Wise Referral

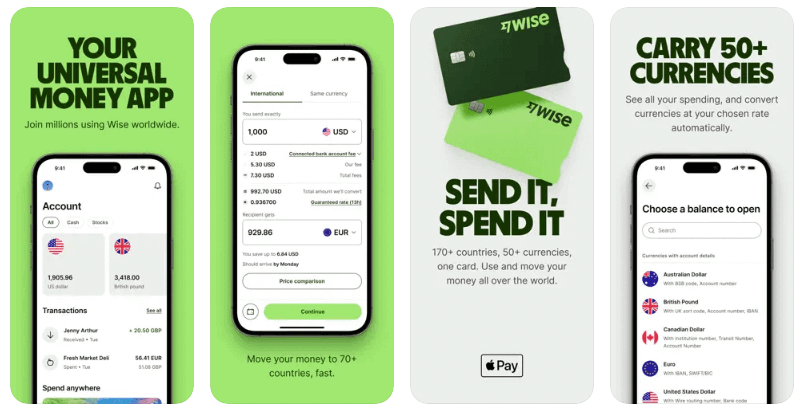

Use the link above or here to register for an account at Wise, and you will get a FREE Wise spending card allowing you to spend at home and abroad with no markups & no transaction fees

Wise Account Review: Best for International Transfers?

Wise is an international money transfer provider based in London. It was previously known as TransferWise, but rebranded as Wise in 2021 to reflect the expansion of its services beyond just international money transfers. The platform offers cheap, fair, simple, and fast international money transfer services and accounts in multiple currencies. In our detailed Wise review below, we will be peeling back the layers of Wise’s operations, looking at its diverse features, perks, limitations, pricing details, and overall user experience.

So, scroll down to discover the range of Wise Bank’s costs, benefits, and features to help you decide if this international payment service meets your financial needs.

Who are Wise?

The need for efficient and cost-effective international financial services has never been greater in a world where global connectivity is the norm. Enter Wise.com, a groundbreaking platform that has transformed how individuals and businesses conduct cross-border transactions. Formerly known as TransferWise, Wise.com has become synonymous with transparency, speed, and affordability in the realm of international finance, offering support for transactions in an extensive array of 40 distinct currencies.

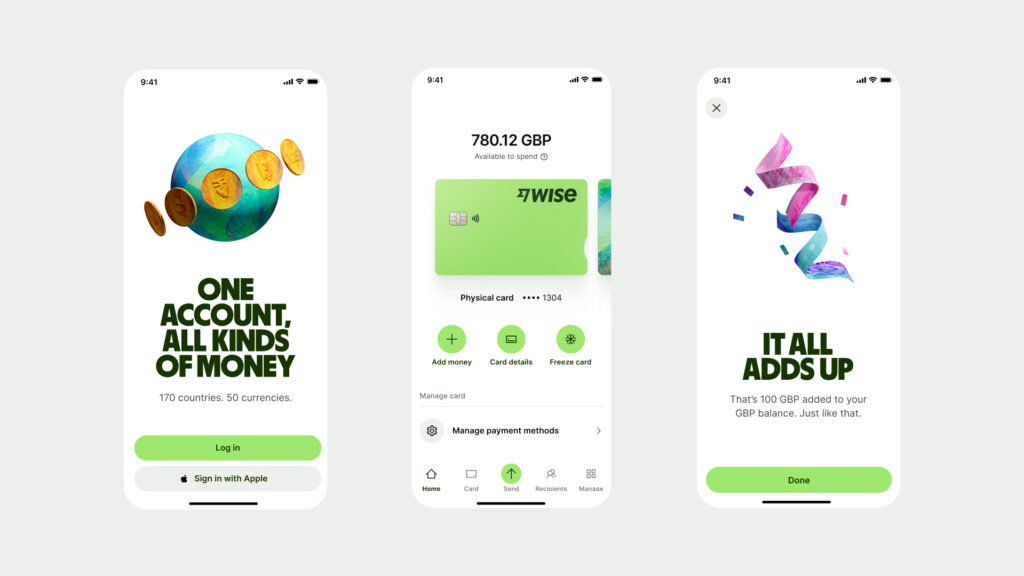

At its core, Wise Bank delivers an international banking service and a comprehensive and versatile savings account that exceeds conventional (national) boundaries. This makes it an excellent choice for international students, freelancers, businesses, and global travellers.

The platform allows users to seamlessly navigate the complicated landscape of international transactions and the limitations imposed by traditional banking systems. It provides a holistic option when it comes to money management on a worldwide scale.

Wise Review of Key Benefits:

Before we delve into the details of opening a Wise Account, let’s take a look at the key benefits which have made it such a popular choice amongst its international banking competitors. Here are some of the advantages which make Wise a smart option for international banking:

- Comprehensive Global Banking Access: Wise operates in 160 countries and manages funds in more than 40 currencies.

- Cost-Effective Transactions: You can potentially save up to 4x compared to UK high street banks. Lower cost transfer fees make international money transfers affordable.

- Transparent Currency Exchange: You can spend, spend, and withdraw in 40+ currencies with transparency.

- Efficient Transactions: You can arrange swift international transfers with funds arriving in as little as 2 hours.

- Multi-Currency Card: Your Wise card will automatically convert and withdraw into the local currency. This applies to over 40 currencies at live exchange rates.

- Interest-Generating Accounts: You can use Wise Interest to invest money in government-guaranteed assets and get more from your money (capital at risk, growth not guaranteed).

- User-Friendly Mobile App: You can download from either the Apple App Store or the Google Play App Store for easy management of your global finances at your fingertips.

Wise Bank empowers users to use, save, and manage money efficiently online, ensuring that your financial transactions are seamless and cost-effective. Whether you’re a frequent traveller, an international business owner, or someone who values transparent international banking, Wise Bank is a straightforward and versatile solution for your global financial needs.

Main Features of Wise Bank

Wise accounts come with a variety of features to help you speedily and easily manage your international payments. These include:

- Multi-Currency Account: Wise’s multi-currency account allows users to hold and transact in various currencies, offering flexibility for freelancers and businesses engaged in global transactions.

- Wise Card: The Wise card helps to facilitate easy online payments, Apple Pay, Google Pay transactions, and even two free ATM withdrawals per month.

- Wise Assets: Wise Assets is a program that lets you invest your Wise account balance in renowned funds like iShares World Equity Index Fund, featuring top stocks like Apple, Microsoft, and Tesla.

- Business Account: Wise’s business account also caters to the needs of global companies involved in remitting funds to suppliers, customers, and employees.

Wise Review: Pros and Cons

As you can see, there is plenty to recommend a Wise account for your international payment choice. But there are some pros and cons for you to consider before making your choice:

Pros of Wise Accounts:

- Transparency in Exchange Rates: Wise is committed to transparent pricing, providing users with exchange rates free from markups. So, users can trust the fairness and accuracy of rates, instilling confidence in cross-border transactions.

- Speedy Transactions: Particularly notable for certain transactions, Wise ensures swift and efficient money transfers. Users benefit from timely processing, enhancing the overall transaction experience.

- Multi-Currency Account: Wise offers a significant advantage with its multi-currency account feature. Users gain the ability to hold and transact in various currencies, allowing flexibility and convenience.

Cons of Wise Bank Accounts:

- Higher Transfer Fees: Wise, while excelling in transparent exchange rates, tends to charge higher transfer fees compared to select competitors. This has a potential impact on cost-effectiveness, especially for users engaged in frequent or high-value transfers.

- Absence of Cash Delivery Option: Notably, Wise Bank doesn’t provide an option for cash delivery to homes or businesses. This limitation could be decisive for users requiring such services for their specific business or family needs.

- Limited Customer Support for Certain Transactions: Customer support, particularly for high-volume and automated transactions, is reported to have limitations. Users who prioritise extensive and personalised customer assistance may find this aspect noteworthy.

The strengths of Wise UK accounts lie in its dedication to transparency, efficient transaction processes, and the provision of a versatile multi-currency account. However, you should carefully weigh these advantages against potential downsides, including higher transfer fees, the absence of cash delivery options, and reported limitations in customer support for specific transaction types.

Wise Accounts Pricing

Understanding the cost structure of Wise Banking is crucial if you want a clear idea of the cost-effectiveness of the service. Here’s an overview of the fees associated with Wise UK account banking services:

How much does it cost to register with Wise UK?

There is no fee or admin cost to register and get set up with Wise, and you can easily do so by following the prompts on the website.

Cost of Sending Money from Your Wise Account

The cost of sending money from your Wise account will vary according to the currency you need to use. Fees start at 0.43%.

Spending and Withdrawing from Your Wise Account:

When using your Wise card for spending, you can enjoy free withdrawals for two or fewer transactions each month, provided the withdrawal amount does not exceed 200 GBP. However, for ATM withdrawals exceeding the 200 GBP limit per month per account, there is a fee of £0.50 per withdrawal or 1.75%.

Costs for Account Funding Transactions:

Account Funding Transactions, such as topping up e-wallets, are subject to a fee of 2%.

Wise Debit Card Costs:

There are no subscription fees associated with the Wise Debit Card. However, obtaining the card incurs a cost of £7. This fee is waived if you use our Wise referral link HERE or at the beginning of this article.

Cost for Converting Money:

The cost for converting money with Wise varies by currency and starts from 0.43%.

How Much Does Investing with Wise Cost?

Investing with Wise incurs an investment fee of 0.6% each year.

Costs for Receiving Money:

Receiving non-wire money in 10 currencies comes with no fee; this covers payments in AUD, CAD, EUR, GBP, HUF, NZD, RON, SGD, TRY, and USD.

If you receive USD wire payments, there is a fixed fee per payment, amounting to $4.14. Similarly, receiving CAD SWIFT payments involves a fixed fee per payment, which is $10 (CAD).

Wise Review of Safety and Security:

Wise prioritises robust account security through dedicated fraud and security teams, continuous transaction monitoring, and proactive measures. The incorporation of 2-factor authentication adds an extra layer of protection. And funds are held in reputable financial institutions, ensuring secure and regulated environments.

The platform’s transparency is evident in its use of the mid-market exchange rate and upfront fee disclosure, fostering trust and clarity. In essence, Wise is a reputable and secure platform for international money transfers, emphasizing user safety and reliability.

What is a Wise Business Account for Business?

Wise Bank also offers specialist services to increase efficiency and affordability when it comes to international money transfers. Wise boldly claims to offer UK businesses substantial savings (up to six times on average) when compared to major UK banks, making it an attractive choice for businesses eyeing global financial success. Here are the key features on offer:

- Bespoke Access for Your Team: Wise Business allows you to regulate team access to your account, deciding who can view specific accounts and setting permission levels.

- Financial Management All in One Place: Wise Business boasts an easy-to-use interface that allows you to navigate and handle 40+ currencies within a single account. The platform also facilitates swift currency conversions at the mid-market exchange rate.

- Security Beyond Expectations: Wise places a spotlight on its unwavering commitment to security, proudly highlighting its pivotal role in assisting 16 million users in moving £9 billion monthly through a robust barrier of safety measures.

- Dedicated Fraud and Security Teams: Wise have dedicated teams who work to ensure the security of users’ funds. Continuous monitoring and proactive measures place Wise at the forefront of financial security.

- 2-Factor Authentication: Wise accounts include the incorporation of 2-factor authentication. This feature strengthens the protection of financial data, contributing to a secure transaction environment for your funds.

- Trusted Financial Institutions: Wise holds funds with established financial institutions, an added layer of assurance reinforcing the safety and integrity of financial assets.

Wise Business is a smart choice for businesses that prioritize efficiency, transparency, and security in their financial operations.

Who Will Benefit from a Wise UK Account?

Whether you’re a seasoned globetrotter, an expatriate embracing a global lifestyle, or a business engaging in international trade, Wise provides convenience and cost-effectiveness for seamlessly managing money across borders. Here are some of the people who would most benefit from the services on offer:

Frequent International Travelers:

For jet setters, Wise’s multi-currency account is a game-changer. It allows convenient payments and banking for those who frequently cross international boundaries, enabling them to effortlessly spend and withdraw in various currencies without falling victim to exorbitant fees.

Expatriates and Global Citizens:

Navigating life as an expatriate or a citizen of the world requires a flexible financial account that adapts to your global footprint. Wise is an excellent choice as it facilitates seamless financial management across multiple countries, giving you the freedom to hold and transact in diverse currencies.

Businesses Engaging in International Trade:

Businesses can use Wise’s transparent exchange rates and pocket-friendly transfer fees. This transparency translates into a more cost-effective approach to cross-border transactions, empowering your business to thrive on a global scale.

Online Sellers and Freelancers:

If you are a freelancer and online seller, then opening a Wise UK account can be a smart move. You can receive payments in different currencies while taking advantage of Wise’s minimal fees and competitive exchange rates to get the most value and return from payments from your international clients.

Students Studying Abroad:

For students embarking on educational adventures abroad, a Wise account allows you to avoid hefty currency conversion fees. It’s an easy and straightforward way to manage your finances, especially if you are reliant on receiving funds from your home country.

A Wise UK account is not just a financial tool; it’s a versatile solution tailored for a spectrum of users. Whether you’re a traveller, an expatriate, a business owner, a freelancer, a student, or anyone in pursuit of transparent and cost-effective international financial services.

Conclusion – Wise Account Review: Best for International Transfers?

Wise has emerged as a formidable leader in the international money transfer market, offering a secure and efficient solution which is available to users across 160 countries and transactions involving 40 currencies. Going beyond the conventions of traditional banking, Wise introduces a versatile savings account that breaks free from limitations, presenting an integrated approach to global money management.

Wise is a reputable and secure platform that places a strong emphasis on user safety through dedicated fraud and security teams, 2-factor authentication, and partnerships with trusted financial institutions.

For businesses, Wise Business extends tailored access, robust financial management tools, and heightened security measures. People who stand to gain the most from a Wise UK account are frequent travellers, expatriates, global businesses, online sellers, freelancers, and students studying abroad. Wise UK accounts are a smart choice for international transfers, seamlessly integrating efficiency, transparency, and security to address the diverse financial requirements of a global user base.

Remember, if you want to receive a FREE spending card to user on your travels at home and abroad then use our Wise referral HERE or at the start of this article.

Pros:

- Easy to use money transfer services

- No surprises or hidden charges; Wise is transparent about its fees

- Very low transfer fees when sending money overseas

- The Wise exchange rate is based on the mid-market rate, ensuring a competitive exchange rate

- Offers multi-currency accounts and Mastercard debit cards

- Services available to both individuals and businesses

Cons:

- Does not accept fund transfers with cash or checks

- Does not support all currencies or allow transfers to all countries

- For transferring large amounts, you may be able to find a specialist foreign exchange provider with lower fees

- Recipients cannot receive money as cash; transfers can only be made to bank accounts or mobile wallets

Recent Comments