Daali Referral Code: mY3ec

Sign up to Daali and enter Daali referral code: mY3ec in the referral field box during registration and you will receive 200 points free. You will need to activate the offer by linking your bank account or buying a £25 giftcard within the app

Read our comprehensive Daali Review

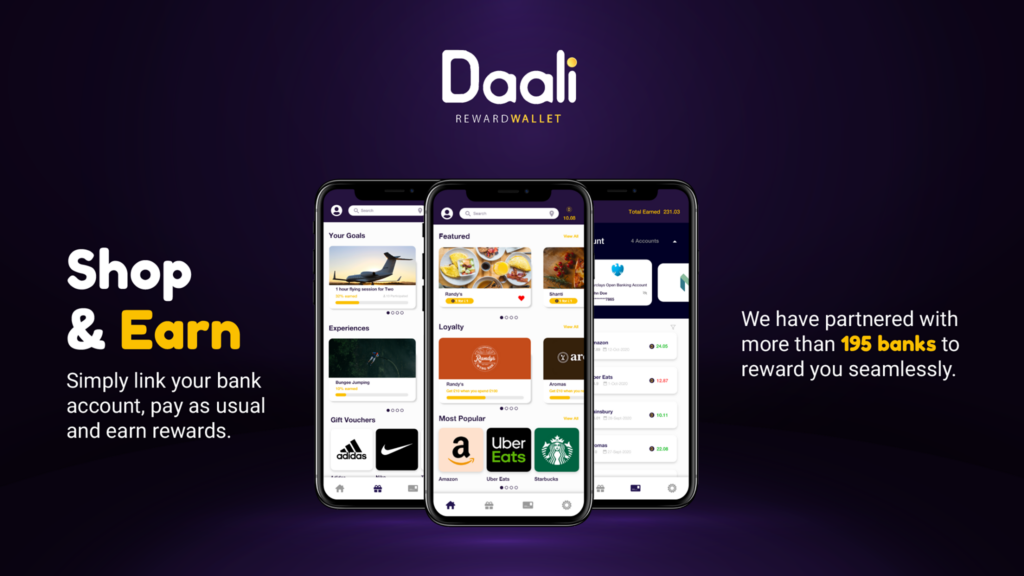

Daali is a new cashback reward app launched in the UK. Working very similar to other cashback rewards apps we have previously reviewed like Airtime Rewards and LoyalBe, Daali connects to your bank account to provide a seamless service in the background which awards points as you shop at qualifying retailers both in-store and online. Just like all cashback apps currently available – this app exists to provide cashback whenever you shop.

What Is Daali And How Does it Work?

Daali is a cashback rewards app that rewards you for shopping. Daali offers 3 separate ways to earn cashback when shopping. These can be broken down as follows:

Buy and earn: Purchase giftcards from various retailers listed in the Daali app and you will earn points in return. By entering the desired amount of giftcard and paying with a bank account – you will receive a giftcard by email and points earned will be deposited in your Daali wallet.

Click to earn: This is similar to popular cashback sites such as Topcashback and Quidco (also reviewed on this site). Click through the Daali app for your preferred retailer and your purchase will be tracked and you will earn cashback.

Shop to earn: Here you will earn cashback automatically by tracking your purchases on your connected bank account similar to Loyalbe and Airtime Rewards (also reviewed on this site)

During signup, you have the ability to link up a bank account to the app which is essential if you want to ‘shop to earn’ as mentioned above. Also for you to earn your bonus referral points for using the dDaali referral code: mY3ec you need to connect your bank account or buy a gift card worth £25 or more.

Daali is still relatively new, but the app shows promise and is extremely well laid out and already has a number of offers for categories such as groceries, fashion, food, and more. It’s already received a large number of positive reviews and looks to be growing month on month.

Is Daali safe to use?

Why do I need to link my bank account?

Daali needs to know when and which retailer you made your purchase with. It is essential for Daali to be able to track your shopping to reward you. Once your bank is linked everything is automated and you should receive your rewards promptly.

Can Daali be trusted?

Daali uses open banking to make sure it is as secure and safe as possible for the user. Open Banking is regulated by the government to ensure a positive customer experience by maintaining a high level of security when dealing with transactional data. It only allows the app to see read-only transactional data so it cannot see any other information and Daali do not have access to make or take any payments from your account. Furthermore, Daali connects with your bank via the FCA-regulated financial company, Salt Edge.

How will Daali use my transaction data?

Daali has confirmed that they will never sell or provide your information to third-parties. The technology they use to analyse your spending will never give them access to see your sensitive personal information.

How Do You Sign Up for Daali?

The Daali app is free to download from either the Apple app store or Google Play.

Once you’ve downloaded the app, you will need to enter some basic information such as your phone number and email address. You will be asked if you have a referral code and you can enter Daali referral code: mY3ec for a FREE 200 Daali points to get you started. To activate the offer (but also if you want to shop to earn as described above) you will need to link up a UK-registered bank account. The list of participating banks is available on the app.

After you’ve set up your Daali account you can get started earning rewards! Simply continue your regular spending and every time you purchase from a qualifying store – the automated tracking process with calculate the level of rewards earned and pop the relevant points into your Daali wallet.

What Are Daali Points And How Can You Redeem Them?

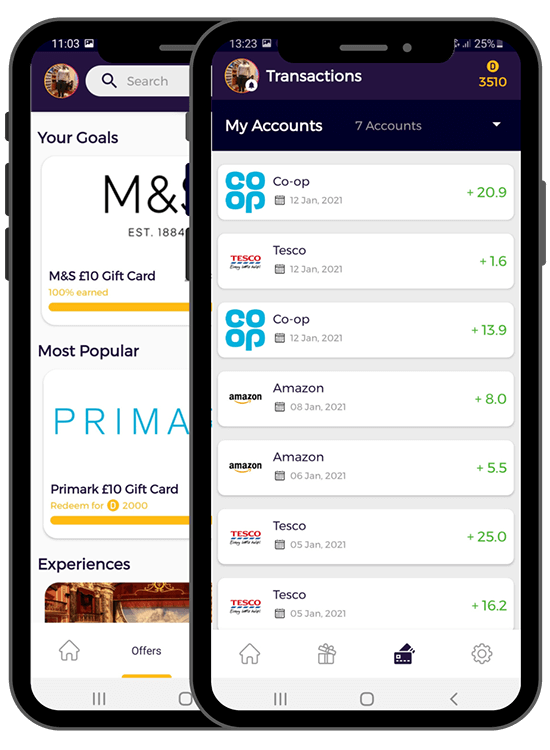

Whenever you shop at a qualifying retailer using your linked banking card, you’ll earn rewards or ‘Daali points’. One Daali point is worth between 0.5p and 10p and can be redeemed for gift cards, vouchers, and deals. Points values (which change regularly) differ dependant on whether you are buying giftcards, clicking through to a site or using a linked bank account and differ between retailers.

As previously mentioned, the Daali app is still quite new, and as such, it has limited options with regard to participating retailers. There are currently 170 ‘click to earn’ and 10 ‘shop to earn’ offers This is bound to change as the Daali app develops but it’s a great start so far.

How long does it take to receive Daali points?

After you’ve made a purchase at any of the qualifying retailers, you will find that transactions will take anywhere from 5 – 7 working days for the app to successful carry out tracking. Any transactions that take longer than this will need to be raised with customer service.

What is the minimum reward with Daali

You will need to earn a minimum reward amount before you can exchange any Daali points earned into gift cards. You’ll need at least £10 worth of points and can only redeem points for available gift cards. Unfortunately, gift cards are not always readily available and you will need to wait until they are back in stock. If you are not keen on waiting, however, there is the option to redeem your rewards against your phone bill similar to Airtime Rewards.

How much could you earn with Daali

You’re not about to make enough money with Daali to retire early and run away to live on some Caribbean Island. You are however going to be able to make a some savings for doing nothing out of the ordinary! The % of earnings you can earn from each purchase completely depends on the particular retailer but start from about 0.5%. A positive to take from the temporarily limited qualifying retailers associated with Daali is that most of them are relatively cheap to shop with.

Participating Retailers

At the moment the list of participating retailers is fairly small, however this will no doubt increase with further development.

Currently, you can earn Daali points at 177 retailers including :

- McDonalds

- KFC

- Primark

- Uber

- H&M

- Morrisons

- Ikea

- Amazon

- Costa

How can you maximise your earning with Daali

There are a few options at your disposal if looking to maximise your earning potential with the Daali app. These include:

- Referral scheme

If you love the app and want to share it around, you can obtain an individual referral code within your account on the app and share Daali around as much as you like! You’ll get £1 worth of Dali points when anyone uses your code to sign up. You can sign up with our Daali referral code: mY3ec to help keep the lights on at Referandsave HQ

- Combine cashbacks wherever you can

Combine cashback forces to truly optimise your earning potential. You could, for example, shop somewhere like Quidco and use a card linked to other cashback reward apps like Airtime Rewards. You’ll get multiple transaction benefits from just the one purchase

Daali – Pros and Cons

Daali is a relatively new cashback app compared to its competitors so there are still some developments to be made before it can be considered a leader in cashback savings. That being said though, there are some pros to Daali which should be noted:

Pros

- Seamless automated transaction tracking with bank account linking

- 3 different ways to earn cashback which is more than most other cashback providers provide

- Easy to set-up with user-friendly features and easy app navigation

- A safe, secure, and regulated application

- Ability to earn enough points to purchase giftcards and not limited to one brand or type (like for example mobile phone credit)

Cons

- Limited participating retailers (much smaller pool of partners)

- Customer service lacking in contact options compared to some of its competitors

- Gift cards known to go out-of-stock (most giftcards out of stock during article write up)

- Cashback rates look lower than the equivalent available at competitors

Summary of Daali App.

The Daali cashback rewards app is abound with promising potential. There’s a clear and focused growth strategy with a clearly dedicated and capable team to drive its development into something that can compete with better-established cashback apps like Airtime Rewards or topcashback. The app is simple to set up and incredibly user-friendly with an easy-to-navigate structure.

Efforts have clearly been made into making the app as secure as possible to maintain a positive customer experience, however customer service contact options could be improved to help with every-day queries.

There’s no doubt improvements need to be made to help elevate this app to the level of its peers, however, its temporarily limited offering should not deter you from giving it a go. The lack of cash-out options available when we downloaded the app is concerning (most giftcards were out of stock) It is after all, free to use, and by strategically combining other cashback rewards apps with purchases you make using Daali, you can maximise earning potential to reap larger benefits.

Don’t forget to use our Daali referral code: mY3ec when signing up to get 200 FREE Daali points when signing up and connecting your bank account.

Recent Comments