Wombat Invest Referral Code: KX5N86SC

Sign up to the Wombat Investing App and enter the Wombat Invest referral code: KX5N86SC and get £10 FREE cash added to your balance to spend on building your investment portfolio. You simply need to complete registration to get this bonus cash

Introduction

Are you looking for a simple and beginner-friendly way to invest? With all the current interest and hype in savings account, stocks, ETFs, and bonds, you may be wondering how you can get started making your money work for you. But a quick online search will show you an overwhelming number of different investment apps and websites, all claiming to be the perfect fit for you.

In our Wombat app review below, we will take a look at this popular online investing option and help you to decide if this is the right choice for you. Whether you are taking your first steps into the world of investing or looking for a new, straightforward way to build your savings with interest – you’ll find all the information you need below.

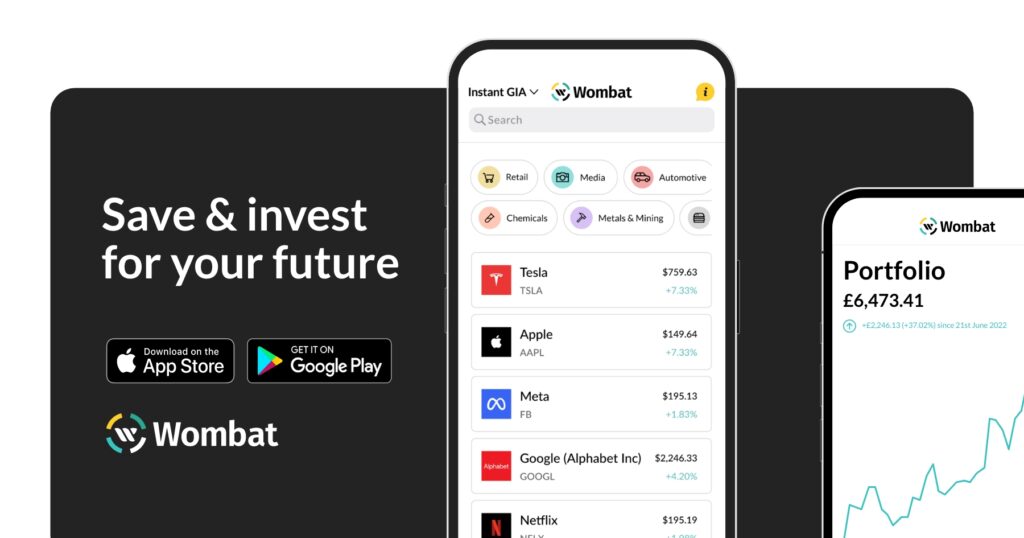

Wombat Investing Review – Investment & Savings App Rolled Into One.

Wombat Investing is a sleek and user-friendly app designed to demystify the investment process and help you take your first confident steps into investing. But is Wombat worth the hype? And does it truly cater to beginners, or is it simply a clever marketing ploy? We’ll unpack everything you need to know about Wombat Investing in this comprehensive review.

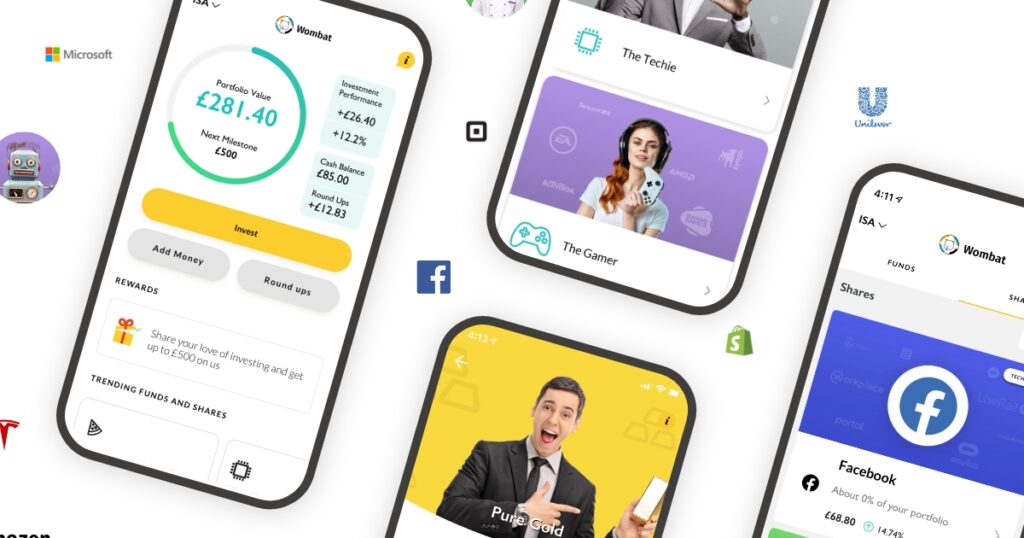

Wombat App’s User-Friendly Interface

So, let’s begin with first impressions. From the first download, the Wombat app’s user-friendly interface truly shines. You don’t have to worry about clunky menus, confusing pathways, and cryptic jargon. Sign-up is simple and straightforward and using our Wombat Referral Code: KX5N86SC gets you £10 added to y our balance to set you on your way.

The app presents you with a clean, modern design that feels more like a shopping app than a financial platform. This accessibility is especially beneficial for beginners, eliminating the overwhelming technical barriers that often deter first-time investors when they download a complicated app. For our review we were were approved for ban account without the need for comprehensive ID checks (such as driving license or passport verification)

You can get started with the basic plan for free, so it’s simple and quick to download and start exploring the app to decide if its interface suits your needs.

Pros and Cons of the Wombat Investment App:

The Wombat Investing app is an attractive option with its bright interface and promises of user-friendly investing. But before diving headfirst into the details of the app, let’s take a balanced look at its strengths and weaknesses, helping you decide if this platform is going to be a good fit for you.

Pros of the Wombat App:

- Beginner-Friendly Interface: You can navigate the investment world with ease thanks to a clean and intuitive app designed for first timers. This will come as a relief to those who have previously struggled with complicated investing apps which are difficult to navigate.

- Affordable Fees: The Standard GIA plan offers access to a wider range of options for a reasonable monthly and annual fee (£1 per month) , making it easier to grow your investing portfolio without breaking the bank. This account provides access to the GIA, ISA, JISA and ability to purchase shares in the UK, EU & US. There is a FREE account which provides access to US stocks only.

- Savings Accounts with market-leading interest rates: You can sign up for a savings account directly in the app, which currently has an interest rate of 4.91% (and FSCS protection for £85k) with daily interest and one withdrawal allowed per month.

- Access to ISA & JISA Shares Account: Build your investment portfolio for yourself or your child with a tax-free account.

- Access Fractional Shares & Themed ETFs: Overcome high barriers to entry with fractional shares, nibbling on expensive companies like Tesla or Amazon. Themed ETFs simplify diversification, letting you invest in curated packages aligned with your interests, like tech or eco-friendly companies.

- Online Learning Hub & Support: Wombat provides educational resources and responsive customer support to guide your investment journey, answer your questions, and ease your investment anxieties.

- Positive User Feedback: Many of the investing app’s current users appreciate the platform’s ease of use, helpful resources, and friendly customer service, giving you confidence in your choice. The investment app currently has a rating of 4.1/5 from over 400 reviews on Trustpilot.

- FREE £10: Sign up using of Wombat referral code: KX5N86SC and get £10 cash added to your balance

Cons of the Wombat Investing App:

- Limited Investment Opportunities: Compared to some other larger investment apps, Wombat offers a smaller selection of individual stocks and ETFs. While sufficient for beginners, seasoned investors might crave a wider pool of investment opportunities.

- FX Fees: While competitive for major currencies, frequent international trades can accumulate higher fees compared to competing apps and platforms.

- Simplicity: Experienced investors might find the platform’s features too basic, lacking advanced tools and functionalities they use regularly.

- Potential Withdrawal Delays: Some user reviews mention slower withdrawal times, which can be frustrating if you need immediate access to your funds. But it shouldn’t be an issue in the majority of cases.

Summary of Pros and Cons:

Wombat Investing is a smart choice for beginner investors seeking a user-friendly and affordable platform to dip their toes into the investment pool. Its strengths lie in its accessibility, educational resources, and unique themed ETFs, and savings accounts rolled into one making it a safe and comfortable app for both a beginner and someone who wants a simple app to use

However, experienced investors might find its limitations frustrating and seek advanced features offered elsewhere.

Wombat Investing Account Types

After downloading the app and then creating your account, your first decision will be which type of investing account you want to use. The Wombat investing app offers a few different options, with the best choice for you depending on your financial status, investing aims, and investment risk tolerance.

Here is a quick breakdown of the Wombat investment account options available:

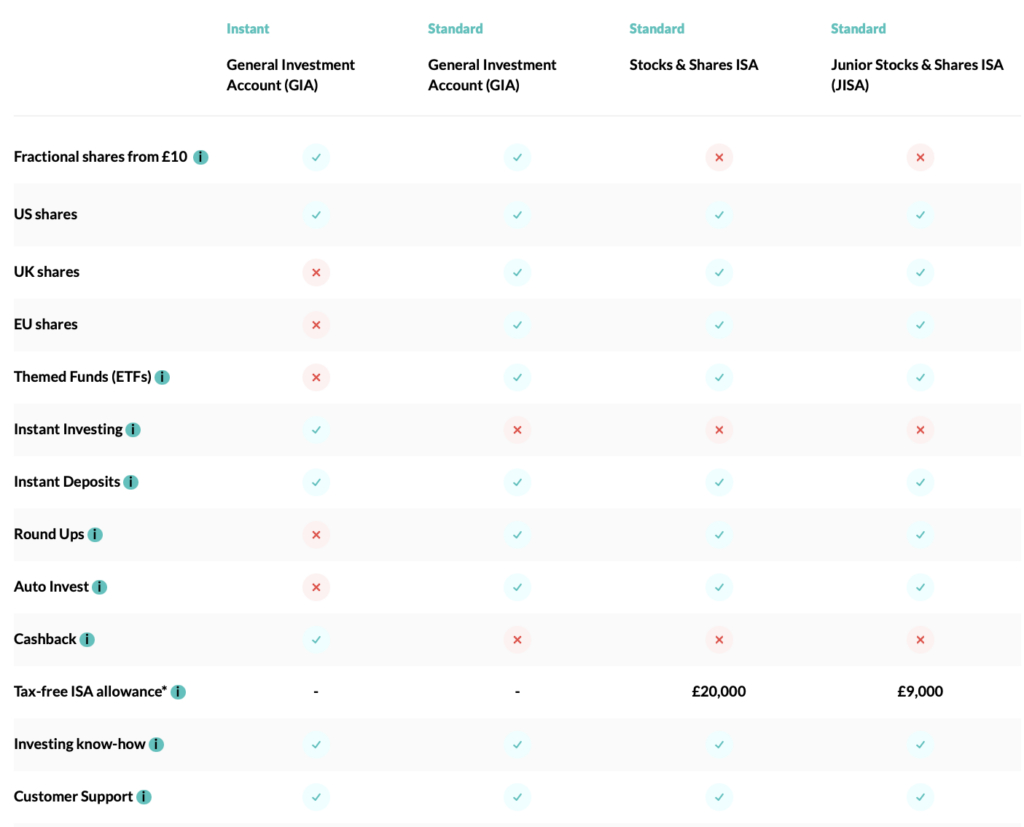

Wombat Investing GIA Instant Plan – Free

After you have set up your Wombat investment Instant plan, you will be able to access the following features:

- Investment in over 500 US stocks and shares options.

- Fractional shares access.

- Cashback on investment orders.

- Entry into the online learning hub where you can educate yourself about investing.

This plan is suitable for the following:

- Beginners: Dip your toes in without commitment.

- Casual investors: Focus on familiar US stocks without extensive needs.

- Short-term goals: Invest for a specific purpose without long-term commitment.

The Wombat App GIA Standard Plan – £1 monthly fee & 0.1% annual platform fee

This account option opens up your investing opportunities a little more and offers increased features such as:

- Investing in more than 40 fractional share opportunities for US, UK & EU investments.

- Access ETF themes. (Unlike traditional market trackers, thematic ETFs offer targeted exposure to exciting industries, trends, or sectors, letting you easily invest in what tickles your fancy.)

- Learning hub access to help you increase your investing knowledge.

- Auto-invest feature to save you time and effort.

- Roundup feature so that your spare change can be invested with no cash wasted.

This plan could be a good fit for:

- Growing investors: Expand your portfolio beyond US stocks.

- Long-term goals: Build a diversified portfolio for retirement or other future needs.

- Active investors: Enjoy automation tools and diverse investment options.

Wombat APP ISA Stocks and Shares (inc JISA) – £1 monthly fee

Wombat investing also gives you the opportunity to set up a stocks and shares ISA on the app. Features of this account include:

- All the features available on the Standard GIA Plan as detailed above.

- Invest up to £20,000 a year free from income and capital gains tax. (Make sure that this applies to your personal financial circumstances.)

- Invest up to £9000 a year free from income and capital gain tax for your child (no withdrawals possible till child reaches 18 years old)

- Articles and educational info on the Wombat app learning hub.

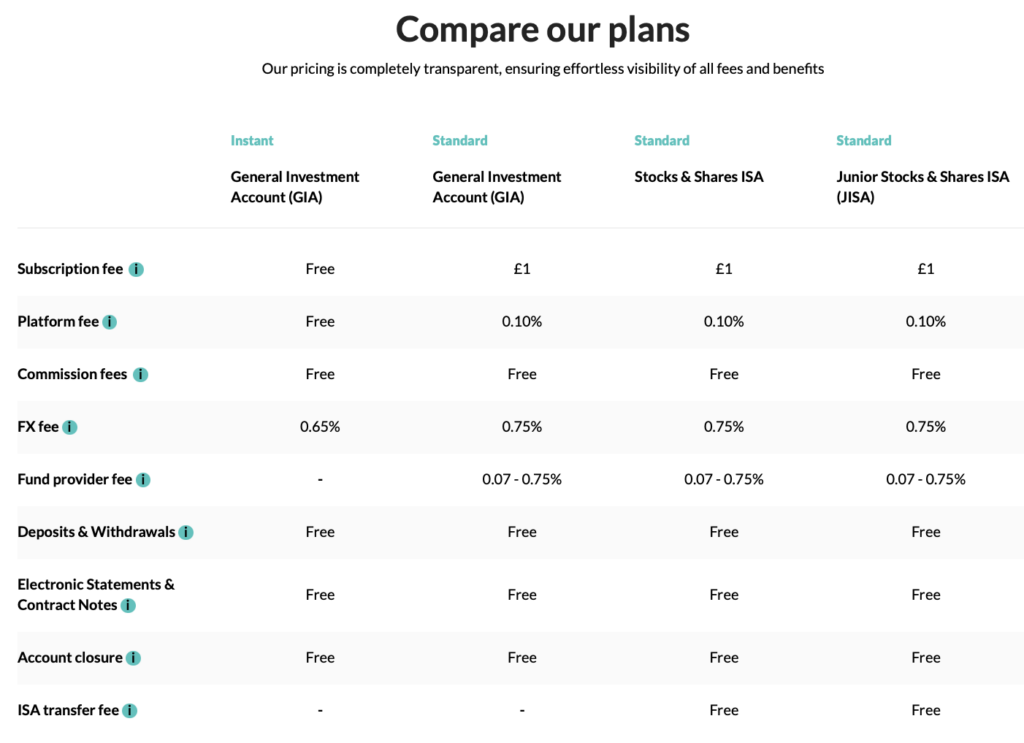

How Much is the Wombat Investing App?

One of the most attractive elements of this investing app is the transparent and affordable pricing structure, which will suit investors with different levels of funds and investment choices.

The Instant GIA is free but comes with limited features and higher 0.65 FX fees (along with currency conversion fees.) As the instant plan currently only has US stocks on offer, this is something to consider when evaluating how much you will make per investment.

For access to more options and lower FX charges, the Standard GIA charges a £1 monthly fee and a 0.1% annual platform fee. There is also a 0.75% fee for foreign exchanges.

If you plan to use the ETF theme option, then a manage free of 0.7-0.75% will also apply.

What Stocks Are Available on the Wombat Investing App?

So, where exactly can you invest your money using the Wombat app? Well, this investing app offers a variety of different options. The best option for you will depend on whether you prefer to be cautious or more adventurous with your investment choices.

Wombat Investment Fractional Shares:

Investing in big-name companies like Tesla, Amazon, or Apple used to be a luxury reserved for the bigwigs with bulging portfolios. But the fractional shares concept lets you ditch the hefty price tags and grab a “bite” of these financial titans, even if your budget is more minnow than shark.

You can think of it like slicing up a cake. Instead of needing the whole thing (and a small fortune), you can claim a slice, enjoying the benefits without breaking the bank. With fractional shares, you can own a piece of these powerhouse companies, gaining exposure to their growth and potential returns, all for a fraction of the full share price.

Investing in Themed ETFs

With Themed ETFs, you can choose portfolios curated depending on a theme or purpose. So, if you think that a particular industry will see growth, you can choose to buy in.

Longing to tap into the tech revolution? “The Techie” themed ETF covers cutting-edge companies shaping the future. Craving a slice of the sustainable movement? “The Green Machine” serves up eco-conscious powerhouses fighting for a more sustainable tomorrow.

This isn’t just about simplified investing; it’s about allowing increased personalisation into your financial journey. You can use the app to choose a theme that resonates with your passions, your values, or simply your curiosity.

Investing in Popular US & UK Stocks:

Whether you’re a seasoned investor seeking a trusted base or a newbie navigating the uncharted waters of the market, Wombat’s Popular US & UK Stocks offer an uncomplicated way to invest in the top-performing stocks.

You can invest in the brands you know and believe in and build a portfolio full of company names that are as familiar and well-established. The benefits of investing in these well-known stocks include:

- Instant Diversification: Invest in a diverse basket of established companies, spreading your risk and maximising your exposure to potential growth.

- Lower Volatility: Compared to emerging sectors, familiar brands tend to experience less dramatic swings in price. Providing a smoother investing experience.

- Dividend Potential: Many of these established companies offer regular dividend payouts, providing a steady stream of income to your portfolio.

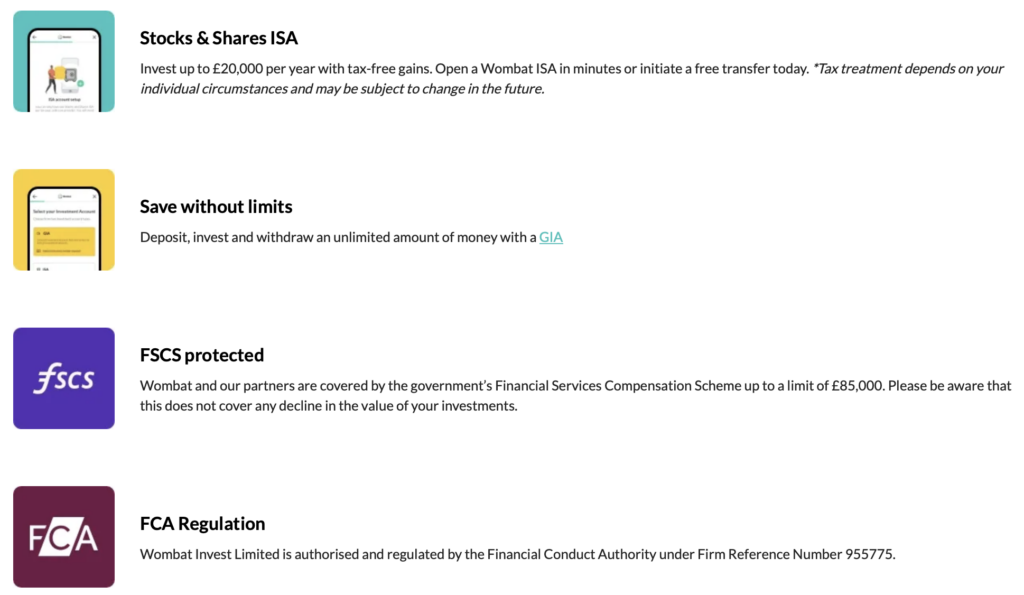

How Safe is the Wombat App?

When it comes to finances and personal information, you can never be too careful. And it is essential to make sure that an investing platform is protecting your interests and online safety. So, how safe is the Wombat Investment app?

Well, the app has a robust security system, which means that you can safely use it to invest whilst remaining safe and secure. These include:

The Wombat App is Regulated by the FCA:

The FCA (Financial Conduct Authority) is the UK’s regulatory body and oversees Wombat’s operations. Every transaction the app processes adheres to the FCA’s strict guidelines, giving you the peace of mind of knowing your investments are in responsible hands.

Segregated, Isolated Accounts:

Wombat tucks your funds away in separate, secure vaults called segregated accounts. This means your money is kept strictly isolated from the company’s operational funds. And is shielded from any unforeseen circumstances the company may be subject to. It’s like having your own private bank vault within Wombat’s fortress of financial security.

FSCS Scheme Protection

Wombat is partnered with the Financial Services Compensation Scheme (FSCS). This is a safety net that allows compensation of up to the limit of £85,000 in the unlikely event of Wombat’s insolvency. So, you can invest with the savings account within the app with confidence, knowing your hard-earned money is protected, even in the face of unforeseen challenges. (note this does not apply to your investments in shares and ETFs where the value of these can go up and down and are NOT protected)

With the Wombat app’s commitment to your financial well-being, you can invest with peace of mind. Knowing your money is in good paws, ready to grow and flourish alongside you.

Alternatives to the Wombat App

Wombat is a great fit for beginners, but before you get started, you may want to consider some alternatives. The financial landscape offers investors a diverse array of investing platforms, each catering to diverse needs and preferences. So, let’s explore some alternatives that might be your perfect financial haven:

Trading 212:

The Trading 212 app is simple, swift, and efficient. Its interface is clean and intuitive. But it focuses on offering a broader selection of stocks and ETFs, particularly international options. Fees are generally lower, making it ideal for cost-conscious investors. We have a detailed review of Trading 212 here

However, you won’t find Wombat’s curated themes or the same emphasis on educational resources.

Moneyfarm:

Moneyfarm specialises in automated portfolios, taking the guesswork out of investing. You simply choose your risk tolerance and goals, and Moneyfarm builds a personalised portfolio that adjusts automatically to market fluctuations. This makes it perfect for passive investors who want to “set it and forget it” but be aware of the management fees involved. We have reviewed this service and more details can be found here

Hargreaves Lansdown:

Hargreaves Lansdown is a premium investment app that boasts advanced tools and research resources. The platform caters to seasoned investors who crave in-depth analysis, charting capabilities, and a vast selection of investment options, including funds, trusts, and even options trading.

However, the learning curve can be a little steeper than Wombat’s, and fees might be higher for smaller portfolios.

Is Wombat App the Right App for You?

So, now that we’ve looked at the pricing, plans, and functionality of the Wombat app, how do you decide if this is the right app for you and your investing journey? Well ultimately, the best platform is the one that aligns with your individual needs and investment goals. Here are some things to consider when weighing up if this is the app for you.

When it Comes to Beginner Investors, Wombat Shines:

- Clean Interface & Educational Resources: Wombat’s user-friendly interface and readily available educational resources make it a perfect playground for first timers. With its clear navigation, you don’t have to worry about deciphering financial jargon or feeling lost in a labyrinth of complex features.

- Affordable Access & Diverse Options: The Standard GIA plan offers a wide range of helpful features at a reasonable monthly and annual fee, letting you explore fractional shares and themed ETFs to build a diversified portfolio without worrying about your profits being stolen by hidden or unexpected fees.

- Positive User Feedback: Wombat app users appreciate the ease of use, smooth navigation, and helpful customer service, meaning this could be the perfect app to begin your investment journey.

- Free Cash To Get You Started: You can use the Wombat Invest referral code: KX5N86SC to get you started if you are unsure about adding funds to see how

Experienced Investors Might Require More Investment Opportunities:

- Limited Investment Opportunities: Compared to some competing platforms, Wombat’s selection of stocks and ETFs is smaller. And while the options may be sufficient for beginners, seasoned investors might crave a more expansive pool of options.

- FX Fees Can Add Up: While competitive for major currencies, frequent international trades can incur higher fees than some of the investing opportunities available on competing platforms.

- Overly Simple for Experienced Investors: Experienced investors accustomed to advanced tools and functionalities might find Wombat’s features too basic, lacking the depth and complexity they require to make more involved and complicated investing decisions.

- Potential Withdrawal Delays: As we stated above, some user reviews do mention that the app can have slower withdrawal times than competitors. This can be frustrating and inconvenient if you need immediate access to your funds. However, if you are looking to invest long term, this will be less of a concern.

Questions to Consider When Deciding if This is the Right App for You:

Ultimately, the best investment app is the one that caters to your unique financial goals and needs. Consider your experience level, investment style, budget, and desired features. Ask yourself:

- Am I a beginner seeking a simple introduction or a seasoned investor requiring complex functionality?

- Do I prefer hands-on control of my investments or more of a set-and-forget approach?

- Are cost-effective fees a priority, or am I willing to pay for premium features?

It’s important to compare, analyse, and choose the platform that equips you with the right tools and resources to navigate your financial journey with confidence.

How to Get Started with the Wombat Investment App:

If you feel like the Wombat Investment app is the right fit for your investing needs, then here are some tips to help you get the best experience from using the investment platform:

Take Advantage of the Wombat Learning Hub

Before taking the plunge, invest in yourself. Wombat’s educational resources include articles, tutorials, and even webinars to equip you with the basics. Learn about different investment types, understand market terminology, and grasp key concepts like risk and diversification. Knowledge is power, and a well-informed investor is a confident one.

Start Small and Don’t Rush In

Rome wasn’t built in a day, and your portfolio shouldn’t be either. Begin with a small investment of a manageable sum that allows you to test the waters and gain experience without feeling overwhelmed. As you gain comfort with the interface and confidence in your investing knowledge, you can gradually increase your contributions, building your financial muscle one stroke at a time.

Diversify Your Portfolio:

Don’t put all your eggs in one basket (or one stock). You can spread your investment choices across a variety of diverse companies, sectors, and even asset classes. This creates a diverse portfolio which will be resistant to the currents of market fluctuations and help to protect your financial future.

Concentrate on the Long Term

Investing isn’t a sprint; it’s a marathon. There will be sunny days and stormy nights, periods of growth and moments of stagnation. But with patience, discipline, and the right tools, you can navigate the tides and build a portfolio on Wombat that weathers any storm. Remember, it’s also important to enjoy the process, learn from your experiences, and celebrate your milestones, big and small.

Sign up using a Wombat Referral code

Make sure to sign up using our Wombat referral code: KX5N86SC and get £10 FREE cash added to your balance to spend on starting your investment journey

Conclusion: Wombat Investing App Review – Daily Interest and Easy Access

The Wombat Investing App is a beginner-friendly and affordable platform that’s perfect for first-time investors or those seeking a simple way to invest their money. With its clean interface, educational resources, fractional shares and themed ETF options, Wombat takes the intimidation and confusion out of investing and makes it easy to build a diversified portfolio.

However, if you’re an experienced investor with a large appetite for options and advanced tools, Wombat’s limited selection of investments and basic features might feel restrictive. Additionally, potential withdrawal delays could be an inconvenience if you think you may need immediate access to your funds.

Ultimately, the best investment app is the one that aligns with your individual needs and goals. Consider your experience level, investment style, budget, and desired features before making a decision.

Remember, if you use our Wombat invest referral code: KX5N86SC you will get £10 free cash added to your balance

Recent Comments