CLICK HERE TO SIGN UP TO EMMA

Emma Budgeting App Review – Saving, Investing and Budgeting

In today’s busy financial world of instant payments, ongoing subscriptions, and multiple accounts- managing your finances can be an overwhelming task. With countless bills, expenses, and financial goals to juggle, it’s easy to feel overwhelmed and completely lose track of your financial situation.

Thankfully, several budgeting apps are available to help you gain control of your spending and achieve your financial goals. Among these, Emma stands out as one of the most popular and user-friendly budgeting apps, with approximately 1.6 million customers.

Emma Financial App Review of Features and Price Plans

Our comprehensive Emma Financial App review explores its features, benefits, and drawbacks. We’ll examine how Emma simplifies budgeting, assists in saving money, and empowers users to make well-informed financial decisions. We’ll also talk you through the various plans on offer to help you decide if Emma is the right tool for you to take charge of your finances.

What is the Emma App?

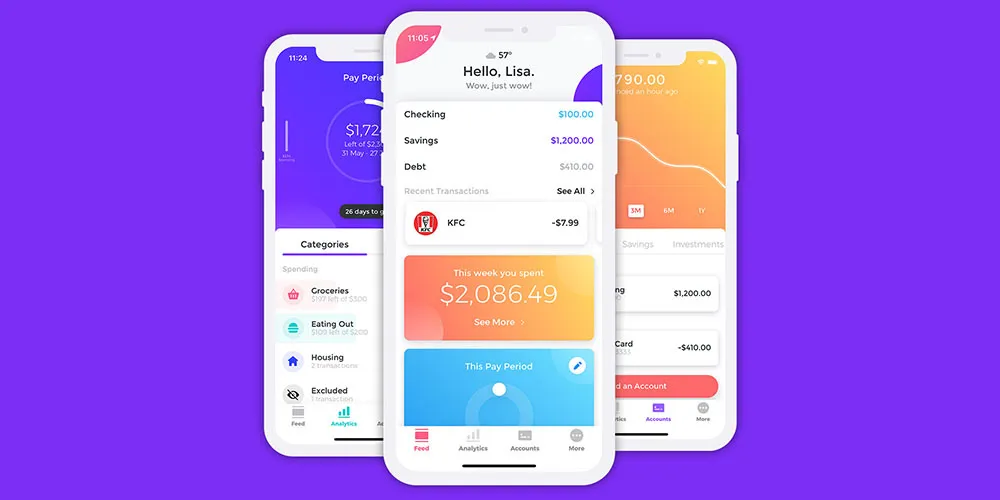

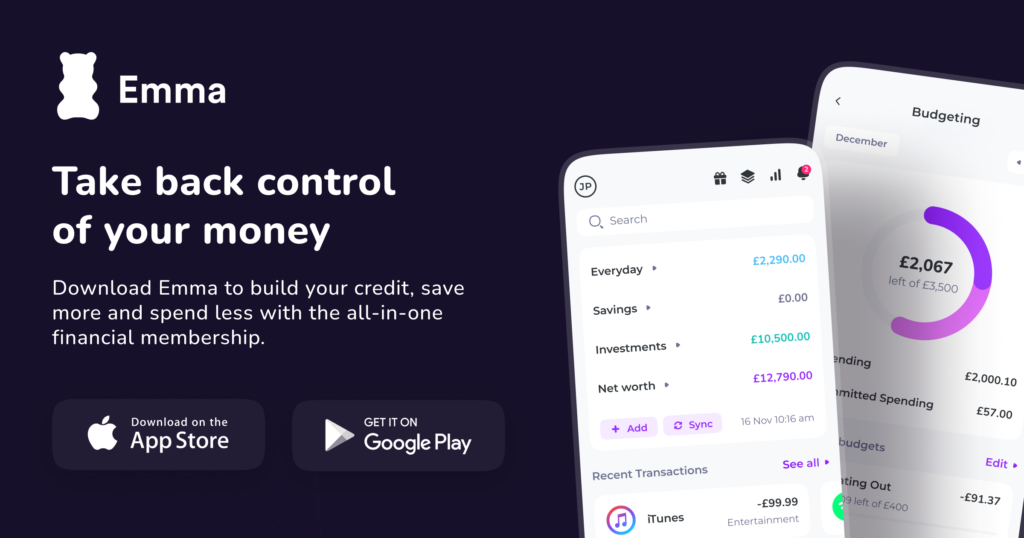

The Emma app is a budgeting app that has been designed to help users take back control of their money and financial future. It allows you to track your expenses, set budgets, invest in stocks, send and receive money, and organise your finances in a variety of ways.

With over a million users, the Emma app has gained a stellar reputation for helping people improve their financial well-being. Whether you’re looking to save money, build your credit, or invest your future, Emma can be a valuable tool to help you in your financial journey.

Emma Budgeting App Review of Key Features

The features of the Emma app cover five financial areas – budgeting, investing, saving, payments, and borrowing. Here is a quick guide to the features you’ll find available on the app.

Emma Budgeting

Emma’s budgeting features allow you to track all your finances in one place, identify wasteful subscriptions, and sync your budgets to payday. Here’s a more detailed overview:

- All Your Accounts in One Place: Emma connects with over 30 UK banks, giving you a comprehensive view of your finances across all your accounts.

- Track and Cancel Wasteful Subscriptions: Emma analyses your transactions to identify recurring payments, including subscriptions.

- Sync Your Budgets to Payday: Emma automatically tracks your income and expenses, including pending transactions.

- Advanced Insights into Your Spending Behaviour: Emma provides powerful analytics that help you understand where your money is going.

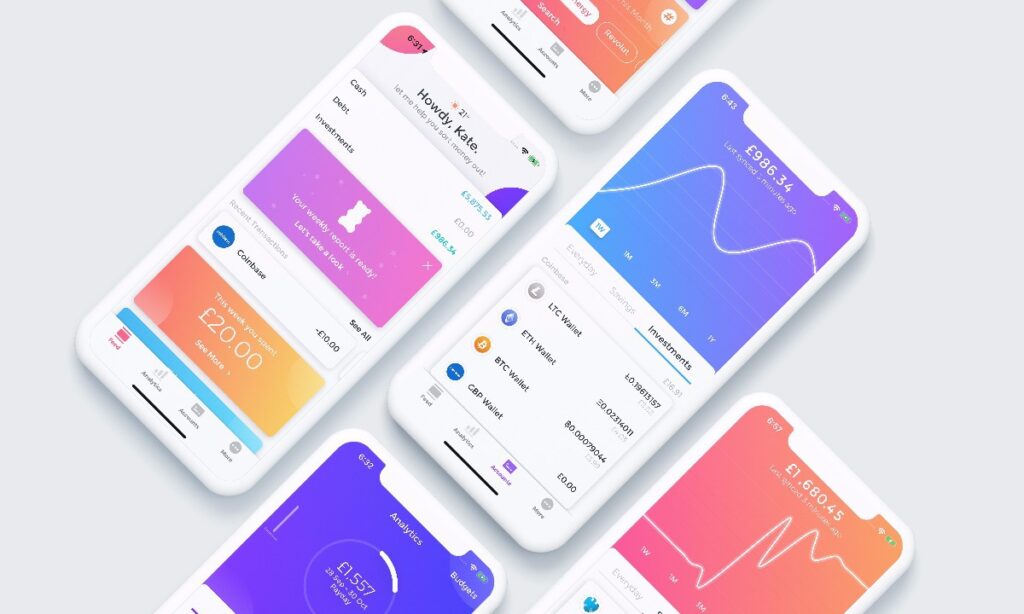

Emma Investing Features

Emma’s investing features allow you to buy and sell stocks commission-free, own fractional shares, and track your investments with watchlists. Here’s a more detailed overview of the investing options on the app:

- Commission-Free Stock Trading: Emma removes the friction of investing by offering commission-free trading on US stocks and funds.

- Fractional Shares: With fractional shares, you can own a piece of even the most expensive US stocks.

- Diversify Your Portfolio: Emma offers access to over 1,000 US stocks and funds, giving you the flexibility to diversify your portfolio.

- Track Your Investments: Emma provides powerful tools to track your investments and keep up with the latest market news.

Emma Payment Features

Emma’s payment features allow you to pay anyone instantly, store bank details, leverage faster payments, send payment reminders, and share your spending with Emma Groups. Here’s a more detailed overview:

- Pay Anyone Instantly: With Emma, you can send payment links or flash QR codes to transfer funds quickly and securely.

- Saving Bank Details: No need to remember your friend’s account number and sort code. You can tap on their name and enter the amount you want to send.

- Leverage Faster Payments: Emma uses Faster Payments to move money across multiple banks in seconds.

- Send Payment Reminders: If your friends forget to pay their share of rent or other shared expenses, you can send a payment request with a reminder message and let the app do the rest.

- Share Your Spending with Emma Groups: Manage your shared spending and balances with housemates, trips, groups, friends, and family using Emma Groups.

Emma Saving Features

Emma’s saving features allow you to start saving with Emma Pots, create pots to save for goals, earn interest, and save on utilities. Here’s a more detailed overview:

- Saving with Emma Pots: You can start saving using pots with as little as £1 and earn up to 4.34% AER, ensuring that your money is working hard for you.

- Earn Interest: Emma’s Easy Access Pots offer competitive interest rates, helping you grow your savings over time. The current AER is 4.34%, which is significantly higher than the rates offered by some traditional savings accounts.

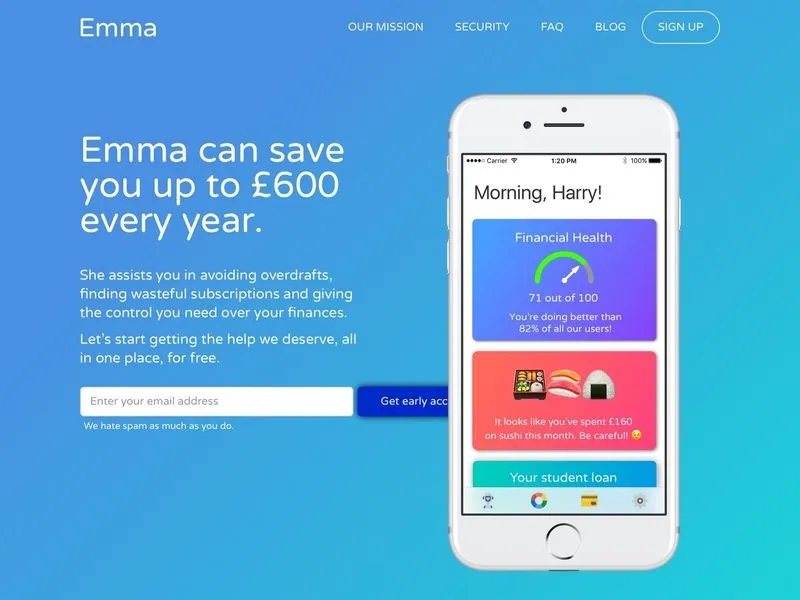

- Save on Utilities: Emma helps you save money on your utilities by analysing your recurring bills and suggesting better deals from other providers. The finance app claims that the average customer saves up to £600 per year.

- Get Cashback: Emma partners with over 500 retailers across the UK to offer cashback on everyday purchases.

- Review Recurring Bills: Emma also helps you review your recurring bills and switch energy, broadband, mobile, and many other services.

Emma Borrowing Features

Emma’s borrowing features are designed to help you reach your financial goals, whether you’re looking to improve your credit history or find the right loan or credit card for your needs. Here’s a more detailed overview:

- Find a Loan that Suits Your Needs: Emma Borrow connects you with a panel of over 60 lenders, allowing you to compare loan options and find the one that best suits your financial situation.

- Compare Credit Cards: Emma Borrow streamlines the credit card comparison process, providing you with real-time insights into interest rates, fees, and other key terms.

- Grow Your Credit History by Reporting Rent: Emma Borrow allows you to report your rent payments to credit bureaus, effectively adding a positive mark to your credit history.

- Competitive Interest Rates: Emma Borrow offers competitive interest rates on loans, helping you save money and manage your finances effectively.

- Flexible Payment Options: Emma Borrow provides flexible payment options so you can manage your loan repayments comfortably.

What Are the Pros and Cons of the Emma App?

The Emma finance app is a robust financial tool which can help you get a grip on your financial status and planning. However, the app may be a better fit for some users than others. Here is a guide to the pros and cons of this budgeting app.

Pros of the Emma App:

- Connect multiple bank accounts: Emma integrates with over 30 UK banks, allowing you to view all your finances in one place.

- Robust tracking and budgeting tools: Emma provides detailed insights so you can identify areas where you can cut back. It also offers customisable budgeting tools to help you reach your financial goals.

- Investment opportunities: Emma Invest allows you to invest in US stocks and ETFs commission-free, starting with as little as £1.

- Pay anyone instantly: Emma’s payment feature enables you to send and request money from anyone, even if they don’t use Emma.

- Earn cashback: Emma partners with retailers to offer cashback on everyday purchases, helping you save money without changing your habits.

- Save money on bills: Emma analyses your bills and suggests better deals from other providers, helping you save money on your utilities, broadband, and other services.

- Grow your credit history: Emma reports your rent payments to Experian and Equifax, helping you build and maintain a strong credit score.

- Security and reliability: Emma is backed by robust security measures and industry-leading encryption standards to safeguard your data.

- User-friendly interface: Emma’s intuitive and easy-to-navigate interface makes it simple to manage your finances.

Cons of the Emma App:

- Limited financial planning features: Emma’s financial planning tools are not as comprehensive as those offered by some other budgeting apps.

- Subscription-based model: In order to access all of Emma’s features, you need to subscribe to one of its paid plans.

- Potential for over-advertising: Emma may display targeted ads to users, which some may find intrusive and annoying.

- Few offline features: Emma is primarily an online app, so some features may not be available when you are offline.

Emma Budgeting App Review of Price Plans

There are four different plans available for Emma app users, ranging from a free basic option to the Emma Ultimate premium plan. Here is a breakdown of the prices and what is available with each option.

Emma Free

- Connect up to 2 bank logins: Connect more than 30 UK banks to see a comprehensive overview of your finances in one place.

- Track and budget your money: Use Emma’s powerful tracking tools to analyse your spending habits and create personalised budgets to manage your finances effectively.

- Earn 2.84% AER Interest: Earn interest on your savings with Emma’s Easy Access Pots, with interest paid daily and protected up to £85,000 by the FSCS.

- Invest commission-free: Invest in US stocks and ETFs with Emma Invest, starting with as little as £1.

- Pay anyone instantly: Send and request money with Emma Pay using payment links or QR codes for quick and secure transactions.

- Access exclusive cashback deals: Earn cashback on everyday purchases at over 500 stores across the UK.

- Stay on top of your bills: Receive bill reminders and track your spending patterns to ensure you always stay on top of your financial obligations.

- Set financial goals and then track your progress: Set your own personalised financial goals and track your progress towards achieving them with Emma’s clear and intuitive interface.

Emma Plus Plan – £4.99 per month (1 Week Free Trail)

- Connect up to 4 bank logins: Seamlessly connect and manage up to four bank accounts with Emma’s robust aggregation tool. Gain a comprehensive overview of your finances across multiple institutions.

- Track and budget your money: Gain deeper insights into your spending habits with Emma’s advanced tracking tools. Create personalised budgets to stay on top of your finances and achieve your financial goals.

- Grow your credit history with Experian: Emma Proactively helps you build and maintain a strong credit score by reporting rent payments to Experian, one of the leading credit bureaus.

- Earn 3.24% AER Interest: Enjoy a higher interest rate of 3.24% AER on your savings with Emma’s Easy Access Pots. Keep your money working hard for you while earning competitive returns.

- Security notifications: Protect your financial security with Emma’s advanced fraud detection features. Receive alerts if your personal information is compromised, allowing you to take immediate action.

- Stay on top of your bills: Receive timely bill reminders and track your spending patterns to ensure you never miss a payment and maintain a healthy financial standing.

- Set financial goals and track progress: Define and track your financial goals with Emma’s intuitive and user-friendly interface. Emma Pro Plan – £9.99 each month (1 week free trial.)

- Unlimited Bank Logins: Connect and manage an unlimited number of bank accounts with Emma’s powerful aggregation tool. Gain a holistic overview of your finances across all institutions.

- Track and Budget Your Money: Gain unparalleled insights into your spending habits with Emma’s advanced tracking tools. Create personalised budgets, set financial goals, and track your progress towards achieving them.

- Grow Your Credit History: Emma proactively helps you maintain a strong credit score by reporting your rent payments to both Equifax and Experian, the leading credit bureaus in the UK.

- Earn 4.07% AER Interest: Enjoy the highest interest rate of 4.07% AER on your savings with Emma’s Easy Access Pots. Keep your money working hard for you while earning competitive returns.

- Lower Fees on Investing: Experience lower fees when investing in US stocks and ETFs through Emma Invest. Diversify your portfolio and build wealth with a cost-effective investment platform.

- Customise Emma’s Financial Features: Tailor Emma to your specific needs with custom categories, offline accounts, split transactions, and legendary icons. Personalise your experience and enhance your money management.

Emma Ultimate Plan – £14.99 a month (7-day free trial.)

- Separate Your Personal and Business Accounts: Seamlessly separate your business or joint account spending from your personal one in two taps. Give access to whoever you want, allowing you to manage multiple financial scenarios effortlessly.

- Manage Your Business Accounts: Manage all your business accounts in one place, gaining a comprehensive overview of your financial health and simplifying your business operations.

- Unlimited Bank Transfers: Transfer money across multiple banks instantly and without any limits, ensuring you can manage your finances efficiently whenever and wherever you need to.

- Lower FX Fee on Your Trades: Enjoy a lower FX fee when investing in US stocks and ETFs through Emma Invest, making your international investments more cost-effective.

- Earn 4.34% AER on Your Savings: Enjoy the highest interest rate of 4.34% AER on your savings with Emma’s Easy Access Pots. Keep your money working hard for you while earning competitive returns.

| Emma Budgeting App Features By Subscription Type | |||

| Feature | Plus | Pro | Ultimate |

| On-demand syncs | ❌ | ✅ | ✅ |

| Cashback | ✅ | ✅ | ✅ |

| Bank Transfers 🇬🇧 | ✅ £1500 month | ✅ £3000 month | ✅ Unlimited |

| Spaces | ❌ | ❌ | ✅ |

| Business Accounts | ❌ | ❌ | ✅ |

| Turbo Updates 🇬🇧 | ✅ | ✅ | ✅ |

| Rent Reporting 🇬🇧 | ✅ 1 Agency | ✅ 3 Agencies | ✅ 3 Agencies |

| Priority Support | ✅ | ✅ | ✅ |

| Fraud Detection | ✅ | ✅ | ✅ |

| True Balance | ✅ | ✅ | ✅ |

| Bill Reminders | ✅ | ✅ | ✅ |

| AER on Savings* 🇬🇧 | ✅ 3.24% | ✅ 4.07% | ✅ 4.34% |

| FX fees on trades* 🇬🇧 | ✅ 0.45% | ✅ 0.20% | ✅ 0.12% |

| Accurate Net Worth | ❌ | ✅ | ✅ |

| Set Savings Goals | ❌ | ✅ | ✅ |

| Custom Categories | ❌ | ✅ | ✅ |

| Offline Accounts | ❌ | ✅ | ✅ |

| Merchant Budgets | ✅ | ✅ | ✅ |

| Rolling Budgets | ❌ | ✅ | ✅ |

| Exporting of Data | ❌ | ✅ | ✅ |

| Smart Rules | ❌ | ✅ | ✅ |

| Advanced Transaction Editing | ❌ | ✅ | ✅ |

| Split Transactions | ❌ | ✅ | ✅ |

| Rename Transactions | ❌ | ✅ | ✅ |

| Change of Date | ❌ | ✅ | ✅ |

| Customise Feed | ❌ | ✅ | ✅ |

Emma Financial App Review of Security

The Emma budgeting app is safe. It uses industry-standard security measures, including 256-bit encryption, to protect your data. It also does not have access to your bank account details, so your money is not at risk of being stolen. Additionally, Emma is regulated by the FCA (Financial Conduct Authority), so it is subject to strict financial regulations.

Here are some specific security features that Emma uses:

- Two-factor authentication: When logging in, you will need to enter a security code sent to your phone or email as well as your password when you log in.

- Secure socket layer (SSL) encryption: This encrypts all data that is transmitted between your device and Emma’s servers, making it impossible for anyone to intercept or read your information.

- Access control: Emma limits access to your data to authorised employees, and it has a process for investigating and addressing security incidents.

In addition to these technical measures, Emma also has a team of security experts who are constantly monitoring its systems for potential threats. Emma also conducts regular security audits to ensure that Emma’s security measures are up-to-date and effective.

Top 5 Emma App Features

Budgeting: Budgeting In Emma: With Emma’s budgeting section, you can easily create a budget for a specific period of time and monitor your expenses in one convenient place. The budgeting section also allows you to set up different budgets for specific categories, such as groceries or entertainment, so you can keep track of your spending in each area. Moreover, Emma helps you to view your committed spending, which is the amount of money you’ve already spent and can’t be allocated to another category. This helps you stay on top of your finances and avoid overspending. To make budgeting even easier, Emma provides a daily allowance feature that shows you how much you can spend each day to stay within your budget before the end of the period. This way, you can plan your spending accordingly and avoid surprises at the end of the month.

Saving Pots: One of the key features of the app is its savings pots, which allow users to save money for specific goals or expenses. Savings pots are essentially sub-accounts within your main Emma account, and you can create as many pots as you like. You can set savings targets for each Pot, and Emma will help you track your progress towards those targets. Savings pots can earn interest of upto 4.34% (dependant on subscription) Overall, Savings Pots are a great way to stay on top of your finances and save for the things that matter most to you.

Rent Reporting: Rent reporting is a powerful tool that can help boost your credit score without requiring you to take out a credit card or loan. With Emma, every new rent payment you make will be reported to credit referencing agencies, allowing you to improve your credit position over time. By building a higher credit position with all the major credit referencing agencies, you can enjoy many benefits, such as more accessible access to finance at better rates, ultimately saving you money in the long run. The best part is that you can keep paying your rent as you do today – Emma will securely read the rent payment from your bank and let the credit agencies know about it. Plus, if you’re an Emma plus user, Emma will report your rent payments to Experian, and if you’re an Emma Pro or Ultimate user, it will be reported to TransUnion, Experian & Equifax.

Cashback: Emma’s cashback feature allows users to earn cashback on purchases from selected retailers. To use this feature, you need to click a link and then shop at one of the participating retailers. When you make a purchase, Emma will track it and credit your account with a percentage of the purchase value as cashback. The cashback percentage varies depending on the retailer and the offer available at the time. Once you have earned cashback, it will be credited to your Emma account, and you can withdraw it to your linked bank account at any time.

Groups: If you have shared expenses with a group of friends, housemates, or family, Emma has a feature that can help you track, split, and settle expenses. To get started, you can create a group within Emma and track how much each person owes. This feature is particularly useful if you want to keep track of expenses for a shared vacation, utility bills, groceries, or any other expenses that group members share. To access this feature, simply go to the Pay tab at the bottom of your Emma app and tap on Groups. From there, you can manage and track your shared expenses with ease.

Conclusion: Emma Financial App Review – Saving, Investing and Budgeting

The Emma budgeting app is a comprehensive and user-friendly tool that can help you take control of your finances. Its ability to connect to multiple bank accounts, track spending, manage budgets, and invest in stocks and ETFs makes it a versatile option for individuals and families alike.

While the subscription-based model limits access to some features, the free plan still offers valuable tools for essential financial management. Overall, the Emma app is a solid and easy-to-use choice if you are looking for a simplified and effective way to manage your finances.

Recent Comments