Introduction

In the era of quick and easy contactless payments and digital wallets, the idea of saving for set costs in a pot or piggy bank might seem like a relic of the past. But the desire to save and manage our finances with greater control and purpose remains a modern need for savvy savers and spenders. There are now several digital money pot apps available that can help you organise and control your saving and spending habits.

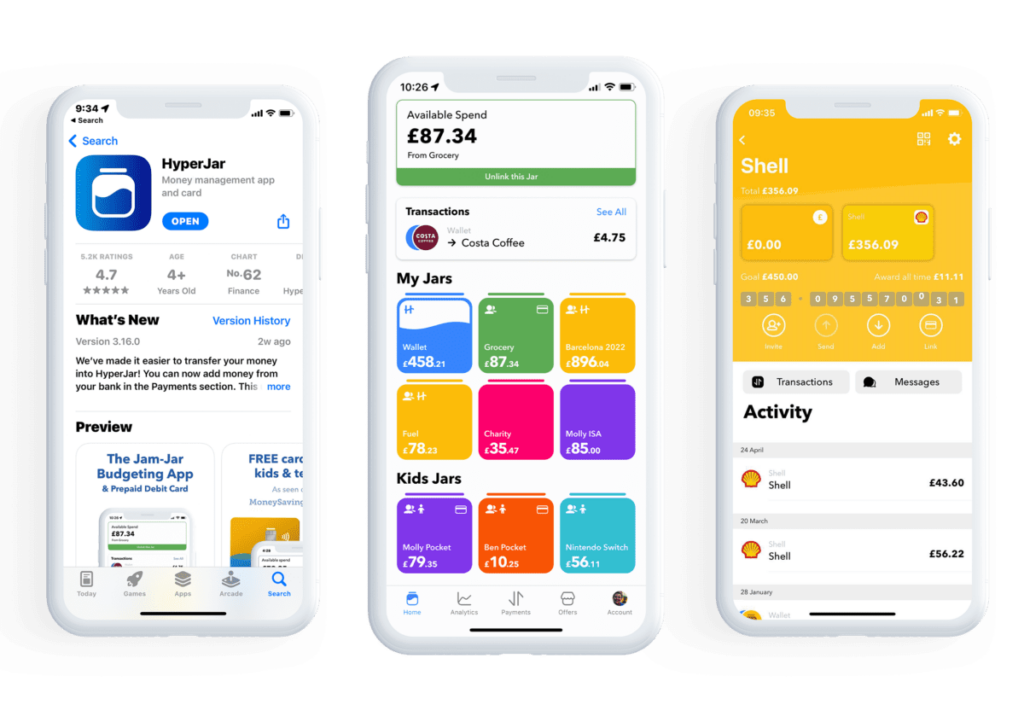

One of the most popular options is HyperJar, a UK-based fintech app that aims to be the modern equivalent of a physical savings jar, reimagined for the digital age.

The app promises a simple and intuitive way to budget, save, and spend your money, all through its user-friendly app and accompanying prepaid debit card. But is this the best option for you and your spending habits? Let’s dive into our HyperJar card review and see if the app lives up to the hype.

Hyperjar Review of Card, Apps and Saving Tools

In this Hyperjar review, we’ll be taking a close look at:

- What is Hyperjar? Its features, functionality, and ease of use.

- The HyperJar kids card and adult debit card: Fees, spending limits, and top-up options.

- Saving and budgeting tools: How well does this finance app help you manage your finances?

- Hyperjar pros and cons: Weighing the benefits and drawbacks of using this money management solution.

So, whether you’re a seasoned saver or a financial newbie, buckle up and get ready to discover if this digital piggy bank is the perfect fit for your financial and savings requirements.

What is Hyperjar?

HyperJar is an innovative money management app and prepaid debit card designed to help enhance spending efficiency, promote effective saving, and provide customers with opportunities for earning rewards.

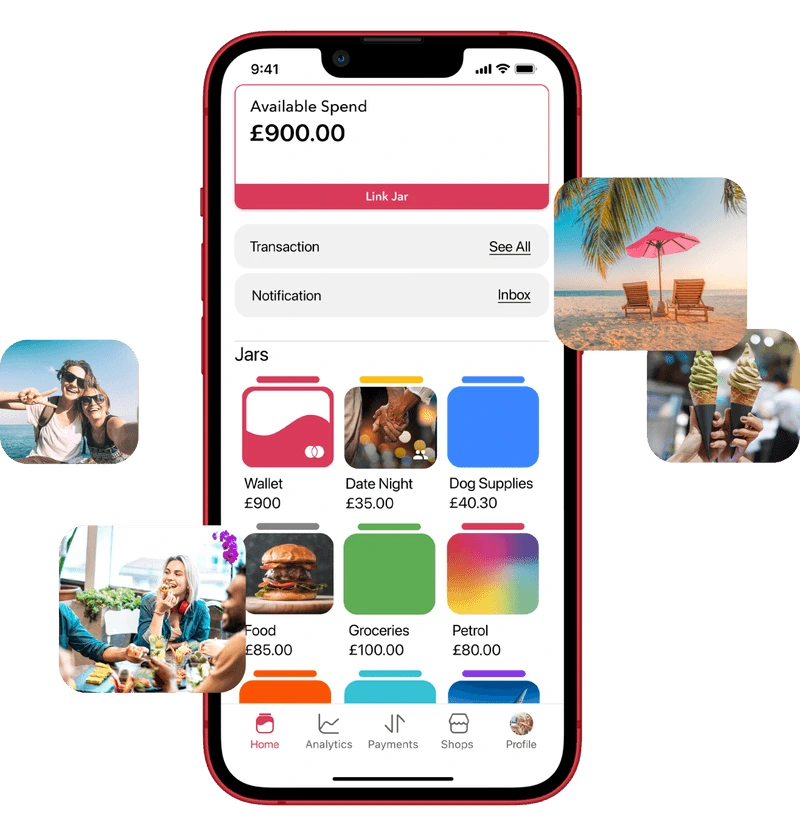

In the app, users can establish designated “Jars” for various spending categories, allowing for personalised budgeting tailored to specific categories such as rent, groceries, and shopping. The debit card then allows direct spending from each jar.

Using the app, you can manage your spending budget with more control, gaining insights into your spending habits and tracking your available budget without having to resort to the time and effort of creating budget spreadsheets.

The platform also enables shared financial responsibilities by allowing users to share Jars with friends and family for collective saving and spending goals, such as vacation funds, household bills, or joint gift purchases.

Along with this, the service also offers a Kid’s card and app for managing pocket money, tracking spending, and encouraging good financial habits.

Hyperjar Pros and Cons

Overall, This app offers a unique and innovative approach to managing finances, particularly for individuals seeking convenient budgeting tools, family-friendly features, and cost-effective financial education for children. However, it’s essential to consider its limitations and ensure it aligns with your specific needs and preferences before relying on it as your primary financial solution.

Pros:

- Financial education for kids: The Kids Card and app offer a fun and engaging way for children to learn about budgeting, saving, and responsible spending through digital jars, goal setting, and real-time transaction notifications for parents.

- Budgeting and organisation: The app’s “Jars” system helps individuals of all ages organise their finances by creating personalised spending categories and tracking expenses within each jar.

- Control and security: Users have control over their spending with features like limit setting, blocking specific retailers, and instant card freezing. Additionally, bank-level encryption protects financial data.

- Travel convenience: HyperJar offers fee-free spending abroad with Mastercard exchange rates and access to exclusive travel discounts and partner offers.

- Cost-effective: Most of the features, including the card, are free to use. It can be a valuable and affordable tool for managing finances compared to traditional bank accounts with various fees.

- Shared savings and goals: With shared jars, families and friends can collaborate on setting and achieving common financial goals, like saving for a vacation or managing household expenses.

Cons:

- Not a replacement for a bank account: HyperJar is a prepaid debit card, not a complete bank account. You cannot deposit checks or access other traditional banking services like loans or overdrafts.

- Friends & family also need app: In order to use the full functionality with friends and family – they also need to download the Hyperjar app to make the sharing functions work.

- Still potential for overspending: While the app offers control features, users are still responsible for their spending and could overspend within their set limits.

- Limited customer support: Customer support options are limited compared to those you receive from established banks, especially for international users.

Hyperjar Review of Key Features

Here is a breakdown of the key features available with the card and app to help you decide if this is the best spending and saving option for your financial circumstances.

- Hyperjar pots to organise your spending and saving digitally and maintain tighter control of your budgets.

- Prepaid Card from Mastercard to help you keep on top of your spending and avoid going over budget.

- Cashback Rewards: You can purchase brand name giftcards and receive immediate cashback

- Rewards for planned spending. Helping you to stay on track and motivated to remain within budget.

- Shared spending options to help you and your friends cover joint costs and monthly expenditures such as rent.

- No foreign transaction fees on your card when you travel abroad and instant card freezing for extra financial security while overseas.

- Payment blocking and spending controls to help you remain on track and avoid impulse buying.

Hyperjar Card Review of Features and Plans

The HyperJar card is a prepaid Mastercard debit card paired with a user-friendly app designed to help you manage your finances effectively. It’s not a silver bullet, but it offers several practical features for those looking for better budget control, including:

- Spending Limits: Set custom limits on your spending jars to avoid overspending on your card or exceeding your budget.

- Block Spending: Block specific retailers from purchases made with a particular jar, promoting responsible spending habits.

- Spend Lists: Restrict spending within a jar to specific vendors, ensuring funds are used as intended, particularly for shared expense jars or children’s accounts.

- Rewards: Earn cashback and discounts on everyday purchases from partnered brands.

- Annual Growth Rate: For specific savings goals like travel or investment, some jars offer an annual percentage rate, allowing your money to grow over time.

- No Foreign Transaction Fees: Spend abroad without worrying about additional charges. Mastercard exchange rates apply.

- Travel Perks: Access exclusive discounts and partner offers for hotels, flights, and activities.

- Security: Freeze your card instantly in the app if lost or stolen for added peace of mind.

- Secure: Bank-level encryption protects your financial information.

- Kids’ Card: Get a free card and app for children to teach them healthy money habits.

The HyperJar card is a versatile tool for individuals who want to gain more control over their finances, budget effectively, and save more efficiently. It’s not a replacement for a traditional bank account, but it can be a valuable addition to your financial toolkit.

Hyperjar Kids Card

The Hyperjar Kids Card offers a unique approach to teaching children aged 6 and above about managing their finances. It’s not a traditional bank account but a prepaid debit card paired with a user-friendly app that provides several practical features:

- Digital Jars: Kids can create virtual “jars” for different spending goals, like lunch money, saving for a toy, or contributing to a family vacation. This helps them categorise their funds and visualise their budget.

- Transaction Visibility: Parents receive real-time notifications when the Hyperjar Kids card is used, allowing for open discussions about spending choices and financial priorities.

- Jar Customisation: Children can personalise their jars with names and colours, making saving more engaging and motivating.

- Shared Responsibility: Parents can collaborate with their children on budget planning and goal setting within the app, fostering understanding and communication about financial decisions.

- Prepaid Card: The card functions like a prepaid budget, eliminating the risk of overspending or debt. Parents can reload the card as needed, providing control over available funds.

- Spending Controls: Parents have the option to set spending limits within each jar, block specific retailers, or even temporarily freeze the card if needed, ensuring responsible usage.

- Shared Accounts: The app allows families to connect and share jars, facilitating collaborative saving for shared goals like family trips or birthday presents.

The Kids Card offers a valuable tool for parents to introduce their children to the concepts of budgeting, saving, and responsible spending in a fun and engaging way.

What Are Hyperjar Pots?

Hyperjar Pots are essentially digital saving and spending compartments within the app. They work like traditional piggy banks or saving jars but in a digital format, allowing you to visualise your money better and stay in control of your budget.

Think of them as virtual envelopes for your money, each with a specific purpose. You can create Pots for anything, from short-term goals like groceries and bills to long-term aspirations like vacations or a new gadget.

Key features of Hyperjar Pots:

- Customisation: Name your Pots, choose their colours, and set individual goals for each.

- Spending Convenience: Use your prepaid debit card to spend directly from any Pot.

- Automated Spending: Link Pots to specific UK retailers for automatic deductions when you shop there.

- Spending Control: Use features like “Block spending,” “Only”, and “Never” options to restrict payments from Pots and boost your financial discipline.

- Mobile Payment Integration: Add Hyperjar to Apple Pay or Google Pay for secure and convenient spending on the go.

- Shared Saving and Spending: Collaborate with friends and family on shared Pots for group goals, bills, or fun activities.

- Free to Use: Download the app and enjoy all the benefits of Pots for free, with no subscription fees or hidden charges.

Rewards for Spending

Hyperjar Rewards functions as motivators for you to stay smart with your money and budget. They reward you for planning your spending ahead of time, not just for spending itself. Here’s how it works:

- Tailored Deals & Discounts: Hyperjar partners with popular UK brands to offer you personalised discounts and rewards based on your planned spending.

- Easy Redemption: You simply need to browse rewards, claim them, and redeem them quickly with your card.

- Get Paid to Plan Your Spending: Some partners offer an Annual Growth Rate (AGR). If you commit a set amount to them, you can watch your money grow around 5% yearly.

- Spend & Earn: Spend a specific amount with a merchant within a certain period, and you will get additional cash to spend however you please.

- Partner Brand Prize Lottery: These rewards put smaller pools of participants against exciting prizes from partner brands.

- Stamp Rewards Storage: Hyperjar’s stamps program tracks your spending automatically. And when you spend at certain UK retailers several times, you access bonus cash to spend there again.

Hyperjar Review of Shared Spending

Shared Spending is a straightforward way to manage bill splitting and group expenses digitally. Here’s how it works:

- Create a Shared Jar: Pick a fun name for your shared expense, like “Food Spending,” “US Vacation,” or “Lisa’s Hen Night.”

- Invite Friends who Also Use Hyperjar: Share the Jar link with anyone else who has the Hyperjar app.

- Contribute and Spend: Everyone can easily add money to the jar and spend directly from it using their Hyperjar cards.

- Transparency and Communication: Keep track of contributions and spending for complete transparency.

Shared spending takes the stress and confusion out of group expenses. Plus, it’s free, simple, and secure, making it the perfect solution for everyday bills, fun outings, and even ambitious group goals.

Hyperjar Travel Features

Hyperjar can also help you manage your holiday and travel budgets with its fee-free spending, smart saving tools, and convenient shared Jars for group travel adventures. Helpful features include:

- No foreign transaction fees: You can spend in over 36 million locations across 200 countries with your prepaid Mastercard, completely free of charge.

- Exclusive Rewards: Hyperjar partners with top holiday brands like TUI and hotels.com, offering you exclusive discounts and an “annual growth rate” on your committed travel funds.

- Shared Jars: Create a shared saving jar for your travel destination and invite everyone to contribute and spend from the same pot. No more awkward IOUs or chasing who paid for what – everything’s transparent and hassle-free.

- Mastercard’s best exchange rates: Get the most out of your money with Mastercard’s best offers guaranteed.

- Apple Pay and Google Pay integration: Use secure and convenient payments while abroad by integrating Hyperjar with your phone payment apps.

- Freeze and unfreeze your card instantly: You can immediately stop payments if your card is lost or stolen while you travel.

What Are Hyperjar Payment Controls?

HyperJar also provides users with a suite of payment control features designed to enhance financial discipline and responsible spending. In an environment filled with enticements like “Buy now, pay later”, these tools empower users to set individual and targeted spending boundaries. Key functions include:

- Spend Blocking: Users can restrict spending with specific retailers directly within the app, offering a direct response to impulsive temptations.

- “Only Lists”: Money allocated to certain Jars can be limited to authorised vendors, ensuring funds are used as intended. This is ideal for controlling budget categories like transportation or family expenses.

- “Never Lists”: Specific merchants or categories can be excluded from spending with designated Jars, providing an effective way to manage children’s online gaming habits or curb spending on specific non-essential items.

These features provide individuals with a proactive approach to managing their finances, promoting awareness and control over spending patterns.

Conclusion: Hyperjar Review –Taking Control of Your Saving, Spending and Budget

HyperJar is an excellent option if you are looking for a fresh and accessible approach to managing your finances. The app’s emphasis on organisation, control, and family-friendly features makes it particularly attractive for those looking to take charge of their spending while empowering their children with financial literacy.

Its blend of innovative features, cost-effectiveness, and engaging user experience makes it a strong contender in the ever-evolving landscape of financial management. So, whether you’re a seasoned budgeter or just starting your financial journey, HyperJar offers a unique and potentially transformative path towards a healthier and more empowered relationship with your money.

Recent Comments