Having a bank account is essential for managing your finances, paying bills, and accessing financial services in the UK. However, for some individuals, opening a bank account can be a challenge, particularly if they have a poor credit history, limited identification, are an expat or asylum seeker or have been refused by multiple banks in the past. If you are in this situation, there are still options available to you.

One of the most popular options in the UK is Suitsme. First established in 2015, Suits Me provides a life-line to those struggling to open accounts in more traditional banks by providing a range of financial services designed for individuals who are financially excluded from the UK banking market.

The primary product offered by Suits Me is the prepaid Mastercard debit card, which can be used anywhere Mastercard is accepted. This debit card is different from traditional debit cards as it allows users to load money onto the card and spend it as they wish, without the need for a credit check. This makes Suits Me a great option for people who may struggle to get approved for a traditional bank account due to poor credit history.

In addition to the prepaid Mastercard debit card, Suits Me also offers an online current account that includes features such as budgeting, money management, and instant spending notifications. This account is designed to help users manage their finances and keep track of their spending, making it easier to stay within their budget.

What Is Suits Me And How Does It Work?

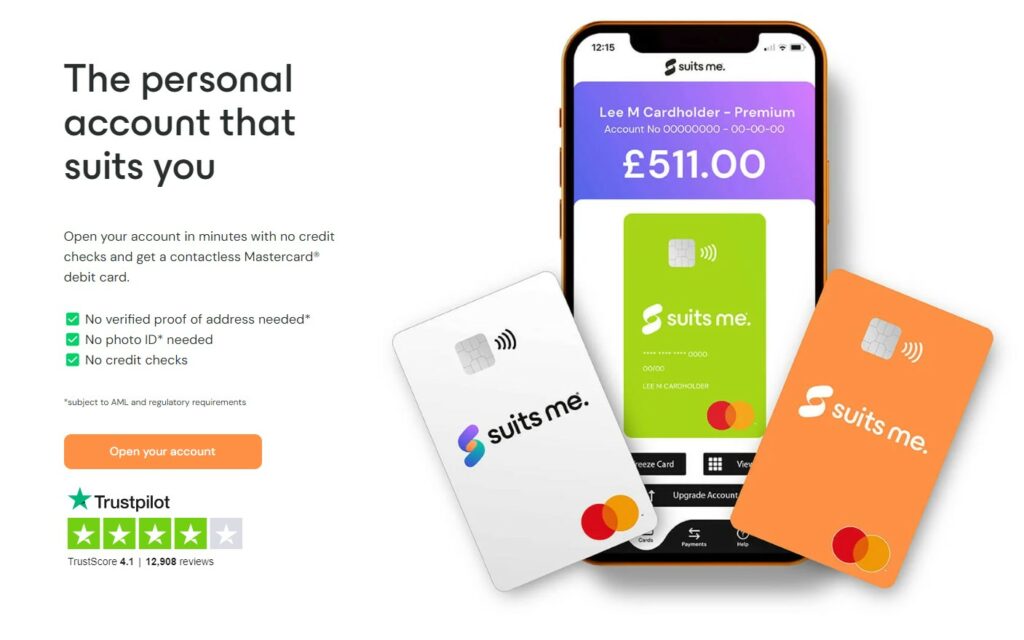

Suits Me is an online banking platform for UK residents aged 18 and over providing a service similar to traditional banks in the UK but with fewer features. This enables Suitsme to be accessible to those who may struggle to sign up for the more mainstream bank accounts in the UK. There are no credit checks or proof of address requirements in the application process which can make Suits Me a more accessible banking option for many.

How Do You Sign Up To Suits Me?

To sign up for any of the accounts on offer with Suits Me you must be 18 or over, have a valid proof of ID, and have a UK address (however a proof of address is not required).

Signing up is an extremely simple process and can normally be completed in a few minutes as follows:

- Visit the Suits Me website: Sing up by clicking here and then click the “Get Started” button.

- Complete the online application: Next, complete the online application form, providing your personal and contact information, including your name, address, and date of birth.

- Verify Your email: You will receive an email that will include a secure link for completing registration.

- Verify your identity: To verify your identity, Suits Me may ask you to provide government-issued ID, such as a passport or driving license and a selfie to complete identity checks – you will not be asked to provide proof of address.

- Choose your account: You will need to decide which account type meets your requirements. Full details on the accounts available and pricing are provided further below.

- Fund your account: Once your identity has been verified, you can fund your Suits Me account using a debit card, credit card, or bank transfer.

- Activate your card: After funding your account, Suits Me will send you a card in the mail. To activate your card, follow the instructions provided with your card.

- Start using your card: Once your card has been activated, you can start using it immediately. You can use your Suits Me card to make purchases online, in stores, and at ATMs, as well as to withdraw cash from ATMs.

In summary, the Suits Me signup process is simple and straightforward, and can be completed entirely online within 10 minutes. By following these steps, you can quickly and easily access the financial services you need and manage your finances with ease.

What Account Types Are Available & What Do They Cost?

Compared to competitors such as Revolut, Monese or Wise (all reviewed on this site), Suits Me isn’t particularly cheap although it is likely you will be accepted for an account here whereas you may be declined at the others.

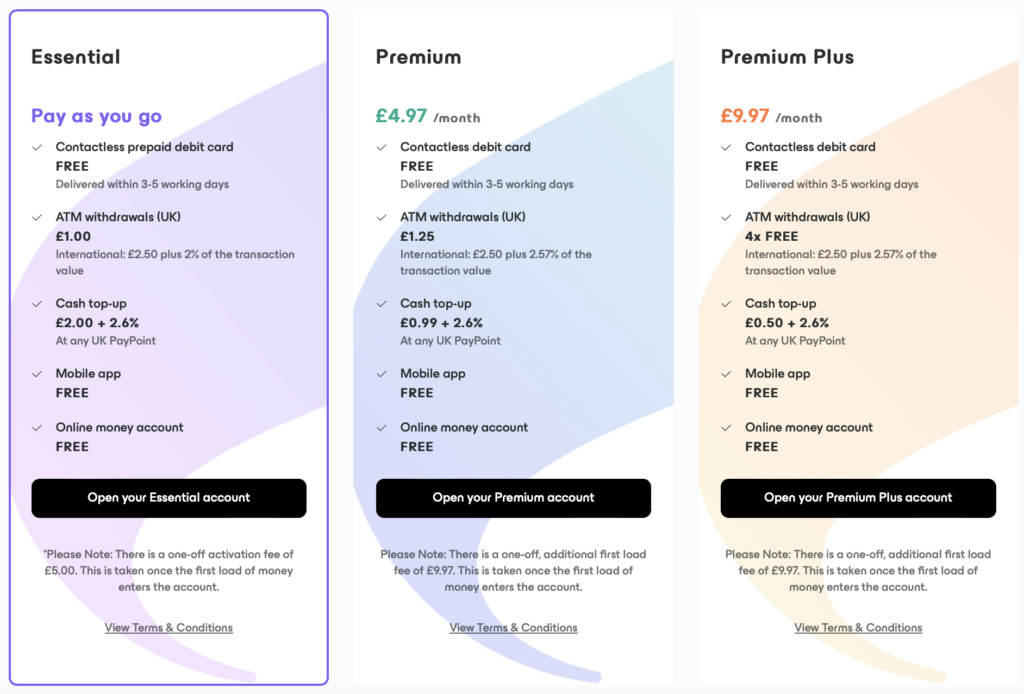

There are three different types of accounts available with Suits Me and each one comes with a slightly different cost profile and monthly. All three accounts will come with a free contactless debit card, use of mobile app, and eligibility for the Suits Me cashback rewards scheme. The account you choose is completely down to personal needs and preferences so it’s worth considering the different benefits available with each option:

Essential Account:

The essential account is perfect for someone with very basic banking requirements and relatively few transactions month on month. This is your basic Pay As You Go banking solution and charges each time you make transactions but doesn’t charge a monthly fee

- Sign up is completely FREE

- No monthly cost – it’s a pay as you go account, with some associated costs relating to general use

- UK ATM Withdrawals – £1.50

European ATM Withdrawals – £1.50 + 2% of the transaction value

International ATM Withdrawal – £2.50 +2% of the transaction value

Cash Top-Up – £2.30 + 2.6% - Top up account – £1.25

Premium Account:

The premium account is the most popular account for Suits Me customers. It’s designed to benefit individuals who want to benefit from the features provided in the essential account, but with the added benefit of being able to set up direct debits and standing orders.

- Sign up is completely FREE

- £4.97 monthly charge

- UK ATM Withdrawal – £1.25 + 2.5% of the transaction value

European ATM Withdrawal – £1.5 + 2% of the transaction value

International ATM Withdrawal – £2.50 + 2% of the transaction value

Cash top-up – £1.29 + 2.6% - Top-up account – free

Premium Plus Account:

The premium plus account comes with the highest monthly charge but includes more features or lower costs per transaction. It’s best suited to someone looking to use the account as their main account for things such as wage payments.

- Sign up is completely FREE

- £9.97 monthly charge

- UK ATM Withdrawal – 4x free withdrawals per month with a free-standing order setup

European ATM Withdrawal – £1.25 + 2.35% of the transaction value

International ATM Withdrawal – £2.50 +2.57% of the transaction value

Cash top-up – £0.080 + 2.6% - Top-up account – free

- Priority in call queue to customer service

How To Top Up Your Suitsme Account?

Suits Me has put in great effort in making payments as seamless a process as possible. It’s far easier a process than traditional banking, as you don’t have to wait for a branch to open or get stuck in any queues due to the fact the online bank is digital and not tied to any one location. Transactions can be carried out 24/7 in any location.

Wages & Salary: Provide your employer with your bank sort code and account number and get your wages paid directly into your account

Cash Top Up with Paypoint: Top up your account at one of 26000 UK Paypoint locations. Simply take your suits me debit card and ask at the counter to top up your account. Your payment will be instant to your suits me account.

Direct Transfer: You can transfer from another account or money transfer service directly to your suits me account by providing your account details.

Who Would Benefit Most From A Suits Me Account?

The fact that you are not required to undergo a credit check, or provide proof of address to set up a Suits Me account, makes it a brilliant option for anyone struggling to open an account with a more traditional bank.

If you’ve just moved to the UK, have a poor credit score, or are unable to provide a relevant recent address history as proof of address, Suits Me could be perfect for you.

Furthermore, Suits Me has no credit facility. This means it’s a great option for individuals who often find themselves unable to efficiently manage their finances and often go overdrawn. You can only spend what you have when using Suits Me so it’s a great way to help with effective budgeting.

What Other Features Do You Get With Suits Me?

Apart from the aforementioned benefits for individuals struggling to open up an account with more traditional banking options, Suits Me has additional benefits which can make opening an account quite appealing:

- Cashback rewards:

If you use your Suits Me card at qualifying retailers, you can earn cash back. The qualifying retailers don’t tend to stay the same, so it’s worth looking into the updated and current list of retailers if you want to benefit from this. The percentage you earn can be anywhere in the region of 1% to 12% and it’s paid directly into your account. More details are available on the Suits Me site.

- Friend referral system

If you find using Suits Me to be a great experience, then why not share the good news with your friends and get them on board? There’s no limit to how many friends you can refer to Suits Me. If your referred friend continues to use Suits Me for a minimum of 2 months, you get £25 added straight into your account!

- Other Services:

Suits Me is developing more features regularly and the website suggest that there are more features in the offing. These include: Google/Apple Pay, budgeting and saving dashboard, envelopes and others.

What About Customer Services?

So, if you’ve got any issues when setting up your account, completing the registration application, or with getting started, or maybe have some general questions about banking with Suits Me, where can you get your answers?

There’s a detailed help page on their website which covers many frequently asked questions. However, if you find this page does not answer your question(s), Suits Me has a multi-lingual team of customer service representatives available each weekday, 9am – 5pm (excluding UK public holidays). Customer service can be contacted in a number of ways:

- Online contact form

- Telephone – You can contact customer service during operating hours via telephone. In addition to this, there’s a separate dedicated helpline for lost or stolen cards.

- Email – you can email ‘hello@suitsmecard.com’

- Live Chat – Use the live chat feature for instant assistance (during operational hours)

- Social Media – Suits Me has a strong social media presence and you can direct message them either via Twitter, Facebook, or LinkedIn.

Is Suits Me Safe For My Money?

Unlike your traditional bricks and mortar bank, your money is not protected by the Financial Services Compensation Scheme. However, it is still protected in a ringfenced account. This means that your money is kept in its own segregated account, separate from Suits Me’s own finances. The level of protection given here is still sufficient and if something were to ever happen to the company, your money is safe and you can claim it back. Further doubts can be relieved by the knowledge that it is a completely legitimate company, regulated by the Financial Conduct Authority.

Suits Me Pros & Cons

Suits Me has generally received some really great reviews, evident on sites such as Trust Pilot. However, it won’t suit everyone, and you should take the same kind of precautions and considerations when applying for an account with Suits Me as you would do with any other banking provider, digital or physical.

Pros

- No credit check or requirement for proof of address makes Suits Me easier to open an account with and opens opportunities for individuals struggling to open up traditional bank accounts

- Lack of credit helps with responsible money management

- Digital and easily accessible – can fulfil majority of banking needs

- Application process is simple and straightforward

- Potential to earn cashback when spending at qualifying retailers

- Multi-lingual customer service representatives

Cons

- Fairly expensive compared to other banking platforms offering digital banking services

- There are cheaper options offering similar features

- A range of different fees for different banking activities, can potentially be a bit tricky to keep track of

- No physical branches to visit to speak to someone in person if a problem persists

- No overdrafts, loans, or savings accounts available – basic accounts

Summary Of Suits Me Service

There is definitely a requirement for a service such as Suits Me in the UK – most notably for those struggling to open an account elsewhere. For such individuals banking Suits Me serves to be a brilliant solution providing a financial service for those who are excluded from traditional banking solutions.

The Suits Me digital platform is user-friendly, easy to navigate, and comes with a range of features useful in managing your money. The cashback offering provided by Suits Me is fantastic, and not something provided so readily by other providers. The ease of signup and multi-lingual support is perfect for a significant proportion of Suits Me’s target market.

One key area which may need to be addressed is the pricing. Unfortunately, it is not the cheapest service compared to some of the more accessible financial services providers out there but this may be due to the additional risks undertaken by Suit Me in providing a service to a riskier demographic. If you are unable to get financial services elsewhere this may be your only option but and the pricing is not overly expensive – just more expensive than some of the more mainstream competitors.

If we were struggling to get a bank account – we would seriously consider signing up for Suits Me.

Recent Comments