Tuck referral code: FAISA32

Sign up for the Tuck ap using the Tuck referral code: FAISA32 and get free bonus cash (worth between £1-£4). Enter the code during signup or if you forget you can add the code in the referal tab of the app. Note you need to complete a £10 giftcard card purchase to receive your free bonus

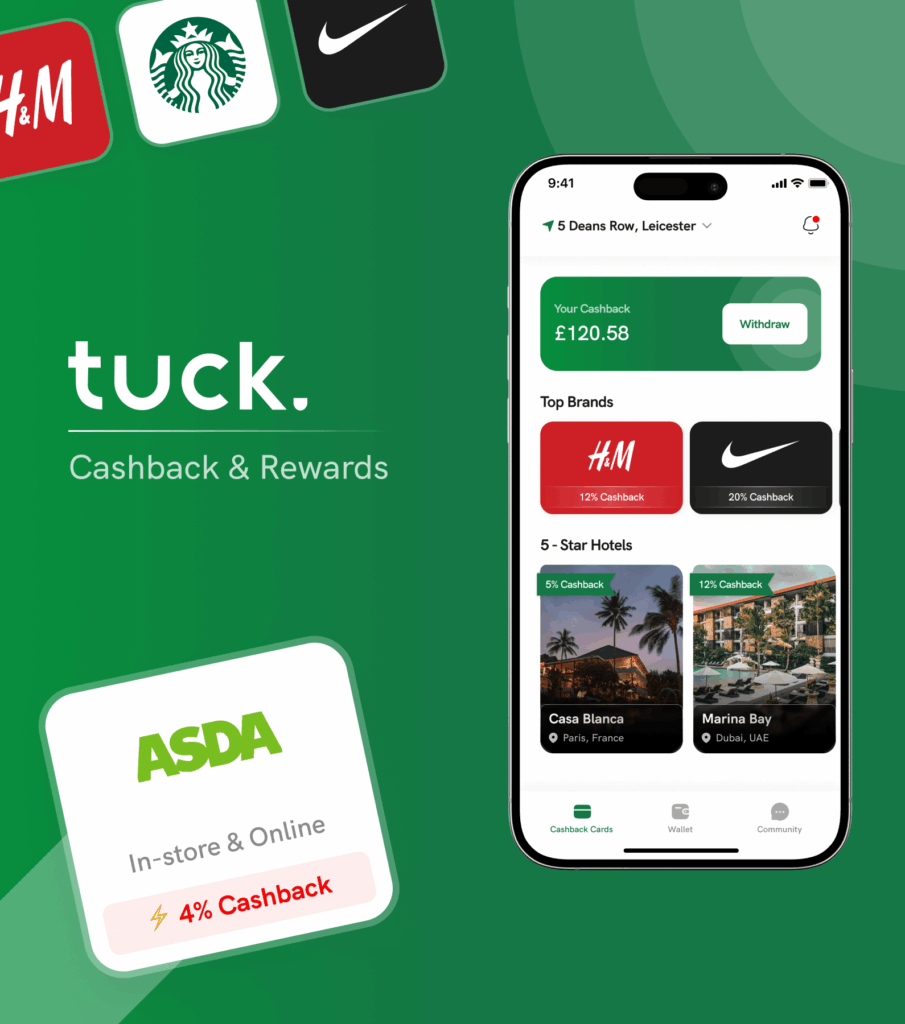

If you’re looking for an easy, repeatable way to save money on groceries, fashion, homeware, dining, and hotels, the tuckapp is worth a serious look. It turns digital gift cards into instant cashback—and a valid tuck referral like FAISA32gives new users a head start. This long-form guide explains how the app works, how to claim and activate the referral bonus, and the smartest strategies to stack, track, and withdraw your savings with minimal effort.

TL;DR (for the skimmers)

- What it is: tuck lets you buy retailer gift cards and get instant cashback at purchase.

- Best tuck referral for new users: Enter FAISA32 at sign-up (or later in the app’s Referral section).

- Activation: After adding the code, buy a £10 cashback card in the app to unlock a £1 bonus.

- Routine: Right before you pay at a retailer, buy a tuck gift card for the amount you need—pocket the instant cashback—then spend the card online or in-store.

- Cash out: Withdraw to your bank once you hit the in-app minimum (check the current threshold and any fees in the app).

What is tuck—and why do people use it?

tuck is a UK shopping app where you purchase digital gift cards for well-known retailers and receive instant cashbackwhen you buy those cards. You then use the gift card as your payment method at checkout—either online or in-store. Because the cashback lands immediately, you don’t have to wait weeks for tracked cashback to clear.

Key benefits at a glance

- Instant rewards: Cashback is credited as soon as your gift card purchase completes.

- Everyday categories: Groceries, fashion, home, dining, electronics, and more.

- Flexible spending: Many gift cards support part-spend across multiple visits; remaining balances can be tracked in-app.

- Optional bank linking: You can use tuck without linking a bank account; linking is only for extra insights.

The tuck referral everyone asks about: FAISA32 (£1 for new users)

If you’re hunting for a tuck referral, use FAISA32 to secure a £1 bonus as a new UK user.

How to add the code

- During sign-up: Enter FAISA32 in the “Referral code” field.

- After sign-up: Open the app’s Referral section and add FAISA32 there.

How to activate the referral bonus

- Add FAISA32 as above.

- Purchase a £10 cashback card in the app (any participating brand you’ll spend with soon).

- Once the purchase is confirmed, your £1 bonus should appear in your tuck wallet.

Tips to avoid hiccups

- Didn’t see a referral box at registration? No problem—add FAISA32 straight after in the Referral tab.

- Choose a brand you’ll use immediately for the £10 activation (e.g., your regular supermarket).

- Referral terms can evolve; always check the wording inside the app before you purchase.

Bottom line: Add the tuck referral code FAISA32 and complete a £10 cashback card purchase to unlock £1 free.

How tuck works (step-by-step)

- Open tuck and pick a retailer

Choose the brand you’re about to shop with and check the current cashback rate. - Select the amount

Estimate your bill and buy a gift card for that amount. If you’re unsure, it’s often safer to slightly under-buy and top up later. - Pay in-app and get instant cashback

As soon as the transaction clears, the cashback drops into your tuck wallet. - Spend your gift card online or in-store

At the till, show the barcode or code; online, paste the code at checkout. If you don’t spend it all at once, the remainder stays on the card. - Repeat this before every shop

Doing this consistently is how the savings compound month after month.

Example: How the savings add up (realistic scenario)

Let’s say your household has the following monthly spending:

- Groceries: £300

- Fashion & home: £120

- Dining & coffee: £80

- Miscellaneous gifts: £50

If your blended average cashback rate across brands were a conservative 3%, you’d earn:

- Groceries: £300 × 3% = £9

- Fashion & home: £120 × 3% = £3.60

- Dining & coffee: £80 × 3% = £2.40

- Gifts: £50 × 3% = £1.50

Total per month: £16.50

Total per year: ~£198

Now add the tuck referral bonus FAISA32 (+£1 after your first £10 card) and any occasional promos, and you’re well past £200/year in savings for a routine that takes seconds per checkout.

(Your actual rates will vary by brand and time—always check the app right before you buy.)

Advanced strategies to maximise value

1) Buy “just-in-time”

Right before you pay at the till or the online checkout, buy a tuck card for the exact amount (or slightly less if the bill is uncertain). This reduces leftovers and locks in cashback on every purchase.

2) Use part-spend to your advantage

If you’re not sure of the final total, under-buy and part-spend. Top up with another card if you need more. Track the running balance in the app so no pounds go missing.

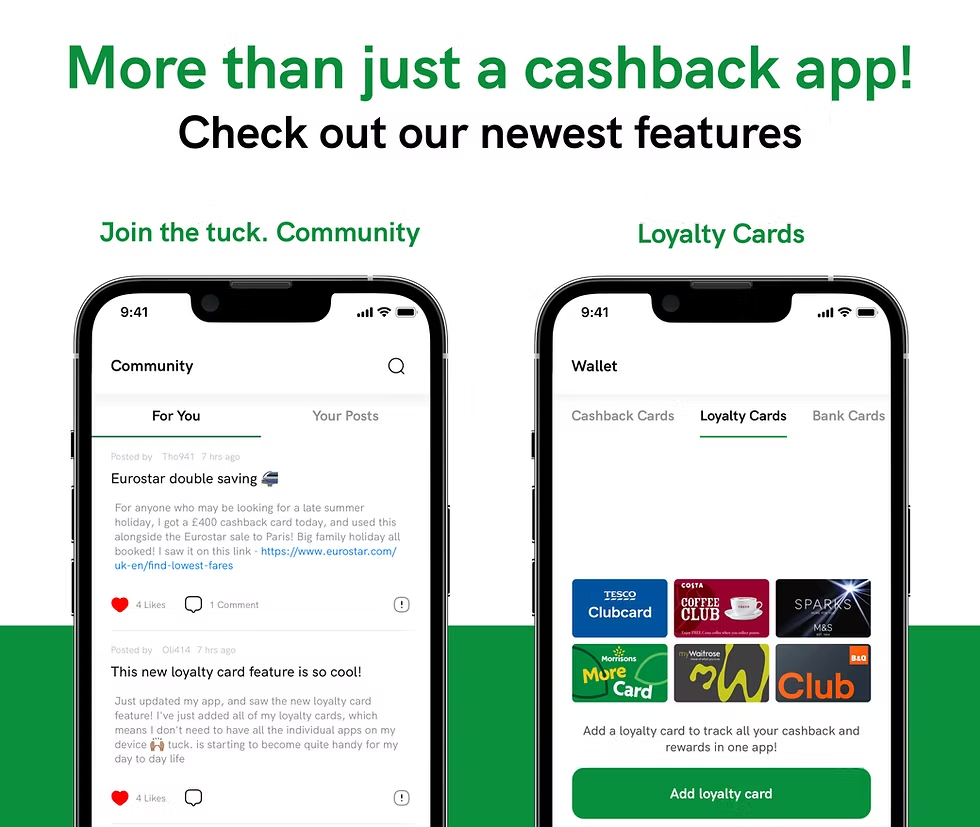

3) Stack with retailer loyalty

In many cases, paying by gift card still earns retailer loyalty points as usual. Check your retailer’s terms—but if allowed, you’re effectively double-dipping: loyalty + instant cashback.

4) Split larger purchases

Big basket? Consider buying multiple cards (e.g., two £100 cards instead of one £200). This helps with:

- Per-card maximums

- Easier record-keeping if you return an item

- Precision (you can keep one card unused if plans change)

5) Keep an eye on expiry rules

Many gift cards are generous, but some have expiry windows or brand-specific quirks. If you’re loading a large amount for a future project or trip, skim the brand’s terms first.

6) Use tuck Travel (when it makes sense)

If you’re booking hotels, compare in-app rates and note that travel cashback usually becomes available after the stay. Treat it as a bonus: if the rate is competitive, great—if not, book elsewhere.

7) Track and tidy monthly

Once a month, open tuck and reconcile your active cards. Clear small leftover balances with low-risk top-ups (e.g., coffee or groceries) so your wallet stays tidy.

Cashing out: withdrawals, timing, and fees

- Withdrawal minimum: You’ll need to hit the app’s minimum before you can withdraw to your bank.

- Timing: UK bank transfers typically take a few working days.

- Fees: Always review the latest in-app guidance on any transfer fees before withdrawing.

Pro tip: If you’re close to the minimum and you need the cash, plan a weekly or fortnightly check-in. Buy your usual card (e.g., for groceries), nudge your balance over the line, and then cash out.

Do you need to link a bank account?

No. The tuck referral bonus and instant cashback on gift cards work without bank linking. Some users connect an account via open-banking to get personalised suggestions or to streamline withdrawals, but it’s strictly optional.

Common mistakes (and how to avoid them)

- Forgetting the referral activation: Add FAISA32 and remember to make that £10 card purchase to unlock your £1.

- Over-loading a single card: If you’re uncertain about upcoming spend, buy smaller denominations more often instead of one big card.

- Ignoring brand rules: Scan the brand page for limits, where you can use the card (in-store vs online), and any expiry info.

- Letting leftovers linger: Use part-spend and tidy your balances monthly so you don’t strand small amounts.

- Assuming rates never move: Cashback rates can change. Always check right before buying.

Who is tuck best for?

- Regular supermarket shoppers: Quick, repeatable savings on the most frequent spend in your budget.

- High-street and online shoppers: Instant rewards are ideal if you dislike waiting for traditional cashback to track.

- Families or shared households: Splitting big baskets into multiple cards makes expense-sharing and returns easier.

- Frequent travellers: tuck Travel can add a post-stay cashback cherry on top when the price is right.

Security and privacy at a glance

- Payment processing: Purchases are made in-app via secure third parties.

- Bank linking: Entirely optional; used for insights and convenience, not required for the tuck referral or instant cashback.

- Good habits: Keep email confirmations until balances are spent, and avoid loading amounts you’re not confident you’ll use within the gift card’s valid period.

Practical checklists

Referral activation checklist

- Download tuck

- Enter the tuck referral code FAISA32 at sign-up or in the Referral tab

- Buy a £10 cashback card (brand you’ll use today)

- Confirm £1 bonus has appeared in your wallet

Weekly savings routine

- Before every grocery trip, buy a tuck card for the estimated total

- Do the same for coffee, lunch, or any planned shopping

- Track gift card balances and clear leftovers

- Check your cashback total; plan a withdrawal when you hit the minimum

FAQs about the tuck referral (UK)

Q: What is the best tuck referral for new users right now?

A: Use FAISA32 to unlock a £1 bonus. Add the code at sign-up or in the Referral tab, then buy a £10 cashback card to activate.

Q: Can I add the tuck referral after creating my account?

A: Yes. Open the Referral section in the app and enter FAISA32.

Q: Which retailer should I use to activate the £10 requirement?

A: Any participating brand you’ll spend with immediately (supermarkets are ideal).

Q: Is a bank link required to use tuck or the referral?

A: No. Bank linking is optional and not required for the tuck referral or instant cashback.

Q: How long do withdrawals take?

A: Typically a few UK working days, once you’ve reached the in-app minimum. Check the app for the current threshold and any fees.

The final word

The tuck referral is an easy booster for a money-saving habit that compounds. Add FAISA32, make your first £10cashback card purchase to trigger the £1 bonus, and then keep repeating the core play: buy a digital gift card right before you pay and enjoy instant cashback on everyday spending. With a few smart routines—just-in-time purchases, part-spend, monthly tidy-ups—you’ll turn small moments at checkout into meaningful savings across the year.

Recent Comments