Profile Pensions Referral

Click the Profile Pensions referral link above or here and once you have transferred an old pension across to Profile Pensions – you will receive a FREE £50 Amazon voucher. Only applies to first transfers

Profile Pensions Review – Easy to Use, Straightforward Service?

When it comes to selecting the best pension plan for you, navigating the complexities and making informed decisions can be an overwhelming task. With so many plan options and pension providers, it’s easy to feel unsure of where to turn. Amongst more complicated competitors, Profile Pensions UK stands out due to their clarity and simplicity, offering a refreshingly user-friendly approach to managing your retirement savings.

In our Profile Pensions review below, we will look into the different plans on offer and highlight both the strengths and weaknesses of this simple and straightforward pension service. By the end of this article, you should have an idea of what is on offer and whether this is the right choice for your pension planning.

What is Profile Pensions UK?

Boasting an impressive 4.6-star rating from over 2,400 reviews, Profile Pensions has garnered a loyal following of over 400,000 customers who have trusted them to safeguard their long-term financial well-being. With a focus on personalisation, ongoing support, and transparency, Profile Pensions stands out as an accessible and uncomplicated pension plan provider.

Their streamlined online platform allows you to sign up in minutes, providing a personalised pension plan tailored to your specific circumstances and goals. Whether you’re seeking to consolidate old pensions, embark on a new saving plan, or commence pension drawdown, you should be able to find an easy-access solution with Profile Pensions.

Key Features of Profile Pensions

Before we delve into our Profile Pensions review in detail, let’s take a look at some of the standout features of the service which make it such a popular choice for UK pension holders.

- All-inclusive fee: Eliminate hidden costs with a transparent pricing structure that includes platform, fund, and ongoing advice fees.

- Personalised pension plan: Receive tailored investment guidance for your specific goals and circumstances.

- Combine your old pensions: You can consolidate your previous pension plans to streamline your finances.

- Ongoing advice and support: Enjoy ongoing support from a dedicated Pension Adviser who monitors your plan’s performance and provides personalised guidance.

- Easy-to-use and secure online platform: Manage your pension effortlessly through a user-friendly online platform.

- Pension tracing service: Easily locate and combine old pensions with a dedicated pension tracing service.

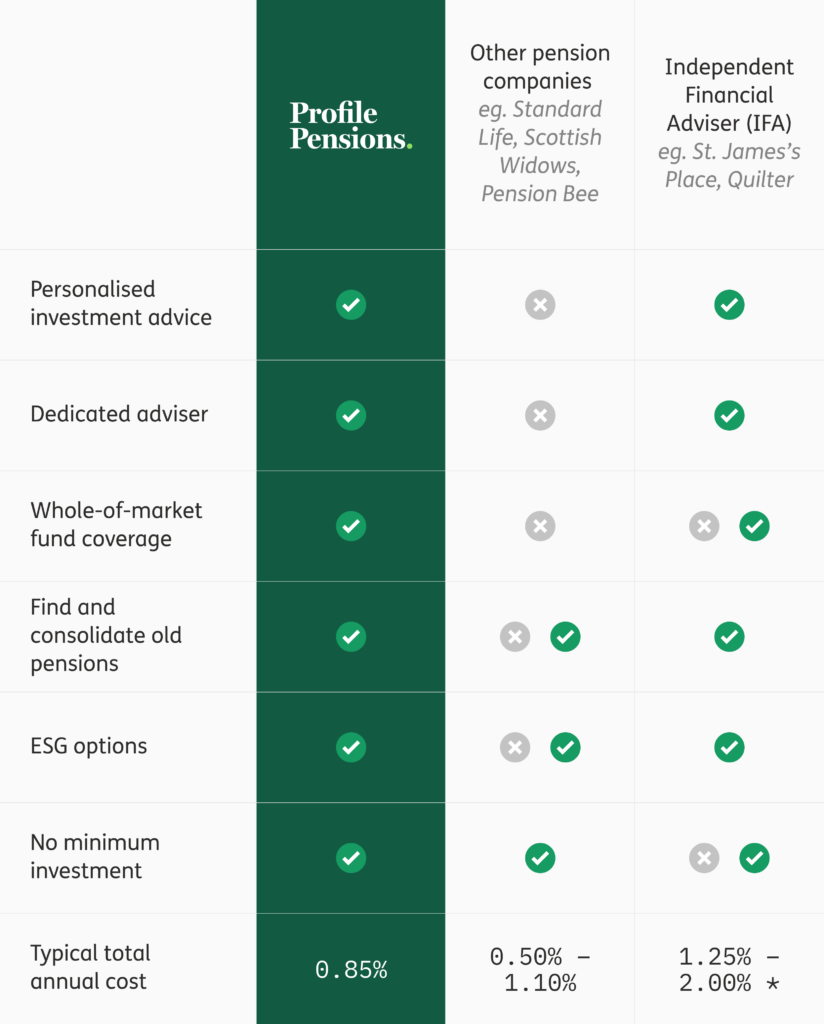

- Competitive fees: Enjoy lower costs compared to traditional Independent Financial Advisers.

- Free pension calculator: Gain insights into your pension’s potential value and income stream with the Profile Pensions free pension calculator.

As you can see, there is plenty on offer from Profile Pensions to recommend it to those looking for an easy and simplified process. Below, we’ll take a look at what is on offer with specific plans and features, as well as how the process works.

How Much is Profile Pensions?

Profile Pensions offers a transparent and competitive pricing structure, with no hidden fees for joining, starting a new pension, or making contributions. The annual fee falls within the average range for pension providers, and the one-off fee for pension tracing or benefit checks is reasonable for the service provided.

- Joining: Free

- Starting a new pension or making contributions: Free

- Pension tracing or benefit checks: One-off fee of 1% of the pension value

- Annual fee: Between 0.82%-0.86% depending on the right pension plan for your circumstances (inclusive of platform, fund, and ongoing advice fees).

How Does Profile Pensions UK Work?

Profile Pensions has become a popular choice for its streamlined and uncomplicated process. In contrast to more complicated competitors, Profile Pensions has crafted its service with an emphasis on ease and transparency.

Getting Started (Don’t forget to activate our Profile Pensions referral here before to get a FREE £50 Amazon voucher)

- Create an account and then answer some quick questions about your retirement goals and preferences.

- Receive a personalised pension plan tailored to your individual needs.

- You will be introduced to your dedicated Pension Adviser, who will guide you through the process.

Combine Your Old Pensions:

- You can add all your existing pensions to your Profile Pensions account.

- If you know your old pension details, Profile Pensions will transfer them for free.

- For lost pensions or those requiring additional research, a one-off fee of 1% of the pension value will apply.

Start a new pension:

- Even if you don’t have existing pensions, you can start a new one directly with Profile Pensions.

- Set up regular or one-off contributions and enjoy tax relief from the government.

Receive ongoing advice:

- Profile Pensions also offers ongoing advice and monitoring to ensure your pension is aligned with your changing circumstances.

- Your dedicated Pension Adviser will keep you updated on your needs and adjust your plan accordingly. The advice is impartial and leverages funds from the whole market.

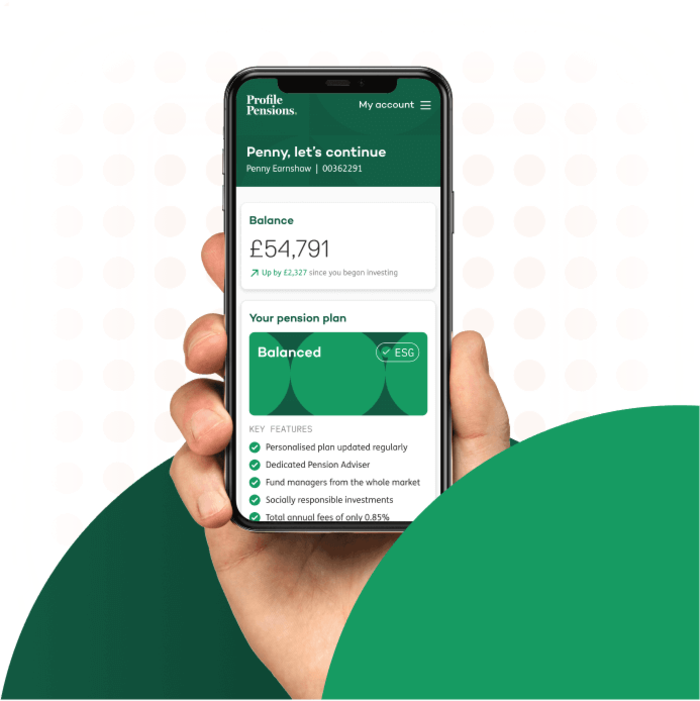

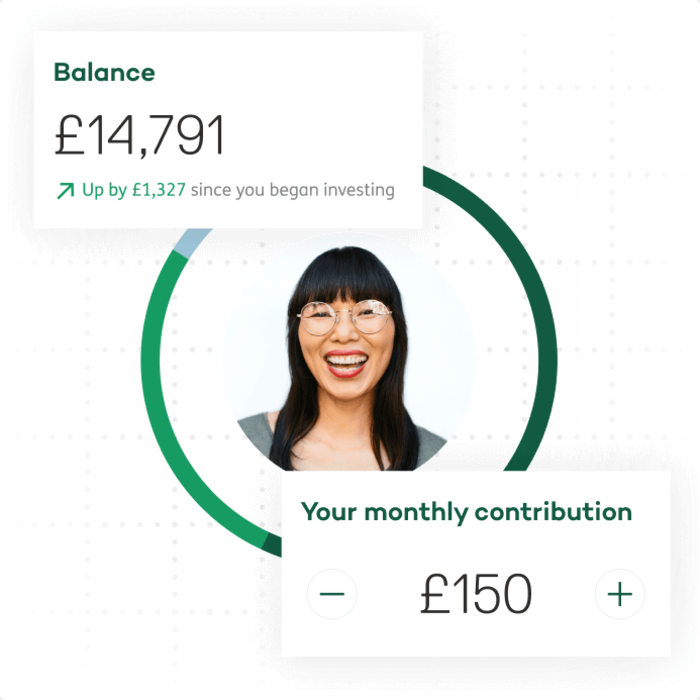

Check your pension online:

- You can access your pension plan, balance, and performance through a secure online account.

- Your account can also be used to communicate with your Pension Adviser directly online.

- Make one-off or regular contributions, add additional pensions, and plan for retirement.

Access your funds in retirement:

- From age 55 onwards, you can access your pension and start pension drawdown.

- Access to a real-time withdrawal schedule will guide you on sustainable withdrawal rates.

- Your Pension Adviser will remain available for support throughout the retirement process.

Profile Pensions Review of Pros and Cons

There are strengths and weaknesses to any pension provider, depending upon your individual needs and circumstances. Here is a rundown of some of the pros and cons you should consider when looking at Profile Pensions UK.

Pros:

- Transparent and competitive fees: Profile Pensions has a transparent pricing structure with no hidden charges. The annual fee is between 0.82%-0.86%, which includes platform and fund charges, as well as ongoing advice.

- Personalised pension plan: Profile Pensions will create a personalised pension plan for you based on your individual circumstances and goals.

- SERPS check: Profile Pensions will offer a free SERPS check to see if you have a lost SERPS pension. If you do, they will help you find it and transfer it into your new pension plan.

- Dedicated pension adviser: You will have a dedicated pension adviser who will be available to answer your questions and provide you with support.

- Real-time drawdown rate: You can see your estimated sustainable annual or monthly drawdown amount in your online account in real-time.

- Continued investment: Your pension will continue to be invested while you are drawing down, so you have the potential to grow your pension pot even further.

- Responsible investing: Profile Pensions offers ESG investing, which is a type of investing that considers environmental and social factors in addition to traditional financial factors when making investment decisions.

Cons:

Not suitable for everyone: Profile Pensions may only be suitable for some, such as those who are looking for a guaranteed income stream from their pension.

There may be other providers who offer more bespoke services. If you have complex financial needs, consider using a provider that provides more tailored services.

The fees for pension tracing or benefit checks may be higher than for other providers: The one-off fee for pension tracing or benefit checks is 1% of the pension value. This may be higher than the fees charged by other providers.

Can Profile Pensions Help With a SERP Trace?

Profile Pensions offers a free SERPS check to help you find out if you have a lost SERPS pension. If you do, their experts will do all the legwork for you to find your pension, check for any benefits or penalties, and complete the transfer into your new pension plan. A one-off 1% fee of the pension value is charged for this service.

Here’s how their SERPS tracing service works:

- Get started: Contact Profile Pensions and provide your National Insurance number and basic details.

- HMRC SERPS trace: Profile Pensions UK will contact HMRC on your behalf to see if they have any records of a SERPS pension in your name. This is a free service with no obligation.

- Find, check & transfer: If HMRC finds a SERPS pension, they will check for any benefits or penalties and complete the transfer into your new pension plan. You will need to pay will charge a one-off fee of 1% of the pension value.

Here are some of the benefits of using Profile Pensions to find and transfer your lost SERPS pension:

- They will do all the work for you: You don’t have to worry about tracking down your pension or dealing with the paperwork involved in the transfer. They will manage the entire process.

- They are experts in SERPS pensions: They have a team of experienced pension experts who specialise in finding lost SERPS pensions. They know the ins and outs of the system and can help you get the best possible outcome.

- They are transparent about their fees: They charge a one-off fee of 1% of the pension value for their SERPS tracing service. This is a fair fee for the service they provide, and it’s much less than what you would pay to hire a financial advisor to do the same thing.

So, if you’re concerned that you may have a lost SERPS pension, it’s worth getting in touch with Profile Pensions to see if they can help you locate it.

What are Profile Pensions Drawdowns?

Profile Pensions drawdowns are a flexible way to access your pension savings as you need them, while still allowing the remaining amount to grow. This is an alternative to a traditional annuity, which provides a guaranteed income stream.

Benefits of Profile Pensions drawdowns:

- Real-time drawdown rate: You can see your estimated sustainable annual or monthly drawdown amount in your account in real-time.

- Dedicated pension adviser: Who will be on hand to help you with any questions.

- Continued investment: Make sure your pension benefits from the potential of further growth to maximise your income.

- Tailored pension plan: Profile Pensions will help you understand how much you can potentially withdraw each year from your pension to last you through retirement.

- Easy withdrawal: Arrange withdrawals from your pension through your online account or over the phone with your adviser.

If you’re looking for a flexible way to access your pension savings, Profile Pensions drawdowns could be a good option for you.

Does Profile Pensions Offer ESG Investing?

Profile Pensions offers ESG investing for customers who want to consider environmental, governance, and social factors when making investment decisions.

The service only recommends funds that meet its high ESG standards, and it excludes funds that invest in fossil fuels, weapons, tobacco, or organisations that don’t adhere to the UN Global Compact Initiative.

Here are some of the benefits of ESG investing with Profile Pensions:

- A competitive annual fee: Profile Pensions UK’s ESG funds have a market-leading cost, which is a fraction of the cost of the average ESG investment.

- Impartial and whole of the market: The service looks at all funds available on the market and removes any that overcharge or are not market-leading.

- A responsible investment process: Profile Pensions only uses reputable companies that embrace responsible investing.

If you’re looking for a way to invest your pension money in a way that has a positive impact on the environment and society, ESG investing with Profile Pensions is an excellent option.

Conclusion: Profile Pensions Review – Easy to Use, Straightforward Service?

Profile Pensions is a reputable pension provider with a wide range of helpful features that appeal to a wide range of customers. Its personalised pension plans, free SERPS checks, and dedicated pension advisers make it a good option for those who are looking for a straightforward and comprehensive pension solution. Additionally, its ESG investing options allow investors to align their investments with their values.

It is worth noting that Profile Pensions may not be suitable for everyone. For instance, those seeking a guaranteed income stream may find a different provider more suitable. Additionally, those with complex financial needs may benefit from a provider that offers more bespoke services.

Overall, Profile Pensions is a reliable and transparent pension provider offering a range of valuable features. It’s a good option if you are looking for a personalised and comprehensive pension solution. However, investors should carefully consider their individual needs and circumstances to determine whether Profile Pensions is the right provider for them.

Remember if you do decide that Pensions Profile is for you – then you should use the following Pensions Profile referral link here to get a £50 Amazon voucher when you transfer a pensions over.

Recent Comments