XE Referral Code: XEREF-N3JK0WUA

Get a £25 gift card free when you enter XE promo code: XEREF-N3JK0WUA when making a money transfer of £1000 or more (in one or multiple transactions).

XE Money Transfer Review – Best for Your Cash?

Introduction

In today’s interconnected world, the need for efficient and reliable international money transfer services has never been greater. Whether it’s sending money to loved ones abroad, making payments for goods and services, or managing overseas investments, individuals and businesses alike require solutions that are fast, secure, and cost-effective. One such option that has been gaining prominence in the United Kingdom is the XE Money Transfer service.

Our Comprehensive XE Money Transfer Review 2024

XE, a subsidiary of Euronet Worldwide, Inc., is a trusted name in the field of currency exchange and international money transfers. With over 25 years of experience in the industry, XE has established itself as a leading provider of foreign exchange solutions, offering competitive rates and a range of services tailored to meet the diverse needs of its customers.

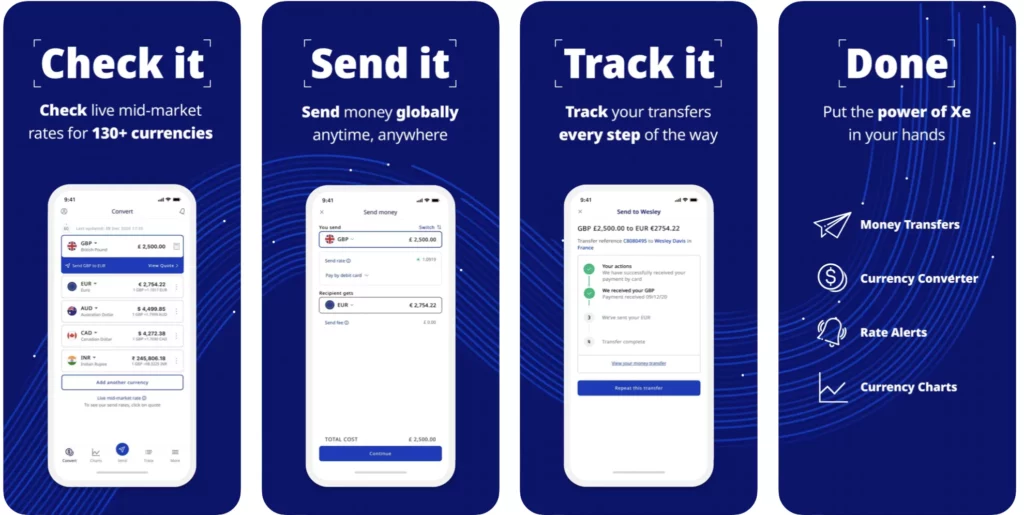

One of the key advantages of using XE Money Transfer is its user-friendly online platform, which allows customers to initiate transactions quickly and conveniently from the comfort of their own homes or offices. The platform is intuitive and easy to navigate, guiding users through each step of the transfer process and providing real-time updates on exchange rates and transaction status.

Moreover, XE prides itself on offering highly competitive exchange rates, often beating those offered by banks and traditional money transfer services. By leveraging its extensive network of banking partners and liquidity providers, XE is able to secure favourable rates for its customers, helping them save money on every transaction.

Pros and Cons of XE Transfers

Before we delve into exactly how the XE currency converter app works, let’s look at the main pros and cons. This should help you to quickly decide if this is the right option for you and your international financial transactions.

XE Transfer Review of Pros

- You can send money quickly and securely to over 200 countries in 100 different currencies.

- Your payment recipients can pick up cash from a variety of locations, such as stores and banks.

- The XE app is available in 11 languages. This makes it easier to send and receive money wherever you are on the globe.

- Wide range of supported currencies and countries. So, you have the flexibility you need for international transfers for your personal or professional transactions.

- XE offers a transparent process with straightforward payment options and fees. Making it simple for you to understand the cost of your transfers.

Cons of XE Currency & Money Transfer

- As with most international transfer services, XE charges transfer fees. These can vary depending on how you choose to pay and the amount you’re sending.

- These exchange rates include a markup. This means you might end up with a higher rate than the mid-market rate, affecting how much your transfer costs overall.

- There is no option to pay in with cash. This might not be ideal for some users who prefer this method.

XE Money Transfer – How Does it Work?

XE Money Transfer has a simple process made up of three easy steps: create an account and then enter recipient and payment details. Next, you need to confirm and send the transfer. Here’s how the process works:

- Create an Account: Begin by creating an account. This only takes a few minutes and requires just an email address to start with.

- Enter Your Banking Details: You can then initiate a transfer by adding the payment recipient’s information. This includes their address and bank account details (such as IBAN or SWIFT/BIC code). You’ll also need to provide your payment information.

- Confirm and Send: After entering the necessary details, you should review the currencies, additional costs, and amounts to ensure accuracy. You’ll then receive an expected delivery date for your transfer. Once everything looks good, you can confirm the transfer and your money will be sent.

- XE promo code: Remember to enter XE referral code: XEREF-N3JK0WUA when making your 1st transfer over £1000 to get a FREE gift card worth £25

What Is The XE Currency Converter?

XE offers a variety of currency services in addition to its international money transfer service. It’s most popular service and what XE is probably best known for is its currency converter charts and tools.

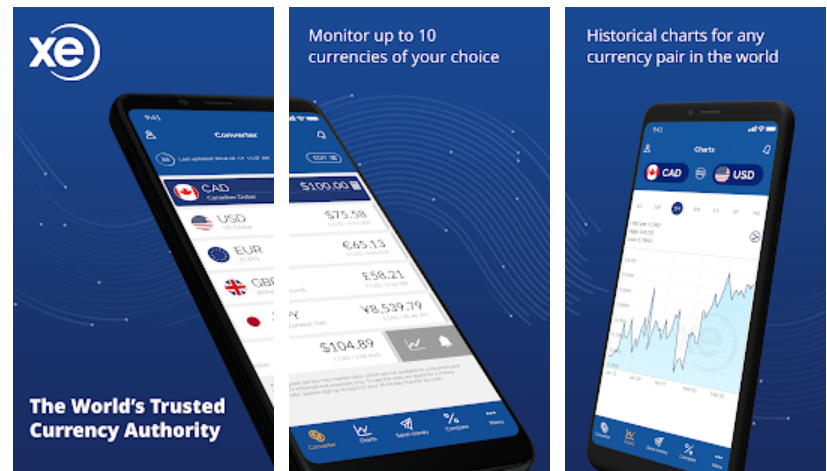

The XE Currency Converter is a powerful and widely used tool provided by XE.com. It allows users to quickly and easily convert currencies from one denomination to another based on real-time exchange rates.

Here’s how the XE Currency Converter typically works:

- Currency Selection: Users can select the currencies they wish to convert from and to using dropdown menus or by typing in the currency codes or names. The converter supports virtually all the world’s currencies, including major ones like US Dollar (USD), Euro (EUR), British Pound (GBP), Japanese Yen (JPY), and many others, as well as numerous less common or exotic currencies.

- Amount Input: Users can input the amount they wish to convert. The converter automatically updates the converted amount based on the real-time exchange rate between the selected currencies.

- Real-Time Exchange Rates: The XE Currency Converter retrieves real-time exchange rate data from various sources, including global currency markets. This ensures that users receive accurate and up-to-date conversion rates, reflecting the constantly changing nature of the foreign exchange market.

- Conversion Results: After entering the desired currencies and amount, the converter displays the converted amount instantly. It typically shows both the converted amount and the corresponding exchange rate used for the calculation. Users can also view historical exchange rate data and charts to track currency trends over time.

- Additional Features: In addition to basic currency conversion, the XE Currency Converter offers various advanced features and tools. These include the ability to set up exchange rate alerts, track multiple currencies simultaneously, access currency news and analysis, and integrate the converter into websites or applications using XE’s APIs (Application Programming Interfaces).

Overall, the XE Currency Converter provides a fast, reliable, and user-friendly solution for individuals, businesses, and travelers who need to convert currencies quickly and accurately. Whether it’s for personal finance management, international business transactions, travel planning, or simply staying informed about exchange rate fluctuations, the XE Currency Converter remains a trusted resource for millions of users worldwide.

XE Money Transfer Reviews of Rates and Fees?

While XE provides transparent information regarding fees, you should be aware of potential third-party deductions. This will help you to choose the most affordable payment method based on urgency and associated costs. The rates and fees you will need to pay for sending money through the XE currency converter app will vary depending on several factors:

XE Currency Send Fees:

XE applies a small send fee to some transfers. The exact cost will be transparently displayed when you initiate the transfer, and you’ll see it again before confirming the transaction. Some transactions require no send payments at all, while others can have a few euros, dollars, or pounds applied.

Several factors affect send rates, including the currency sent, payment destination, and the method of transfer. XE works with a network of global partners to send money quickly and securely, aiming to minimise charges where possible. This means that as you progress through the money transfer process, you may notice fluctuations in the send rate before you confirm and complete.

Payment Method Fees:

Keep in mind that if you choose to pay with a credit card, your card provider may charge a cash advance fee. If you opt for a bank or wire transfer, there won’t be a fee, although it may take up to 4 business days for the money to reach the recipient.

Third-Party Fees:

XE transfers the full amount you send, but sometimes, the recipient’s bank or an intermediary bank will deduct a fee from the received amount. XE doesn’t arrange or profit from these extra fees. And they will vary depending on local laws and regulations in the recipient’s country. Because of the vast range of different global bank policies, XE cannot predict or warn in advance about these third-party deductions.

Using XE for Business Money Transfers

XE Money Transfer for Business simplifies global business payments and offers a safe and simple solution for cross-border payments and FX risk management. Your company can use the service to schedule international transfers and manage foreign exchange risks efficiently.

The money transfer service offers competitive rates for small business global payments and provides data to help you navigate volatile currency markets effectively. And their experienced experts can assist businesses in managing complex market movements with sophisticated risk management solutions and products.

Integration into ERP systems like Dynamics 365 and Sage Intacct will allow easy and direct integration with your XE business account. This will help with consolidating global payments into one place. At the same time, the real-time FX tracking solutions offer your business an instant gain/loss analysis as well as robust reporting capabilities.

Who is XE Currency a Good Fit For?

The XE currency converter app is an ideal choice if you are looking for flexibility, convenience, and reliability in international money transfers. XE provides extensive coverage for global transfers, so you can send money to 200 countries in 100 different currencies.

Your recipients can also benefit from the convenience of picking up cash from various locations, including stores and banks, making it accessible and hassle-free.

One of the critical advantages of XE is its transparent pricing, which offers clear payment options and fees upfront, allowing you to understand the cost of their transfers without any surprises.

However, the absence of a cash payment option might not be ideal if you prefer to pay your transfer in person. Overall, XE provides a reliable and efficient international money transfer service, offering flexibility and convenience in their transactions.

Remember if you sign up and enter our XE referral code: XEREF-N3JK0WUA during your transfers of £1000 or more you will receive a £25 gift card reward.

Recent Comments