Beanstalk Referral

Click the Beanstalk Referral Link above or HERE and get £5 free cash added to your account when you open a JISA or ISA account

BeanStalk Review – Is This The Best Junior ISA Account App for your family?

Check out our BeanStalk review below to find out everything you need to know about the platform and to help you decide if this is the best junior ISA investment app for you and your loved ones. From how to use the app to how much it costs – you’ll find a breakdown of all the essential info below. (Although Beanstalk also provide access to an ISA account for adults – this review will concentrate primarily not the JISA account)

What is an ISA?

An Individual Savings Account (ISA) is a tax-advantaged savings and investment account available to residents in the United Kingdom. ISAs were introduced by the UK government to encourage individuals to save and invest by offering tax benefits on the returns generated within the account. The primary advantage of an ISA is that any income or capital gains earned within the account are exempt from income tax and capital gains tax.

What is a JISA?

Junior Individual Savings Accounts (JISAs) are a popular and tax-efficient way for parents and guardians in the United Kingdom to save and invest money for their children’s future. Introduced in 2011, JISAs provide a valuable opportunity to build a financial foundation for young individuals by creating a tax-advantaged savings and investment account designed specifically for children under the age of 18 who are residents in the UK. It serves as a long-term savings vehicle to help parents, guardians, and family members contribute towards a child’s future financial goals, such as education expenses, purchasing a home, or starting a business.

The best Junior ISA accounts are a smart way to stash away some cash for those looming education expenses. You can contribute to the Junior ISA, building up a tidy sum over the years, and when it’s time for higher education or other adventures, there’s a dedicated fund ready to roll.

But which is the best Junior ISA investment app for your family? With plenty of options online, it’s easy to get overwhelmed when it comes to this crucial decision. Our Beanstalk review will tell you everything you need to know about this Junior ISA investment account platform and how it could benefit you and your loved ones.

Beanstalk Review – Best Junior ISA Account for your Little Ones?

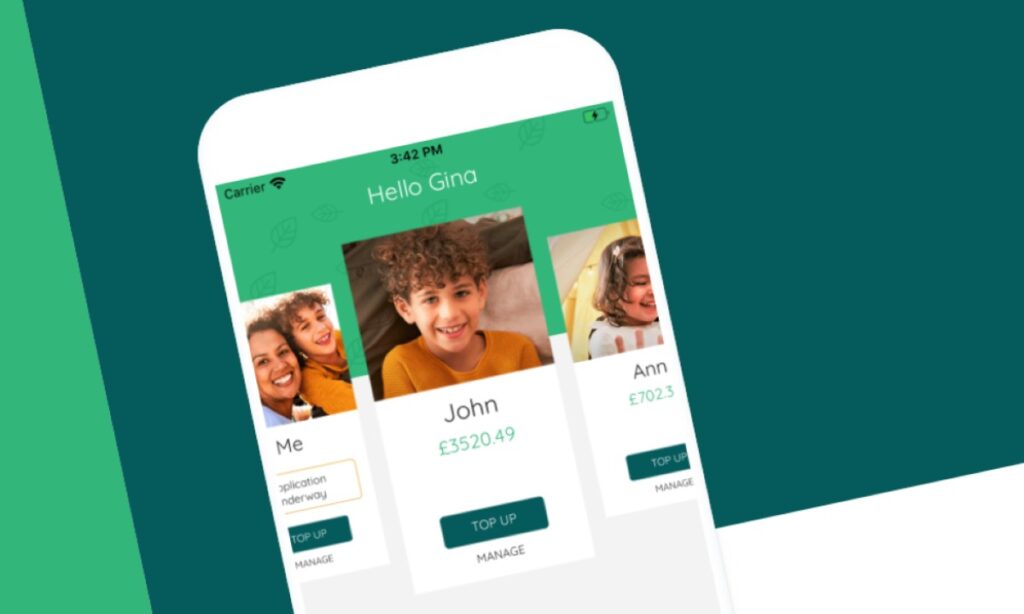

Beanstalk is a leading investment platform designed to simplify and revolutionise the way families save and invest for their children.

We will look at the app’s features, its user-friendly interface, and the unique collaborative approach it fosters among parents, grandparents, and other family members. With its forward-thinking design and commitment to financial inclusivity, this Junior ISA investment app stands as a promising tool to help you secure a solid financial foundation for your children’s future. But is the best fit for you and your family?

What is BeanStalk?

Beanstalk is a popular financial technology (FinTech) platform dedicated to offering Junior ISA investing. The app features easy-to-use features to empower families to easily begin investing for the future of their children.

With a simple, user-friendly interface – the app allows parents to invest in their children’s future with little fuss or complications. The app was founded by the same team behind the cashback site KidStart (another platform we have reviewed here at Referandsave) and has quickly built up a sturdy reputation amongst saving-savvy parents online. And it has been designed to allow your friends and family to invest in your children’s future as well!

Your ISA options are either a junior Cash ISA or a Junior Stocks and Shares ISA. The best choice will depend on the level of risk you are willing to take. This simple and speedy app makes it easy for you to start investing without the time and effort involved in researching and investing in individual stocks.

How Does BeanStalk Work?

The user-friendly Beanstalk platform simplifies the process of saving and investing in your children’s future financial needs. Here’s a general overview of how the Beanstalk Junior Isa app works:

1. Account Creation: (Use our Beanstalk referral code here for £5 FREE)

- You can quickly download the Beanstalk app and create an investment account in a few simple steps. Eliminating the need for extensive paperwork or visits to a bank.

- You can then link your bank accounts for easy investing and set up your child’s Junior ISA through the app.

2. BeanStalk Review of Investment Choices:

- Beanstalk primarily offers Junior ISAs (JISAs) for children as both cash and stocks and shares accounts.

- You can allocate your contributions between the two using a unique slider tool. The platform currently provides access to an L&G cash fund and a Fidelity global shares fund

3. Family Linking:

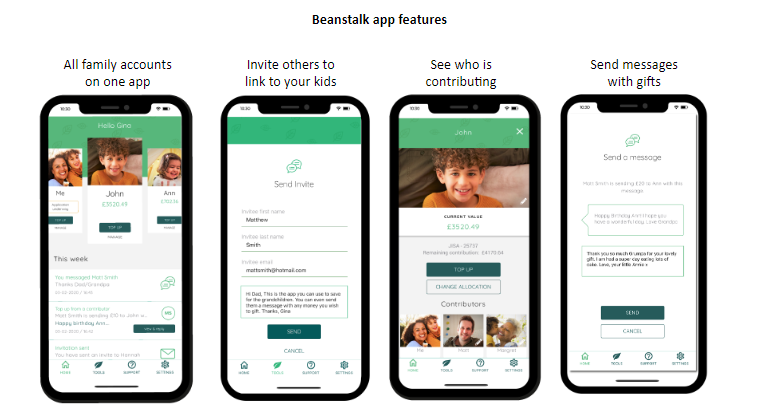

- The app also encourages a family-saving approach. This means that grandparents and other family members can also link to your children’s accounts.

- This linking feature enables a coordinated effort among family members to contribute to the financial future of your children.

BeanStalk Review – Standout Features

Beanstalk has several standout features which make it a popular choice amongst parents looking for streamlined investing options. Here are some of the standout features of this Junior ISA account option:

Collaborative Family Saving:

One of the standout features of the Beanstalk app is its collaborative family approach to saving. The platform makes it easy for grandparents and other family members to link to your children’s Junior ISA accounts. Facilitating a united family effort in building your child’s financial security.

User-Friendly Interface:

The app boasts a highly intuitive and user-friendly interface. Account creation and management are streamlined and quick processes. You can then navigate the app with ease, even without extensive financial expertise.

Invest At Your Own Pace:

Beanstalk doesn’t require large upfront deposits or regular contributions. So, you have the freedom to save at your own pace, aligning with your financial circumstances and preferences.

Unique Slider Tool for Fund Allocation:

A distinctive feature is the platform’s unique slider tool. This tool enables users to allocate their contributions between different funds, such as a shares fund and a cash fund.

Cost-Effective Solution for a Junior ISA:

Beanstalk prides itself on being a cost-effective solution. The app is free to download and use, and the only charge is an Assets Under Management (AUM) fee, which is highlighted as one of the lowest available in the market.

Tracker Funds for Diversification:

The platform offers tracker funds, including a shares fund that tracks the performance of global stock markets. This allows you to gain exposure to a diversified portfolio of companies within an index for increased investing stability (managed by Fidelity)

Beanstalk stands out with its collaborative, flexible, and educational approach to family-oriented financial planning. The user-friendly interface, cost-effective model and a range of customisable features make Beanstalk a notable choice for families looking to secure a solid financial foundation for their children’s future.

What Beanstalk Accounts Are Available?

When you download the Beanstalk app, you will be faced with two investing options – a Junior ISA account and an adult ISA account. Here is a brief introduction to each of these account options:

Beanstalk Junior ISA

One of the key features of the Beanstalk Junior ISA is its low fees and flexible nature. Users are not burdened with payment commitments. And the ability to top up your Junior ISA at your convenience ensures that saving aligns with your unique financial circumstances.

To enhance the savings experience, Beanstalk also offers a variety of tools within the app. Users can earn money back through KidStart, round up their purchases to contribute little and often, and easily facilitate gifting for family and friends. These tools are designed to maximise savings and create a collaborative approach to building a financial nest egg for children.

BeanStalk Review of ISA Account

Beanstalk ISAs are designed to simplify the process of saving for individuals, providing a user-friendly and accessible platform for adults to manage their own personal savings efficiently. You have the flexibility to allocate your savings between a money market fund and a shares fund from L&G and Fidelity.

The platform allows you to manage your savings conveniently through the app with easy access to your financial information, tools, and features at your fingertips. If you need to move your ISA from another provider to Beanstalk, you can do so seamlessly, allowing for consolidation and more centralised management of your finances.

How Much Does BeanStalk Cost? – BeanStalk Review

Beanstalk has firmly positioned itself as a cost-effective solution for families. The app is free to download and use, with the only charge being an annual fee of 0.5% on the value of any investments – one of the lowest in comparison to leading child savings providers. It’s noteworthy that the low-cost funds offered by Beanstalk also have their own management fees, ranging between 0.12% and 0.15%.

Is BeanStalk Safe and Secure to Use?

Beanstalk is associated with KidStart, a reputable name in children’s savings. The platform leverages over 15 years of experience in helping families save for their children.

The junior investment app’s commitment to security and regulation is underscored by its authorisation and regulation by the Financial Conduct Authority (FCA). Additionally, the platform is covered by the Financial Services Compensation Scheme (FSCS), providing compensation coverage of up to £85,000 per person.

BeanStalk Review of Pros and Cons

Now that we have looked at this Junior ISA app and its features and costs, let’s break down the possible pros and cons for users of the app. As you can see from our BeanStalk review so far. There are plenty of reasons to recommend the service, but what drawbacks should you consider before you decide whether to download it?

Review of Beanstalk App Pros:

- User-Friendly Platform: The Beanstalk app makes it simple for users to open and manage Junior ISAs and Adult ISAs. The app-based interface allows for convenient access to savings and investment tools.

- Flexibility in Contributions: You can contribute to their accounts without strict payment commitments, providing financial flexibility.

- Innovative Savings Tools: Beanstalk provides innovative tools, including a slider tool for fund allocation, round-up features for purchases, and gifting options.

- Transparent Fee Structure: The app is free to download and use and has an annual fee of 0.5% on the value of investments.

- Positive Customer Ratings: The platform has received positive ratings on Trustpilot, with over 4 stars on both the App Store and Play Store.

Cons of Beanstalk Review:

- Market Risks: As Beanstalk primarily offers stocks and shares ISAs, users are exposed to market risks. The value of investments can go up or down over time, and past performance is not a guarantee of future results.

- Management Fees on Funds: While Beanstalk’s platform is free to use, the low-cost funds offered by Beanstalk have their own management fees (between 0.12% and 0.15%).

- Dependence on Online Accessibility: There is no physical branch for this Junior Isa account, and you will be dependent on the accessibility and functionality of the Beanstalk app for account management. You will also need to contact customer service online as there is no customer service phone number.

BeanStalk Review – Is This the Best Junior ISA Account for My Family?

Deciding if Beanstalk is suitable for your family involves considering key factors. For long-term savings, especially for education, Beanstalk’s Junior ISA offers growth potential.

Given that Beanstalk primarily offers a cash ISA and a stocks and shares ISAs (which is invested in one fund) with market fluctuations, you should evaluate your comfort with investment risks before you get started. But if you are looking for a simple, streamlined, and straightforward way to get started investing in your children’s future, then the collaborative and innovative features of the Beanstalk app make this platform one you might want to seriously consider.

Remember if you sign up with our Beanstalk referral here – you will get £5 FREE cash added to your balance

Recent Comments