Was your new year’s resolution this year to save money and start building towards long-term money goals? Did you quickly realise that your best intentions weren’t going to be enough this year? With the mammoth food and utility bills we are all facing right now, it can be difficult to save for a rainy day consistently. Our Plum App Review will tell you if this is the best way to achieve your money goals in 2024.

There are quite a few apps and services out there which claim to be able to help you maximise your funds and easily invest. But which ones can you trust to actually help you?

Below we will give you a detailed breakdown of one of the most popular budgeting apps in the UK today.

Setting Aside Smaller Amounts Consistently Can Be An Effective Way to Build Funds

Rather than committing to setting aside large chunks each month, a lot of people find that saving and investing little amounts often is a more sustainable approach. You will be surprised how effective this approach is in steadily building up the totals in your account.

Thankfully, there is a new wave of FinTech apps that take the anxiety and stress out of saving by helping you work out exactly how much you can afford based on your bills and income.

What is Plum App?

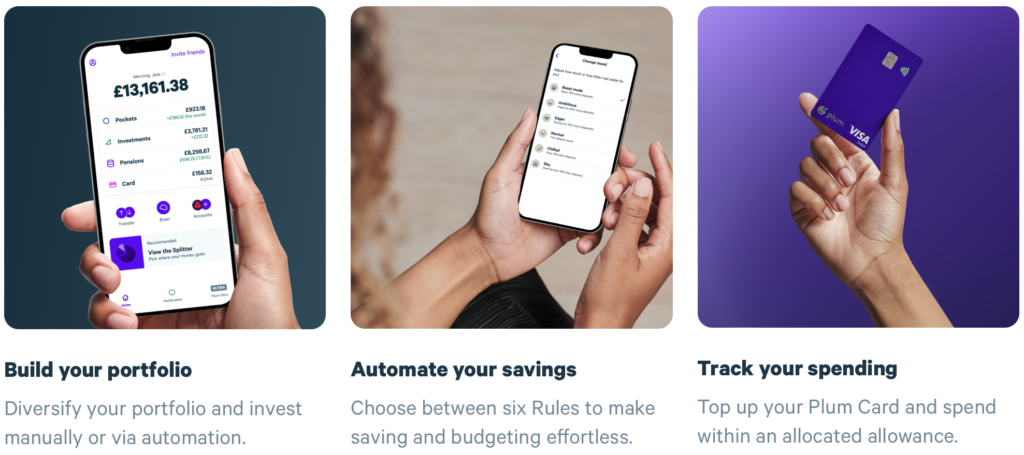

Plum is a FinTech app that works to help users set money aside and invest money consistently over time, based upon the principle of “little and often.” Using the app, you will be able to work out how much you can afford to set aside and how often.

The app will also allow you to grow your funds with investment and money management tools to make sure you get the best return from every pound you put by.

So far, the app has enabled its 1.6 million users to save more than £1.5 billion over six years!

How Does Plum App Work?

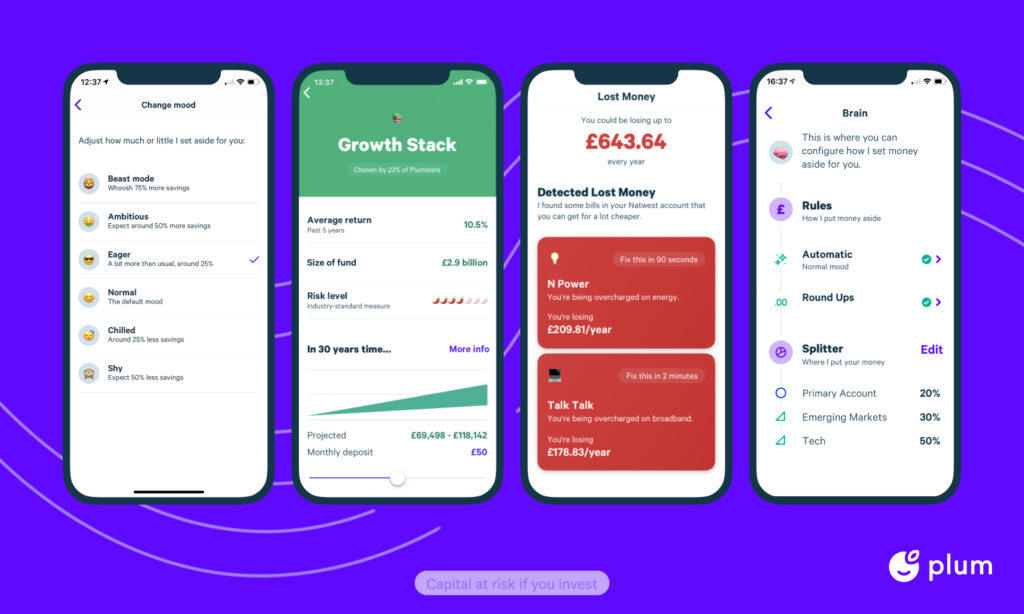

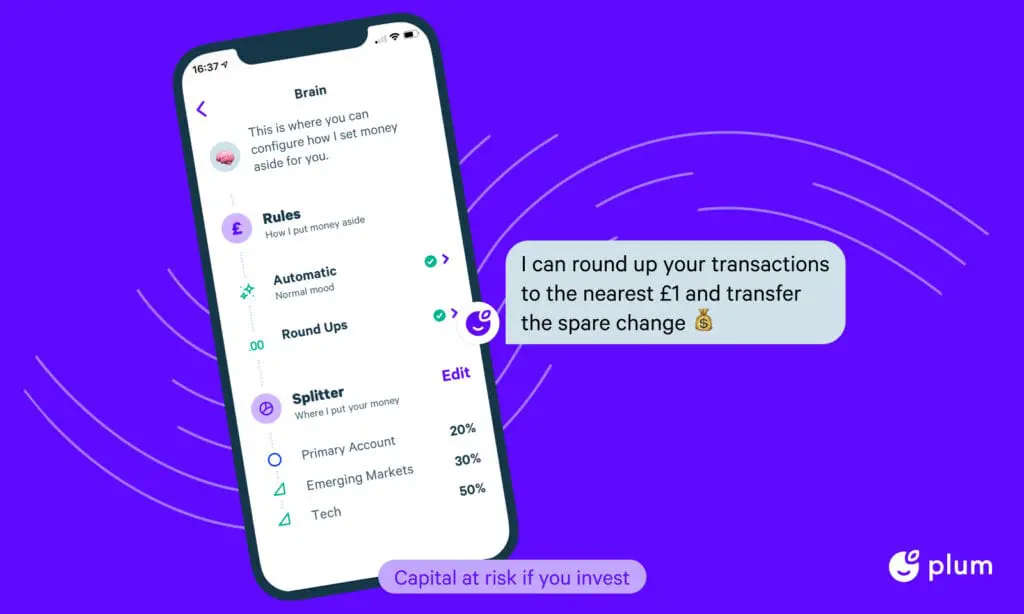

When you download and open up your Plum App, you will begin by syncing your bank accounts with the application. This Open Banking Initiative service will then use the information it accesses about your incomings and outgoings to tailor financial services to your specific circumstances.

The Plum App takes the practice one step further than other budgeting apps by working out exactly how much you can afford to set aside once oper week without having to worry about running out of available cash for spending on your bills and everyday costs.

Once you have synced your current and savings account you can use the Plum App chatbot to access information, advice, and suggestions based on your current spending and savings practices.

The app also highlights areas in which you could save money on your current bills, for example by suggesting energy providers who will charge you less.

What Services Are Available on the Plum App?

- A tailored breakdown of how much you can afford to set aside each week based upon analysis of the incomings and outgoings in your bank accounts.

- Use the budgeting app tools to work out how much you have to spend each month and make sure you have enough to cover your upcoming bills and subscriptions.

- Grow the money you save by putting your savings in an Easy Access Interest Pocket which pays interest at a current AER of 2.7%.

- Use the bill comparison features to identify where you could be saving money on your monthly outgoings.

- Use the Smart Spending function to set a limit to how much you will spend each month to avoid overspending and getting into debt.

- Consolidate your invested personal pensions using the Plum SIPP scheme.

- Set yourself weekly saving challenges to provide yourself with extra motivation to save those pennies!

- Start investing with a plum account at 0% commission, (other fees may apply.) Also please remember that your capital is at risk when investing and that the value of your investment can go down as well as up.

- Earn Cashback rewards when using paid subscription plans, (which start at £2.99 per month for Plum Pro.)

Who Can Benefit From the Plum App?

If you feel completely overwhelmed and stressed when trying to get a handle on all of your outgoings and think it is impossible to save for your future based on your current income, this could be the app for you.

Using the Plum App, you will get a clear idea of everything that is leaving your bank account each month and exactly where it is going. This breakdown of costs can help you to identify unhelpful drains on your funds such as streaming services and subscriptions you no longer use and work out exactly how much you are spending on UberEATS each month!

You will also be able to identify a “manageable” amount you can put by each month to build towards your future without having to worry that you won’t have enough to cover the food bills over the next weeks.

Is the Plum App Safe?

Naturally, most people are nervous about sharing their financial details and spending habits, however, you can feel confident in using the Plum app. The service is regulated and authorised by the Financial Conduct Authority.

On top of this, the money you save is also covered by the FSCS (the Financial Services Compensation Scheme) to make sure you’ll be compensated for up to £85,000 compensation if Plum App goes out of business.

Is the Plum App Free?

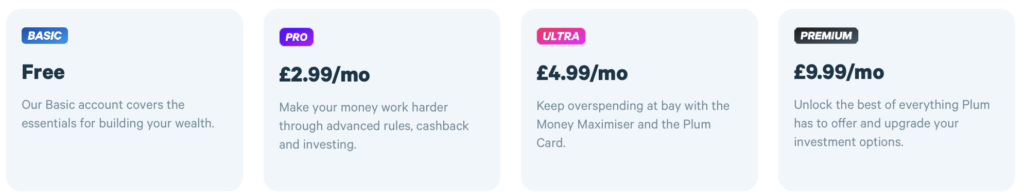

One of the best things about the Plum App is that you can get started for free (additional fees may apply and paid subscriptions are also available – as highlighted below). This way you can familiarise yourself with the functions and features of the app and work out if it is the best fit for you. The features of the Plum App UK include:

- The chance to earn up to 2.7% AER on investments in an Easy Access Interest Pocket provided by Investec Bank.

- Access commission-free trades from 3,000 stocks. – (capital at risk)

- Consolidate your pension schemes using Plum SIPP.

- Set up automated savings of the small amounts you can afford to put away each week.

- Receive alerts notifying you of ways to cut your bills by switching to providers who charge less than you are currently paying.

- Withdraw your money whenever you want with no extra charges.

If you want to experience the other features available in the paid subscriptions you can sign up for a 30-day free trial before the monthly costs become applicable.

Here is a breakdown of the different subscriptions available.

What is Included in Plum Pro?

For £2.99 a month, you will access all the features of the free Plum App plan but will also be able to segment your savings into 15 different pockets so you can set money aside for holidays, education, or other long-term goals.

You will also be able to access the cashback feature and set yourself saving goals to hit each week.

What Features Are Available in the Plum App Ultra Subscription?

The Plum Ultra plan is priced at £4.99 a month and includes all of the features detailed above, along with some added extras.

The Money Maximise feature will allow you to split up your routine spending and earn interest on the remaining amounts. You will also gain access to the Plum Card and upload a budgeted amount onto a Visa debit card to make sure you don’t overspend.

What Features Are Available in the Plum App Premium Description?

For £9.99 each month, you will access the premium feature of the Plum app that allows you to set up automated investments through the app on a daily, weekly, or monthly schedule. This is provided along with all of the features available in the other subscription plans. (Remember when investing your capital is at risk. The value of your investment can go down as well as up and therefore you should always monitor your investment performance)

Takeaway – Plum App Review 2023 – Will It Help You Save Money?

If you are feeling overwhelmed and worried about your current spending and financial future, then the Plum App is a free or low-cost way to start getting a handle on your finances.

If you have been struggling with getting a firm hold of your spending and managing to invest and save in the current economy, this app may give you the advice and motivation you need to get started.

Whether you need to use the paid features depends on how much you want to use the app to grow your money and choose to invest vs. simply using it as a budgeting app. If you decide you want more detailed features, the Plum Pro app offers excellent value at only £2.99 a month (which you may be able to cover with cashback spending from partner retailers).

Whether you want to start investing or learn how to put savings away consistently each month, the Plum App is an educative and practical approach to money management that can help you to improve your financial future.

Recent Comments