Moneyfarm Promo Code:

Sign up to Moneyfarm by clicking the button above or here and then enter the Moneyfarm promo code: ISA_PROMO_2024 to get upto £750 FREE. Full T&Cs are available on the Moneyfarm website and cashback is tiered dependant on the amount you invest in an ISA.

WITH INVESTING YOUR CAPITAL IS AT RISK

Review Of Moneyfarm

Moneyfarm is a digital investment platform that offers an accessible and innovative way for people to invest their money. The platform, launched in Italy in 2012 and has since expanded to other European countries, is designed to make investing simple and easy for everyone, regardless of their level of investment experience or financial knowledge. By combining advanced technology with personalised investment advice, Moneyfarm is helping people across the UK to achieve their financial goals and build long-term wealth. In this article, we’ll take a closer look at Moneyfarm and explore its key features, benefits, and drawbacks, to help you decide if it’s the right investment platform for you.

Introduction to Moneyfarm

Moneyfarm is a UK-based digital wealth management platform that offers investment services to individual investors and is regulated by the Financial Conduct Authority (FCA). It offers a modern, user-friendly platform to help people take control of their financial future – with over 90,000 active investors and £2.4 billion invested, Moneyfarm has quickly established itself as a leading player in the European market.

Moneyfarm offers a range of investment products and services, including fully-managed investment portfolios, stocks and shares ISAs, and general investment accounts. The platform’s investment portfolios are constructed using a blend of ETFs (exchange-traded funds) and are designed to be diversified across different asset classes and geographies.

To get started with Moneyfarm, users can complete a brief questionnaire to determine their investment goals and risk tolerance. Based on their answers, the platform will recommend a specific portfolio of ETFs to invest in. Moneyfarm then manages the portfolio on the user’s behalf, adjusting the investments as needed to maintain the desired asset allocation.

Moneyfarm charges an annual management fee based on the size of the portfolio, and there may be additional fees for certain types of transactions or services. The platform also provides access to a team of investment advisors who can provide guidance and support to users as needed.

Overall, Moneyfarm is designed to provide a convenient and accessible way for individual investors to invest in a diversified portfolio of ETFs, with the goal of achieving long-term investment returns.

Main features of the Moneyfarm financial platform

Below we have outlined several key features of the Moneyfarm platform:

- Investment Portfolios: Moneyfarm offers a range of investment portfolios that are designed to suit different investment goals and risk profiles. These portfolios are constructed using a blend of ETFs that are diversified across different asset classes and geographies.

- Automated Investing: Moneyfarm uses advanced algorithms and technology to automate the investment process, making it easy for users to invest and manage their portfolios. The platform automatically adjusts the portfolio as needed to maintain the desired asset allocation.

- Tax-efficient Accounts: Moneyfarm offers tax-efficient investment accounts, such as stocks and shares ISAs and general investment accounts. These accounts help users to reduce their tax liabilities and maximize their investment returns.

- Low Fees: Moneyfarm charges an annual management fee based on the size of the portfolio, which is lower than the fees charged by traditional investment managers. There are also no upfront fees or exit charges. (* Details below)

- Investment Guidance: Moneyfarm provides users with access to a team of investment advisors who can provide guidance and support. The platform also offers educational resources and tools to help users make informed investment decisions.

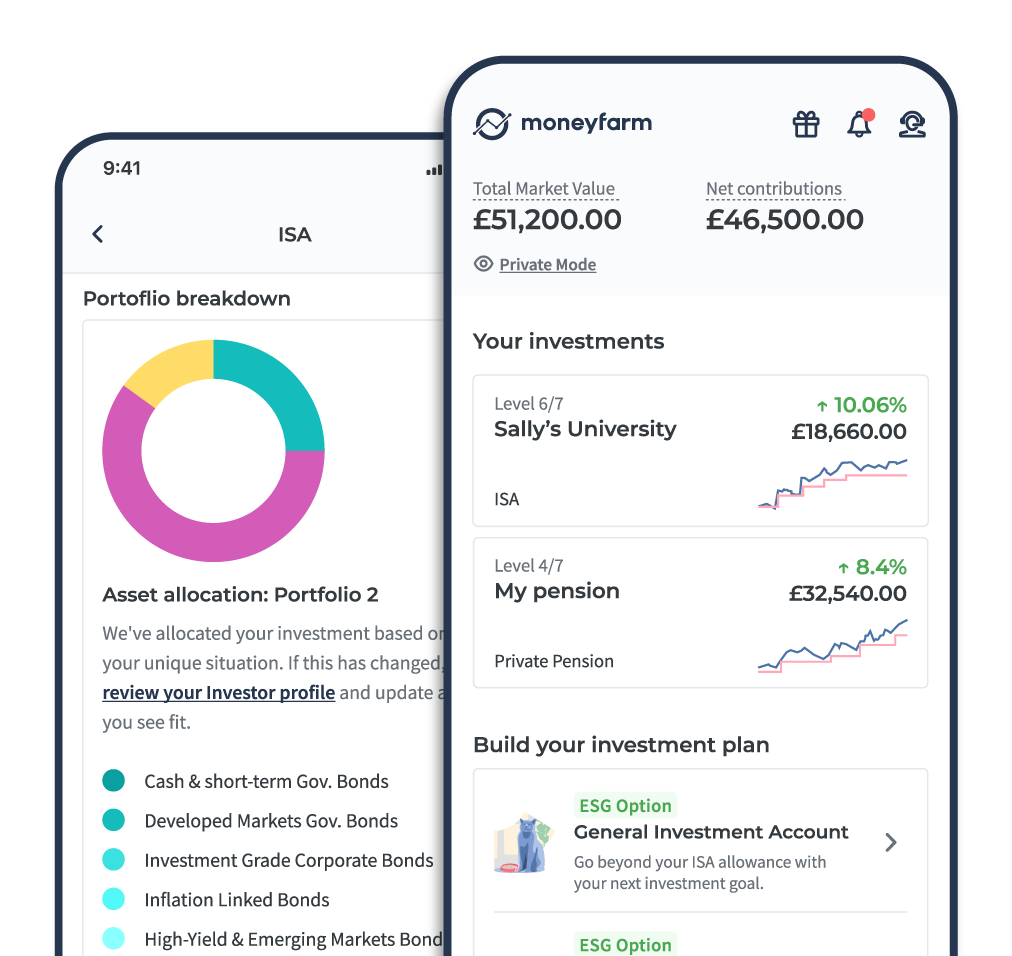

- Mobile App: Moneyfarm has a mobile app that allows users to manage their portfolios on-the-go. The app provides real-time updates on portfolio performance and allows users to make changes to their investments.

Overall, Moneyfarm is designed to provide a convenient and accessible way for individual investors to invest in a diversified portfolio of ETFs, with the goal of achieving long-term investment returns.

How Do You Sign Up For Moneyfarm?

The sign up process for Moneyfarm is extremely simple and well laid out. The whole process should only take a few minutes and is detailed below:

- Visit the Moneyfarm website (www.moneyfarm.com) and click on the “Get started” button.

- You will be asked to provide some basic information about yourself, including your name, email address, and phone number. Click on the “Continue” button.

- You will then be asked to complete a brief questionnaire to determine your investment goals and risk tolerance. This will help Moneyfarm to recommend an appropriate investment portfolio for you. * More details on this below

- Based on your answers to the questionnaire, Moneyfarm will recommend a specific portfolio of ETFs to invest in. You can review the portfolio and make changes if you wish.

- Once you are happy with the portfolio, you will be asked to provide additional information, such as your address and national insurance number. You will also be asked to set up a direct debit to fund your investment account.

- Once you have completed the registration process, Moneyfarm will begin managing your portfolio on your behalf. You can monitor your portfolio’s performance and make changes if needed through the Moneyfarm website or mobile app.

It is important to note that before investing with Moneyfarm, you should carefully review the platform’s terms and conditions, as well as the risks associated with investing. You should also consider seeking professional financial advice if you are unsure about whether investing is right for you.

The Moneyfarm Questionnaire During Signup (point 3 above)

When setting up an account with Moneyfarm, new users are asked to complete a questionnaire that is designed to assess their investment goals, risk tolerance, and investment knowledge. The questionnaire helps Moneyfarm understand each user’s unique financial situation and investment preferences, and to recommend a portfolio that is aligned with their goals and risk tolerance. The questionnaire typically covers topics such as the user’s investment experience, investment goals, time horizon, income, and expenses. Based on the answers provided, Moneyfarm assigns each user a risk profile, which is used to determine the appropriate asset allocation for their portfolio.

The questionnaire is an important part of the account setup process as it helps ensure that the investment portfolio is tailored to the user’s individual needs and preferences. Additionally, the questionnaire can be updated at any time, so users can adjust their risk profile or investment preferences as their circumstances change over time.

What type of account can you hold at Moneyfarm?

Moneyfarm offers a range of investment accounts to suit different investment goals and preferences. Here are the main types of accounts you can hold with Moneyfarm:

General Investment Account (GIA): A GIA is a standard investment account that allows you to invest in a range of assets, such as stocks, bonds, and exchange-traded funds (ETFs). There is no limit on how much you can invest in a GIA, and you can withdraw your funds at any time. A major advantage of this type of account is that when you have used up your annual ISA allowance, you can still make further contributions that are flexible and include fee-free access. Support is available for personal advice and planning your goals, so whether you want to chat with an expert by phone or meet in person, a specialist is there to help. You can achieve different goals with multiple portfolios, so you can decide whether you open a separate portfolio for each of your goals, and play around with low or high-risk investments, if you want to try different scenarios.

Stocks and Shares ISA: A Stocks and Shares ISA is a tax-efficient investment account that allows you to invest up to a certain limit each tax year without paying any tax on your investment returns. The current ISA allowance is £20,000 per tax year. Moneyfarm offers a range of ISA portfolios designed to suit different investment goals and risk profiles.

Pension: Moneyfarm offers a personal pension account, which allows you to save for retirement and benefit from tax relief on your contributions. You can contribute up to 100% of your annual earnings, up to a certain limit each tax year (currently £40,000 tax-free). Moneyfarm’s pension account is designed to be flexible and easy to manage, with low fees and a range of investment options.

Junior ISA: Moneyfarm also offers a Junior ISA, which allows you to invest on behalf of your child and benefit from tax-free investment growth. The Junior ISA allowance is currently £9,000 per tax year. Moneyfarm’s Junior ISA portfolios are designed to help parents save for their child’s future education or other long-term goals.

It’s important to note that each type of account has its own set of rules and restrictions, so it’s important to carefully review the terms and conditions before opening an account.

What Other Products Does Moneyfarm Offer?

Socially Responsible Investing

Moneyfarm offers a socially responsible investing (SRI) portfolio for investors who want to align their investments with their values and make a positive impact on society and the environment. The SRI portfolio invests in various companies and funds that meet strict environmental, social, and governance (ESG) criteria, such as companies with strong labour practices, low carbon emissions, or diverse boards. Moneyfarm’s SRI portfolio excludes investments in companies involved in controversial industries, such as weapons or tobacco.

By investing in the SRI portfolio, investors can feel confident that their money is being used in a way that aligns with their personal values while still benefiting from the potential returns of a well-diversified investment portfolio. Moneyfarm’s SRI portfolio is designed to be accessible and easy to understand, making it an excellent option for socially conscious investors who want to make a positive impact without sacrificing investment performance.

Thematic Investing

Moneyfarm offers a thematic investing option for investors who want to invest in specific industries or themes that they believe will perform well in the future. Thematic investing allows investors to focus on long-term trends, such as the rise of renewable energy or the growth of emerging markets, and to target investments that align with these themes. Moneyfarm offers a range of thematic investment options, such as the “Clean Energy” or “Robotics & AI” portfolios, which are designed to capture the growth potential of these industries.

The portfolios are constructed using a combination of exchange-traded funds (ETFs) and individual stocks, and are managed by Moneyfarm’s team of investment experts. Thematic investing can be a good option for investors who want to take a more active role in their investments and who are willing to accept a higher level of risk in pursuit of potentially higher returns.

Fixed Allocation

Moneyfarm’s fixed allocation option is designed for investors who prefer a more passive investment approach. With this option, investors choose their desired risk level and Moneyfarm creates a portfolio of exchange-traded funds (ETFs) that is aligned with their risk profile. The portfolio is then rebalanced on a regular basis to ensure that it remains aligned with the investor’s chosen risk level.

This option is ideal for investors who want a diversified portfolio that is tailored to their risk tolerance but who don’t want to spend a lot of time managing their investments. Moneyfarm’s fixed allocation portfolios are designed to be low-cost, transparent, and easy to understand, making them a great option for investors who are new to investing or who prefer a more hands-off approach. With the fixed allocation option, investors can benefit from the potential returns of a diversified investment portfolio while also enjoying the peace of mind that comes with a more passive investment strategy.

How Much Does It Cost To Use Moneyfarm?

Moneyfarm charges an annual management fee based on the size of the portfolio. The fee ranges from 0.35% to 0.75% per year, depending on the total value of the portfolio. The fee is calculated and deducted from the portfolio on a monthly basis.

Moneyfarm’s simple, low-cost fee structure means you know exactly what you’re paying and you keep more of your money.

Here’s how it works for actively managed portfolios:

Under £100,000:

- 0.75% on investments up to £10,000

- 0.70% on investments between £10,000 and £20,000

- 0.65% on investments between £20,000 and £50,000

- 0.60% on investments between £50,000 and £100,000

Over £100,000:

- 0.45% on investments between £100,000 and £250,000

- 0.40% on investments between £250,000 and £500,000

- 0.35% on investments over £500,000

Here’s how it works for fixed allocation portfolios:

- 0.45% on all investments up to £100,000

- 0.35% on investments between £100,000 and £250,000

- 0.30% on investments between £250,000 and £500,000

- 0.25% on investments over £500,000

For example: if you invest £50,000 in an actively managed portfolio, you would pay fees of 0.60% on the whole £50,000.

If you invested £120,000 in a fixed allocation portfolio, you would pay 0.35% on the whole £120,000

It’s important to note that the annual management fee is the only fee charged by Moneyfarm for its investment services. There are no additional fees for opening an account, making deposits, or withdrawing funds. However, there may be other fees associated with the investment products used in the portfolio, such as ETF fees or transaction fees, which are detailed here

Moneyfarm also offers a free portfolio review service, which allows users to get personalized advice on their portfolio from Moneyfarm’s investment team. This service is available to all users, regardless of the size of their portfolio. Remember you can get upto £750 cashback if you invest in an ISA before 31st April using the Moneyfarm promo code: ISA_PROMO_2023

Is Moneyfarm safe to use?

Moneyfarm is a regulated financial platform in the UK and is authorised and regulated by the Financial Conduct Authority (FCA). This means that Moneyfarm must comply with strict regulatory requirements, including capital adequacy requirements, client money rules, and operational standards. Moneyfarm also has to meet high levels of transparency, disclosure, and investor protection requirements.

In terms of safety, Moneyfarm takes several measures to protect users’ investments, such as:

- Segregated Accounts: Moneyfarm keeps user’s money and investments in segregated accounts, which means that they are kept separate from the company’s own assets.

- Deposit Protection: Moneyfarm is a member of the Financial Services Compensation Scheme (FSCS), which provides deposit protection up to £85,000 per person in the event that the platform goes out of business.

- Encryption and Security: Moneyfarm uses advanced encryption and security measures to protect user’s personal and financial information. The platform also undergoes regular security audits and tests to ensure that it remains secure.

- Risk Management: Moneyfarm uses sophisticated risk management systems to monitor portfolio risks and make adjustments as needed to maintain the desired level of risk.

Overall, while no investment is completely risk-free, Moneyfarm is a regulated and reputable financial platform that takes several measures to protect users’ investments and personal information. Users should always carefully consider the risks associated with investing and seek professional advice if necessary.

Summary

Overall, Moneyfarm is a digital investment platform that offers a range of investment options to suit different investor needs and preferences. Whether investors are looking for a more passive investment approach or a more active, theme-based investment strategy, Moneyfarm has a portfolio to meet their needs. Additionally, Moneyfarm’s socially responsible investing portfolio is a great option for investors who want to make a positive impact with their investments, while still benefiting from potential returns. With transparent pricing, easy-to-understand investment portfolios, and a user-friendly digital platform, Moneyfarm is an accessible and convenient option for investors who want to manage their investments online. Overall, Moneyfarm is a well-rounded investment platform that can help investors achieve their financial goals with confidence.

Remember, if you sign up by clicking here and then enter the Moneyfarm promo code: ISA_PROMO_2023, you can get upto £750 cashback depending on the amount you invest in an ISA before 31st April 2024

Recent Comments