Monese Invite Code: ZAAKI607

Signup for a Monese current account with Monese Invite Code: ZAAKI607 or click the link. Once you have signed up and completed your 1st transaction you will receive £20. When you spend over £500 you will receive an additional £10.

Monese App is a leading mobile banking and financial services app that allows users to easily manage their money on the go. With Monese App, users can open a bank account in multiple currencies, transfer money, and access a variety of other financial services, all from the convenience of their mobile device. Whether you’re an expat, a traveller, or simply looking for an alternative to traditional banking, Monese App is the perfect solution. In this review, we’ll give an overview of Monese App and its features, so you can see how this innovative app can help you manage your money more efficiently.

What is the Monese App?

Monese is a mobile banking app that allows users to open a UK or European bank account quickly and easily, using only their smartphone. The app was founded in 2013 by Norris Koppel, an Estonian entrepreneur, and is based in London, United Kingdom.

One of the main features of the Monese app is its ability to open a bank account in minutes, without the need for a credit check or proof of address. Users can sign up for an account using only their passport or national ID card, and can start using their account immediately, including ordering a contactless debit card.

The Monese app also offers a range of other features to help users manage their finances. These include:

- Contactless payments: Users can use their Monese debit card to make contactless payments at any retailer that accepts Mastercard.

- Direct debits: Users can set up direct debits to pay bills automatically.

- Money transfer services: Users can transfer money to other Monese users for free, or to any other bank account in the UK or Europe for a small fee.

- Currency exchange: Users can exchange money between different currencies at competitive rates.

- Budgeting tools: The app includes budgeting tools to help users track their spending and stick to their budget.

- Online account management: Users can view their account balance, transaction history, and other account details online.

In addition to the standard account, Monese also offers a Premium account which costs £4.95 per month and comes with additional features such as free cash withdrawals and higher limits on money transfers.

Monese is available on both iOS and Android and currently serves over 5 million customers in over 31 countries. The app is designed to be easy to use, with a simple and intuitive interface that makes it easy to manage your finances on the go. It’s great for people who are new to the UK or Europe, students, freelancers, and other people who need a bank account quickly and easily.

One of the main benefits of the Monese app is its accessibility, it allows people who may have difficulty opening a bank account through traditional methods, such as immigrants, students, or people with a poor credit history, to still have access to financial services as the signup process does not require a credit check of any kind. Additionally, the app’s budgeting tools and other features make it a great choice for people who want to stay on top of their finances.

How Do You Sign Up For Monese?

The signup process for the Monese app is relatively simple and straightforward. Here is an overview of the steps involved:

- Download the Monese app from the App Store or Google Play Store.

- Open the app and click on the “Sign Up” button to start the registration process.

- Fill in your personal details, including your name, date of birth, and address. You will also need to provide a valid passport or national ID card for identification purposes. Don’t forget to include our Monese Invite Code: ZAAKI607 to get a bonus credit added to your balance.

- Verify your identity by taking a photo of your passport or ID card and a selfie.

- Create a secure password for your account.

- Agree to the terms and conditions of the service.

- Verify your email and phone number by following the instructions sent to you by Monese.

- Once you have completed these steps, your account will be created, and you can start using your Monese account right away.

It’s worth noting that Monese does not require a credit check or proof of address to open an account, making it accessible to a wide range of people.

Once you have successfully signed up, you will be able to order a contactless debit card, set up direct debits, make payments and money transfers, and view your account balance and transaction history.

What Are Some Of The Benefits and Features Of Using Monese?

Quick and easy account opening: Users can open a UK or European bank account quickly and easily, using only their smartphone and a valid passport or national ID card. You can even transfer money between your accounts for free

Super fast: On-the-spot accounts, instant top-ups to your Monese account using another debit card and real-time spending notifications. Opening an account is quick and easy. And adding money? Is even easier still !

Contactless payments: Users can use their Monese debit card to make contactless payments at any retailer that accepts Mastercard just like any other bank issued debit card and includes apple/google pay support.

Direct debits: Users can set up direct debits to pay bills automatically and recurring payments are a synch!

Money transfer services: Transfer money for free when sending between Monese accounts, no matter the country or currency. Send and receive SEPA payments quickly, with no fees

Move money abroad: Move money abroad to over 30 countries, with excellent international rates using the wholesale exchange rate. It’s quick and can cost much less than sending with traditional bank or many of the other money trasnfers services you can find online.

Send and Receive Payments From Friends: Make a quick payment request to a friend without all the fuss — and get a notification when it arrives.

Virtual Credit Card: Use a virtual credit card for all your online purchases which is destroyed and replaced with a new number after every use making it a safe way to shop online.

Budgeting tools: The app includes budgeting tools to help users track their spending and stick to their budget with spending overviews and visual dashboards. Setup upto 10 spending pots and leep money aside for when you need it.

Online account management: Users can view their account balance, transaction history, and other account details online. See all your transactions categorised and instant notifications when you buy.

Free ATM withdrawals: The standard account (paid account) allows you to make free withdrawals at thousands of ATMs across the world.

Partner Rewards: Monese includes a number of special rewards and offers only availabale to Monese customers from discounted giftcards to discounted restaurant offers.

24/7 customer support: Monese offers round-the-clock customer support to help users with any issues or queries they may have.

Accessibility: Monese app is accessible to a wide range of people, it does not require a credit check or proof of address to open an account, making it accessible to immigrants, students, or people with a poor credit history.

Security: Real time notifications, the ability to lock your card in app if it is lost, face ID and multi layer security to access the app, virtual credit cards, single phone access and 3D secure when making card purchases means you are well protected when using Monese.

Premium account: Monese also offers a Premium account which costs £4.95 per month and comes with additional features such as free cash withdrawals, higher limits on money transfers, and travel insurance.

FREE Cash: Sign up to Monese using the Monese Invite Code: ZAAKI607 during the signup process and get upto £50 cash added to your balance when you complete the bonus criteria.

Who Can Benefit From Using The Monese App?

Monese App is designed to provide a convenient and efficient mobile banking solution for a variety of users. Some of the types of users who can benefit from using the app include:

Expats: Monese App is especially useful for expats who may have difficulty opening a traditional bank account in their new country. The app allows users to open an account quickly and easily, without the need for a credit history or a minimum deposit. Additionally, the app supports multiple currencies, allowing expats to manage their money in the currency of their choice.

Travelers: Monese App is also ideal for travellers. With the app, you can transfer money, pay bills, and withdraw cash from ATMs worldwide, all from the convenience of your mobile device. Additionally, the app provides a virtual debit card that can be used for online purchases, making it easy to use your account while you’re on the go.

Those without a traditional bank account: Monese App is a great option for those who may not have a traditional bank account, such as those who have been denied a bank account due to poor credit or other reasons. The app allows users to open an account quickly and easily, without the need for a credit history or a minimum deposit.

Budgeters: The app provides a variety of budgeting and financial management tools, such as the ability to set spending limits and track your spending over time, making it an ideal choice for people who are looking for an app to help them budget and manage their money.

Freelancers and entrepreneurs: Monese App provides an easy way to transfer money and pay bills, making it an ideal option for entrepreneurs, freelancers, and small business owners who need to manage their finances on the go.

In summary, Monese App is a versatile mobile banking app that can benefit a wide range of users, including expats, travellers, those without a traditional bank account, budgeters, and entrepreneurs. The app provides a variety of features and financial services that make it a convenient and efficient solution for managing money on the go for everyone!

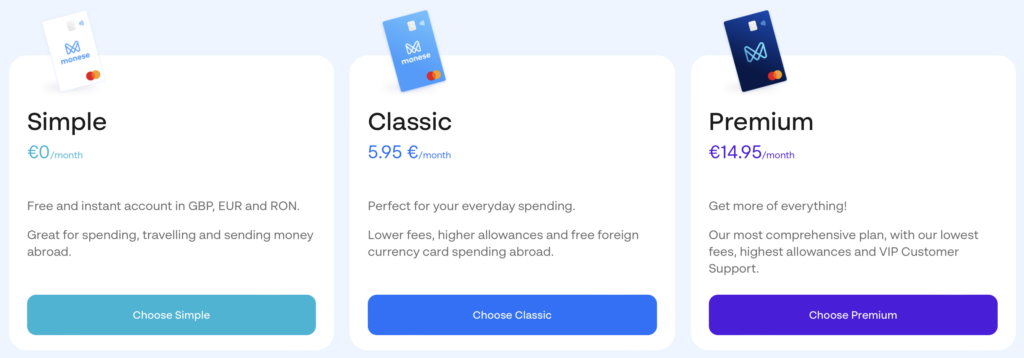

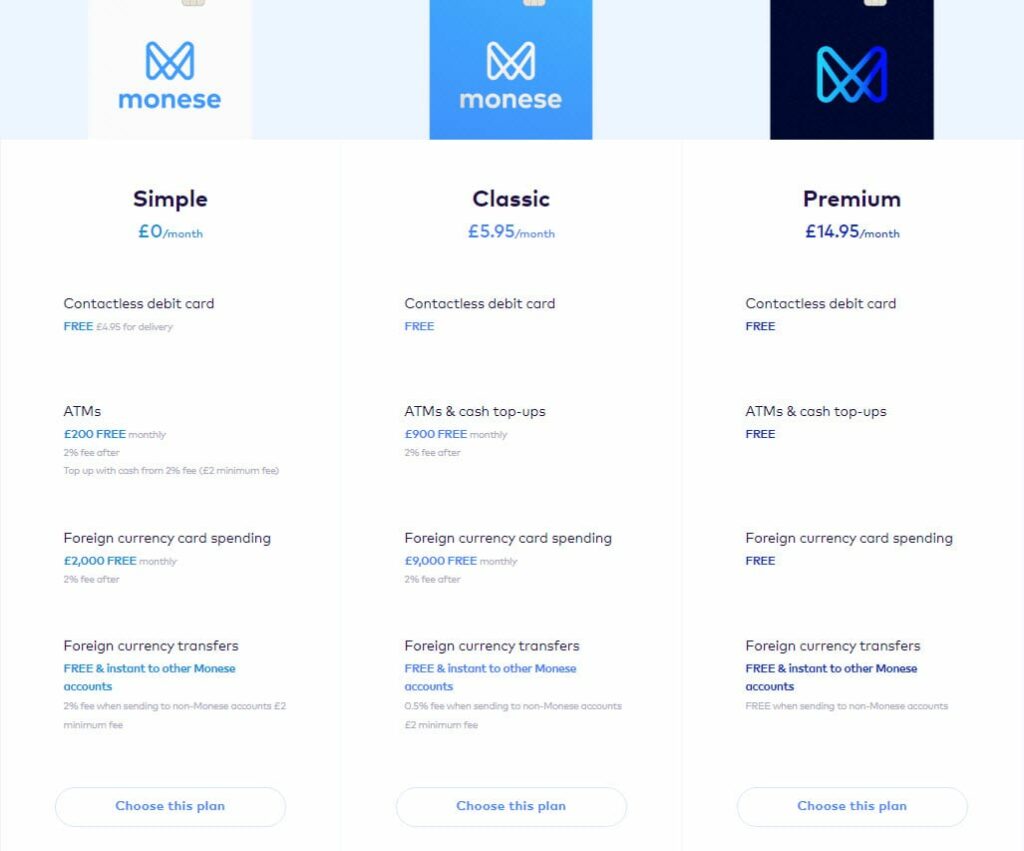

How Much Does It Cost To Use Monese?

In terms of fees, Monese App offers a free plan which includes free account opening, free money transfers, afree virtual debit card and free ATM withdrawals up to a certain limit. However, there are some fees associated with certain services such as delivery of your first physical debit card (£4.95), as cash withdrawals above the free limit, foreign currency exchange, and some other services. The app also charges a fee for certain types of transactions, such as cash withdrawals from ATMs and international money transfers. Users can check the Monese App website or in-app for a detailed fee schedule here

Takeaway – Monese App Review 2023

Monese App is a leading mobile banking and financial services app that provides users with a variety of features to help them manage their money more efficiently. The app allows users to open a bank account, transfer money, and access other financial services, all from the convenience of their mobile device quickly.

One of the key features of Monese App is its ability to help users save money. The app provides real-time information on the best exchange rates, so you can always get the most out of your money when you transfer it. Additionally, the app provides a variety of budgeting and financial management tools, such as the ability to set spending limits and track your spending over time. This can help users keep a better track of their finances and make more informed financial decisions.

Monese App is also very safe and secure. The app uses state-of-the-art security measures to protect user’s data and money, so users can rest assured that their information is always safe. Additionally, the app is fully compliant with all relevant banking regulations, so users can be sure that their money is being handled by a reputable institution.

The app also offers a free plan with no monthly or annual fees, which includes free account opening, free money transfer, free virtual debit card and free ATM withdrawals up to a certain limit. However, there are fees associated with certain services such as cash withdrawals above the free limit, foreign currency exchange, and some other services. Users can check the Monese App website or in-app for a detailed fee schedule.

In conclusion, Monese App is a versatile, easy-to-use, and secure digital banking app that provides a variety of financial services to help users manage their money more efficiently. With its ability to help users save money, budgeting tools, multi-currency support and security features, it can be a valuable financial tool for users. Additionally, the app’s free plan makes it accessible for users who are looking for an alternative banking solution without the need to pay monthly or annual fees. However, it is important to be aware of the fees associated with certain services and transactions, and budget accordingly.

Frequently Asked Questions

What is the Monese invite code?

You need to enter Monese invite code: ZAAKI607 to activate the referral promotion and earn FREE credit which is added to your account balance.

How do I open an account with Monese App?

To open an account with Monese App, simply download the app from the App Store or Google Play Store and follow the prompts to enter your personal information and verify your identity. Once your account is set up, you can add funds to your account and start using the app to manage your money immediately. The whole process should take minutes from start to finish!

Where do you enter the Monese referral code?

Enter the monese referral code: ZAAKI607 on the first page when entering your personal details in the box labelled do you have an invite code.

Is Monese App available in my country?

Monese App is currently available in 31 countries across Europe, including the UK, Germany, France, Spain, Italy, and more. You can check the app’s availability in your country by visiting the Monese App website or checking the app’s availability on the App Store or Google Play Store.

Are there any fees associated with using Monese App?

Monese App offers a free plan which includes a free account opening, free money transfer, free virtual debit card and free ATM withdrawals up to a certain limit. However, there are some fees associated with certain services such as cash withdrawals above the free limit, foreign currency exchange, and some other services. Users can check the Monese App website or in-app for a detailed fee schedule as these are updated regularly

How do I transfer money with Monese App?

To transfer money with Monese App, simply open the app, select the “Transfer” option, and enter the recipient’s account information or phone number. You can also transfer money to other Monese App users by using their unique QR code.

Can I use Monese to withdraw cash from ATMs?

Yes, Monese App allows you to withdraw cash from ATMs worldwide. However, there may be fees associated with cash withdrawals, so be sure to check the app’s fee schedule for more information.

Is Monese App safe to use?

Yes, Monese App uses state-of-the-art security measures to protect user’s data and money. The app uses encryption, two-factor authentication, fraud detection systems, and regular security updates to ensure that user’s information is always safe. Monese App is also fully compliant with all relevant banking regulations, so users can be sure that their money is being handled by a reputable institution.

Can I use Monese App to make online purchases?

Yes, Monese App provides a virtual debit card that can be used for online purchases. Users can view their account balance, transaction history, and more, all from within the app.

Recent Comments