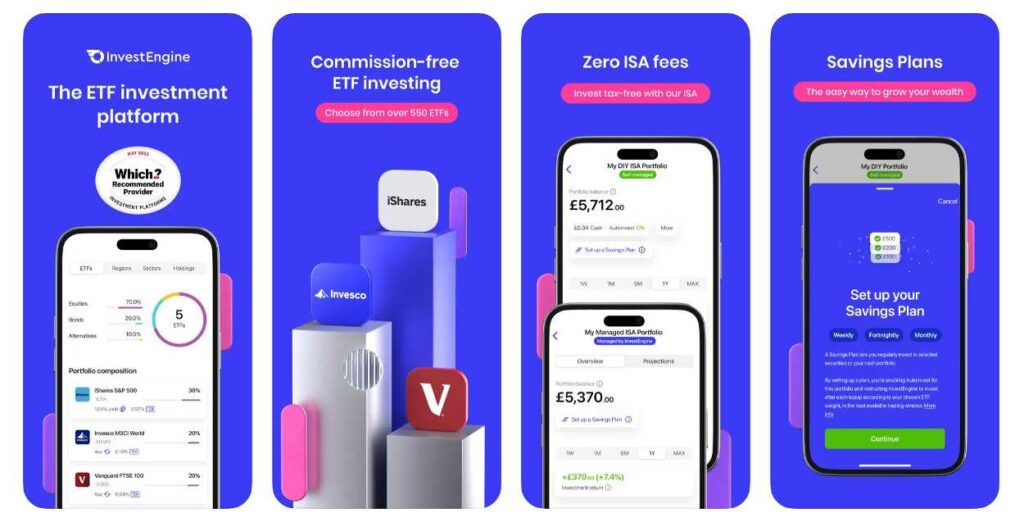

InvestEngine UK is a quick and uncomplicated way for you to get started with ETF investing online. When you sign up with them, you will have two options for managing your investments: DIY (Do-It-Yourself) and Managed.

Both options include the following features:

- Savings Plans and Auto Invest: You can set up recurring investments to ensure regular growth and avoid uninvested cash sitting in your account.

- Portfolio Look-through: You will be able to get a clear idea of your holdings, viewing your investment performance by region, sector, and individual companies.

- Easy investing: A user-friendly interface and helpful resources make managing your investments effortless.

Investing DIY Portfolio:

This option gives you a platform to build your own Exchange Traded Funds (ETFs) portfolio and includes the following features:

- No Account fees or dealing fees.

- No ISA or withdrawal fees.

- Fractional Investing, which allows you to invest as little as £1 in an ETF.

- Smart Orders to help you build and rebalance your investment portfolio quickly and easily.

Managed Investment Portfolio:

Alternatively, if you don’t have the time or don’t feel confident in creating your own portfolio – you can use the managed service. The platform’s expert team will then build and manage your investments based on your investing goals and risk tolerance.

- Annual 0.25% fee.

- Automatic rebalancing according to market conditions.

- Expert investment choices made by teams with years of experience and investing knowledge.

Invest Engine Review of User Experience

InvestEngine is an excellent fit for investors seeking a straightforward and accessible platform for managing their investments. Its user experience prioritises ease of use, making it a strong contender for beginners and those who value efficiency over complicated features.

InvestEngine prioritises clarity and avoids overwhelming menus, ensuring the platform feels uncluttered and easy to learn.

Opening an account is a quick and painless process, taking just minutes to complete. Navigation across both the user-friendly website and functional mobile app (iOS and Android) is intuitive, with crucial information about your portfolio and investment options easy to access and understand.

While not the most visually striking platform, InvestEngine prioritises critical features and simple functionality. Essential information such as portfolio performance, holdings, and transaction history are presented clearly and concisely, allowing you to stay informed without getting bogged down in unnecessary extras.

This focus on functionality extends to cross-platform accessibility, as you can seamlessly access your investments across different devices and operating systems.

Is InvestEngine UK Good for Beginners?

As you can see from our Invest Engine review so far, this platform ticks many boxes for beginner investors, making it an excellent choice for those who are just getting started with ETFs and need a simple way to invest.

- Managed Portfolio Services: The Managed Portfolio service takes the responsibility of choosing stocks away, with an expert team building and managing a portfolio tailored to your risk tolerance and financial goals. You simply need to select a risk level (Cautious, Balanced, or Adventurous) and let the experts manage the rest.

- ETF Focus: InvestEngine exclusively deals with ETFs, a diversified basket of securities that tracks a particular market index or sector. This eliminates the need to research and analyse individual companies, making it easier to spread your risk and achieve long-term growth.

- User-Friendly Platform: The InvestEngine platform is designed with simplicity in mind. The app is easy to navigate, even for those with no prior investment experience.

- Mobile App: You can manage your investments on the go with InvestEngine’s app, which is available for both iOS and Android. The app allows you to view your portfolio on your smartphone, make deposits and withdrawals, and even adjust your risk level.

- Educational Resources: While not the most comprehensive source of investment education available, the platform does offer a blog with informative articles and a community forum where you can learn from other investors and ask questions.

Overall, InvestEngine is an excellent platform for beginners seeking a straightforward and user-friendly way to invest in ETFs. Its Managed Portfolio services, ETF focus, and intuitive platform make it a low-stress entry point into the world of investing.

How Much Does InvestEngine Cost? (Get Up To £50 FREE To Invest Using Our InvestEngine Referral)

InvestEngine has become a popular choice with ETF investors due to its competitive pricing structure. Here is a breakdown of what each option will cost you:

DIY Portfolio:

- No Fees for using the platform.

- ETF Charges: Each ETF investment you make will have its own annual charge of 003% and above.

- Market Spread: There is an average market spread between buying and selling prices of 0.07%.

Managed Investing Portfolio:

- An Annual 0.25% fee for the platform’s investment management.

- ETF Charges: Average of 0.14% annual ETF charge for investment management portfolios.

- Market Spread: Average of 0.07% market spread.

DIY investors can benefit from using a completely free platform, paying only the underlying ETF charges (starting from 0.03%). Managed portfolios incur a modest 0.25% annual fee on top of ETF costs. Unlike some competitors, InvestEngine avoids extra hidden add-on fees, making it a cost-effective choice for both novice and experienced investors. This transparent approach and competitive rates make them a preferable option when compared to other more costly platforms. Remember if you sign up with our InvestEngine referral link here – you will receive a funding bonus of up to £50.

What Investment Accounts Are Available?

This investment app offers users three main account types to cater to different needs and tax situations. Read below for our Invest Engine review of accounts:

Individual Savings Account (ISA)

- Tax-free investing: You can grow your wealth without worrying about capital gains or dividend taxes (with an annual investment limit of £20,000.)

- Ideal for: First-time investors with long-term goals looking to maximise tax-free returns.

General Account

- Flexible Investing: You can invest any amount from £100 into both DIY and Managed portfolios, with easy access and no exit or platform fees.

- Ideal for: Larger investments, short-term or moderate-term goals, if you don’t have ISA eligibility.

Business Account

- Grow your company cash: You can put your company’s surplus funds to work and potentially earn higher returns with no limitations on investment size and immediate access.

- Ideal for: Businesses seeking diversification and potential growth, reinvestment, or cash management purposes.

Invest Engine review of Security Features

One of the main concerns when investing money is making sure that the money you are investing and the personal details you provide remain safe and secure. So, is InvestEngine a safe platform to share your funds and bank details with? Here’s our Invest Engine review of their financial security features:

- Advanced encryption: 256-bit SSL encryption protects your personal information around the clock.

- Secure data storage: All of your data is stored and protected in secure facilities with rigorous security measures.

- Ringfenced accounts: Your money and investments are held in separate accounts from InvestEngine’s own assets, minimising any risk.

- Bank-level security: Your cash is held in pooled client accounts with a reputable bank, ensuring additional protection.

- Independent custody: Your investments are held by CREST, an independent custodian, further separating them from InvestEngine.

- Financial Conduct Authority (FCA) authorisation: InvestEngine operates under the watchful eye of the FCA, adhering to strict regulatory standards.

- Financial Services Compensation Scheme (FSCS) protection: If InvestEngine or the custodian faces financial difficulties, your investments are covered up to £85,000 per person.

Investing your money comes with inherent risks in terms of losing your capital due to stock market fluctuations. But InvestEngine is a safe and secure platform where you should have minimal worries about data or financial security.

Choosing ETF Options Using InvestEngine

There are more than 590 investing options for you to consider when using the platform; these include a massive range of the major ETF Options:

- iShares S&P 500 (IUSA): Tracks the 500 largest US stocks (S&P 500 index) and distributes income—yield: 1.22%, TER: 0.07%.

- HSBC MSCI World (HMWO): Tracks stocks from 23 developed countries (MSCI World index) and distributes income—yield: 1.15%, TER: 0.15%.

- Vanguard FTSE Developed World (VHVG): Tracks largest companies in developed markets (FTSE Developed index) and reinvests income. TER: 0.12%.

- Xtrackers S&P 500 (XDPG): GBP-hedged ETF tracking the 500 largest US stocks (S&P 500 index) reinvests income. TER: 0.09%.

- Vanguard FTSE 250 (VMID): Tracks UK mid-cap companies (FTSE 250 index) and distributes income—yield: 3.42%, TER: 0.10%.

- iShares FTSE 100 (ISF): Tracks the UK’s 100 largest shares (FTSE 100 index) and distributes income—yield: 3.85%, TER: 0.07%.

- Invesco MSCI World (MXWS): Tracks stocks from 23 developed countries (MSCI World index) and reinvests income. TER: 0.19%.

- iShares S&P 500 (CSP1): Reinvesting ETF tracking the 500 largest US stocks (S&P 500 index). TER: 0.07%.

- iShares FTSE 100 (CUKX): Reinvesting ETF tracking the UK’s 100 largest shares (FTSE 100 index). TER: 0.07%.

- Invesco Nasdaq 100 (EQGB): GBP-hedged ETF tracking 100 non-financial stocks on NASDAQ, reinvesting income. TER: 0.35%.

How to Find the Right ETF Fund for You

Given the vast number of options available on this investment platform, it is worth considering how you will decide on the best investment option for you. Here are some tips to get you started.

Sorting Available ETF Funds

- Relevance: You can let the platform prioritise ETFs that align with your search terms and preferences.

- TER (Total Expense Ratio): Alternatively, you can compare the annual management and admin costs of different ETFs, starting from the most cost-efficient.

- Yield: You could also focus on ETFs with higher dividend payouts if income generation is your primary objective.

- Asset Class: Narrow your search by choosing equities, bonds, or alternative investment options.

You Can Filter Available Funds By:

- Provider: Choose from a range of established ETF providers or discover independent options.

- Asset Class: Refine your search based on your preferred asset type.

- Specific Investment Goals: Access advanced filters for specific investment goals, sectors, dividend focus, and more.

Pick From the App’s Featured Collections:

- Leading global indices: Track primary market benchmarks like the S&P 500 or FTSE 100.

- ESG: Invest in companies committed to environmental, social, and governance practices.

- Thematics: You can explore niche sectors with high growth potential, like clean energy or cybersecurity.

- Dividend-focused funds: Maximise income generation through ETFs that prioritise regular dividend payouts.

You can also let InvestEngine decide the best ETFs for you based on the answers you provide to several questions. InvestEngine can decide on the best ETF portfolio by asking you questions such as your likely risk profile, when you think you will need the funds and what percentage of your total assets you have invested with InvestEngine. Based on the answers you provide InevstEngine and can provide a number of suitable options.

Is InvestEngine UK the Right Investing Platform for You?

InvestEngine’s low-cost structure and user-friendliness make this a popular choice for online investors. But is this the right option for you? Here are some things to consider when deciding if this investing app is the best fit for your financial aims.

- New investors: InvestEngine’s ease of use and straightforward platform make it a good starting point if you are new to investing.

- Mobile-first investors: The accessible app provides convenient on-the-go investment management so you can easily keep an eye on your investments.

- Value-driven investors: InvestEngine’s competitive fees might be a significant factor for cost-conscious investors looking to avoid costly fees.

- Advanced investors: If you seek sophisticated tools, extensive functionality, or a highly personalised experience. Then you might need to explore other platforms with more choices and flexibility.

- Experienced Investors: If you’re a seasoned investor seeking advanced tools and features, InvestEngine’s limited functionality might feel restrictive.

- Stock Pickers: If you enjoy the thrill of picking individual stocks, InvestEngine’s ETF-only focus might not be your cup of tea.

Ultimately, the right investing platform for you depends on your individual needs and preferences. InvestEngine shines in its user-friendliness, cross-platform access, and affordability but might not be the best fit if you need advanced features.

Conclusion: Invest Engine Review – Best for 2024 ETF Investors?

InvestEngine stands out as a smart choice for ETF investors, particularly those prioritising affordability and user-friendly interfaces. The platform’s commitment to cost-effective investing, with fee-free DIY ETF options and a modest 0.25% charge for managed portfolio. This makes it an attractive option for both novice and experienced investors.

The versatility of ETF investments offered by InvestEngine allows users to diversify their portfolios efficiently. Meaning users gain exposure to various asset classes and managing risk. The platform’s pros, – including a wide range of ETF options, fractional investing, and an auto-invest feature – may outweigh its cons for many, such as the limitation to ETFs and the absence of personal pension options.

This investing app may not be the right pick for experienced investors interested in day trading or individual stocks. But InvestEngine UK is a great pick if you want an uncomplicated way to get started in the world of ETF investing.

Remember to sign up with our InvestEngine referral code to get upto £50 in FREE funding by CLICKING HERE

Frequently Asked Questions About The InvestEngine Referral

What Is the InvestEngine referral programme?

If you sign up by clicking on an InvestEngine referral- you are provided with a bonus payment to spend on your ETFs

How does the InvestEngine referral work?

By clicking on our InvestEngine referral link here: https://investengine.com/referral-welcome/?utm_medium=share&utm_source=growsurf&grsf=rdbejg you and then signing up, you activate a special offer to get free cash to use on your investments.

What is the value of using the InvestEngine referral?

By clicking our InvestEngine referral and signing up – you are entitled to free cash worth up to £50, which you can then spend on building your portfolio.

What are the criteria for the InvestEngine referral promotion?

To activate the offer, you need to click the following link: https://investengine.com/referral-welcome/?utm_medium=share&utm_source=growsurf&grsf=rdbejg and then sign up for an account. Once registered, you need to deposit at least £100 to receive your bonus payment. You must stay invested for at least 12 months before withdrawing this bonus funding from InvestEngine.

Recent Comments