Snoop Referral

Sign up for the Snoop app using the snoop referral code here or clicking the button above and you will get a FREE amazon £5 voucher when you signup and connect your bank account to the service.

What is Snoop?

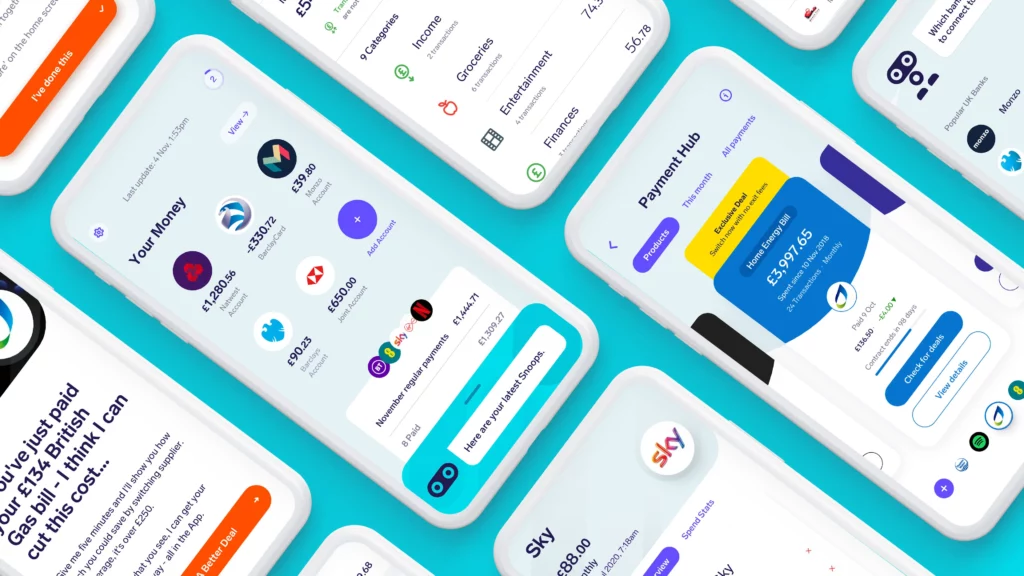

Launched in 2020, Snoop is a secure and free-to-use money management app. It offers ‘everything you need to beat the cost of living increases‘, including hints and tips on tracking your spending, cutting back, and providing guidance on controlling your finances.

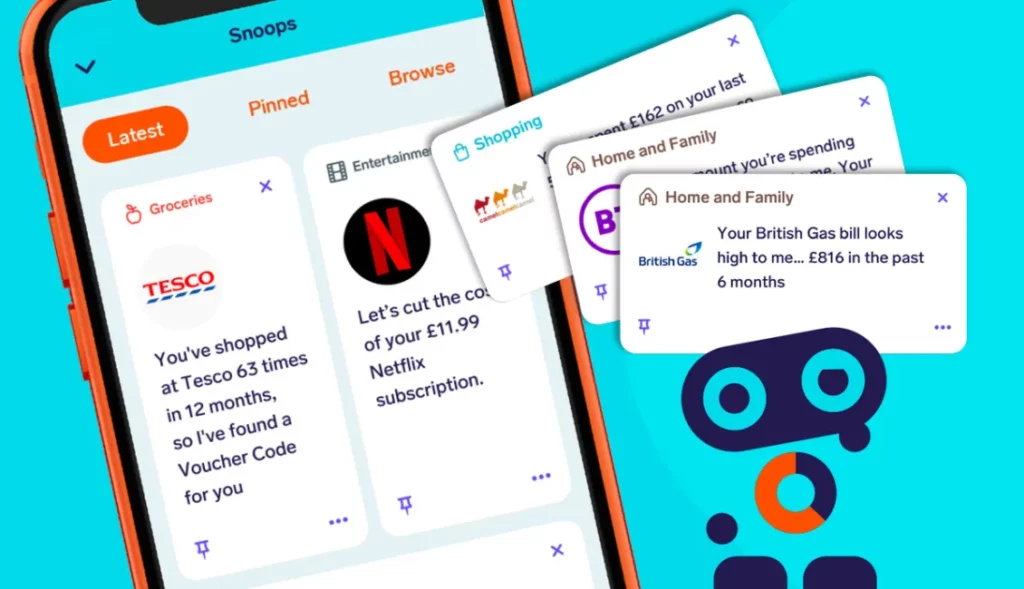

The app prides itself on spotting price hikes on your bills or regular outgoings and suggesting special offers which may be available to you for switching if and when this happens. Snoop can also help you to spot and stop any subscriptions which you don’t use and by providing Snoop with a little bit of extra information, you can set the app to notify you when bills or subscriptions you do want to keep are due to go out. This saves you from the anxiety of forgetting and going overdrawn by helping you to transfer the right amount of money to the right account at the right time each week or month.

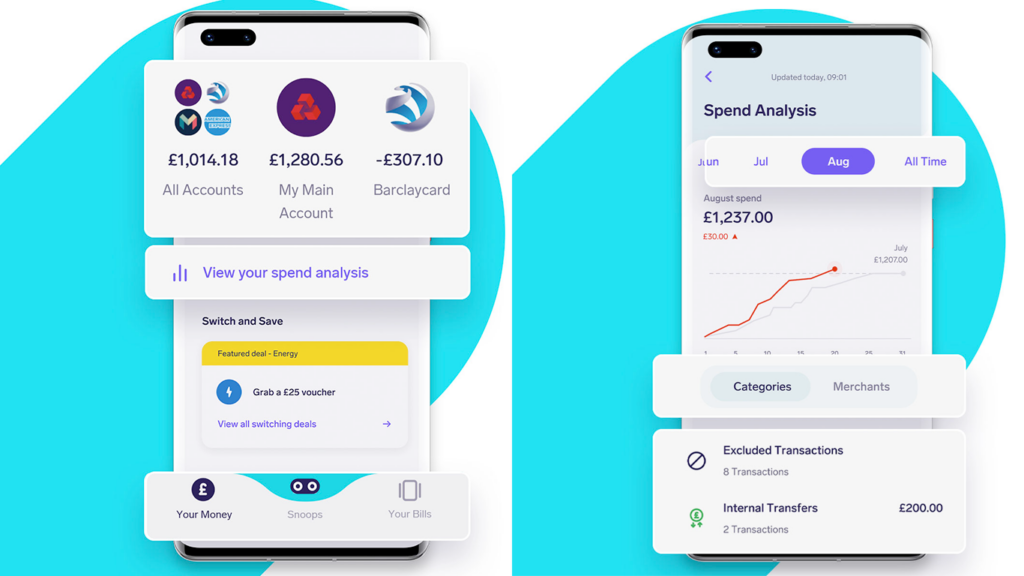

Users of Snoop are able to link as many bank accounts and credit cards as they like to the app, which allows them to see all their spending, filtered by month, in one place. Most if not all of the major providers are catered for (It’s frustrating when you download a money management or budgeting app and find it isn’t compatible with your bank; I remember it took a while for Monzo to appear on a lot of apps I used when I first started banking with them, but there is a very long list on Snoop including many I’ve not yet heard of so hopefully you’ll be covered!)

The list of services offered by Snoop can be broken down as follows:

- Helps you cut your bills by monitoring prices across suppliers and recommending when it is time to change

- Stops subscriptions you don’t use by reminding you what subscriptions you have running at all times

- Avoid bank penalty fees by alerting you when you might go overdrawn by constantly monitoring when payments are made from your accounts and ensuring enough funds are available

- Find better-value alternatives when you are overpaying for a product available elsewhere for less

- Find vouchers and sales at the places you shop by alerting you when these are available

- Spots unexpected price hikes and informs you of the changes so you can take action

- Tracks refunds for items you have returned so you are prompty refunded

- Switch suppliers at the right time by advising you when it is time to move by comparing your current costs to those available on the market

Why join Snoop?

Aside from the fact that they are currently running a promotion using the Snoop referral code: https://click.snoop.app/M2Tu/udttbqni which means you will receive a FREE £5 amazon voucher for signing up and connecting your bank account – I have found that Snoop is one of the best money management tools out there. By providing the ability to combine all my accounts I have a snapshot of all my available balances and a view of all my incomings and outgoings. Combining this with its ability to analyse my spending by constantly tracking my bills against market rates – I know that I have better understading of my total savings and I should never be paying more than I need to for utilities which is one less thing I need to worry about.

Snoop also records which retailers you shop with regularly and using that information, it can display relevant special offers directly to you. Soon after linking my accounts with the app for example – I was offered the chance to book a free eye test with Boots; a retailer which regularly appears on my bank statement(s). It seems the Snoop AI constantly monitors your transactions and provides details of any promotions/vouchers which may be available from places you regularly shop and also highlights any other services they offer which might interest you.

Snoop customers also regularly receive promotional offers that are not freely available to the general public. Today for example I can see an offer in the Snoop app offering a £15 balance credit if I sign up for Curve (which is another offer available to referandsave readers here). The other main offer on the site is £50 free for starting a pension with Pensionbee. Neither of these offers seems to be available freely on the sites in question so Snoop has agreed a special rate for its users.

Signing up to Snoop – The process

Snoop promises signing up for its service can be completed in under 3 min – plus another 4 minutes to link your cards and accounts. I didn’t time myself but this seems about right, The entire process was not only quick but very simple to complete with basic personal information gathering and then linking my accounts After that, it took a short while for the app to bring over my account transactions. I was warned by the Snoop robot (more on that in a sec!) that scanning for my bills, subscriptions and regular payments could take up to 20 minutes, but to be honest, whilst I noted this perhaps was taking a little longer than I expected, it wasn’t something I was too bothered about. In some ways, from both a quality and a security point of view, I would probably prefer it to take a bit longer to make sure it was right! Indeed, my personal spending analysis which was available after 15-20 minutes was extremely detailed, and it was worth the wait.

Another feature I was particularly drawn to is that, once my accounts were synced I could see my month-to-month spending across the app, I started to receive and have access to personalised hints and tips for immediate changes or cutbacks I could make. Furthermore using the custom categories the app offers it immediately began to categorise my transactions – (you can also add an additional three categories to organise your spending habits if you so wish). This is the free Snoop plan and although the majority of services are available you can sing up for Snoop Plus whichc amongst other things allows you to add unlimited custom categories. That said the standard 3 custom categories seem like more than enough for me, even as someone self-employed who regularly works across a number of organisations and industries.

The Snoop App

The app itself has a simple, chummy tone and a clear, coherent layout which is something which always impresses me and indeed makes me less nervous to use some of these new fintech applications. If you’re like me and can find some of the more complicated finance dashbaords which include graphs and charts – you will love Snoop’s layout and the Snoop robot who, according to the Snoop website, is ‘a little robot built with a big heart’. The Snoop ‘bot’ becomes your virtual assistant in the app when it comes to navigating and using the services on offer.

Is the Snoop App Safe?

Despite the ‘cuteness’ of the app from a security point of view, I feel safe using Snoop. You’re not required to input too many personal details beyond your name, date of birth, phone number and an email address except of course the requirement to link your bank accounts or credit cards. Understandably, this can be nerve-wracking, but Snoop boasts that it uses the same high security standards as any bank, is registered with the Financial Conduct Authority and can only view your transactions; the app doesn’t have the authority nor the ability to move or spend your money.

In Summary – The Snoop App Is…

Overall, I think Snoop has great potential and is certainly an app I will be keeping on my device and connected to my bank account. It will be interesting what advice and guidance it provides over the coming months with the ever changing landscape in the UK for pricing. Hopefully it can provide insights into utilities that are offering discounts and other promotional offers which are not openly available on the market. I have already made use of the subscription notifications to ensure that those I am no using regularly are cancelled and I think I might check out the offer for pensionbee as it is not something I was aware of previously

The application itself is extremely well designed. I love the app and this is certainly one aspect that is a huge positive for me. In a time when there are new fintech finance apps popping up in the UK on a weekly basis – this one certainly stands out as a well designed and easy to use application which has been well thought through by the team at Snoop.

Snoop won the Innovation of the Year award at the 2021 British Banking Awards – and so I look forward to getting to know it, and its robot, over the next few weeks.

You too can sign up now and, if you’re nervous to discover it alone, why not invite up to 5 friends to join too. Use our snoop referral code: here and you’ll receive a £5 Amazon voucher and then once signed up refer 5 of your friend too – that’s one way to treat yourself guilt-free whilst managing your spending.

Recent Comments